QUOTE(theberry @ Jun 27 2020, 12:18 AM)

Buy low sell high.STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Jun 27 2020, 06:07 AM Jun 27 2020, 06:07 AM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

|

|

|

Jun 27 2020, 09:41 AM Jun 27 2020, 09:41 AM

|

Junior Member

637 posts Joined: Nov 2018 From: Taman Sri Muda |

|

|

|

Jun 27 2020, 09:44 AM Jun 27 2020, 09:44 AM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Jun 27 2020, 08:24 PM Jun 27 2020, 08:24 PM

Show posts by this member only | IPv6 | Post

#6044

|

All Stars

21,456 posts Joined: Jul 2012 |

The can’t-miss rise of equity markets around Asia is fueling the explosion of interest among retail investors in the region, mirroring their exuberance worldwide. Millions of investors who had never so much as opened a trading account before have been piling into the market.

.... In Japan, the Tokyo Stock Exchange Mothers Index, which hosts many tech start-up listings, has soared throughout the pandemic: buying the dip on almost any small-cap stock would make money. All but seven of the 320 companies on the board have gained since April’s start, from vaccine hopeful Agnes Inc., up 235%, to Precision System Science Co., which is developing a virus test and has added more than 480%. Japan's Mothers startup board has outpaced the broader Topix this year “If there’s a report on TV about a coronavirus-related stock that’s going up, they can just buy it the next day and make profit,” said Naoki Murakami, a long-time Japanese day-trader. He points to “simple” bets by amateur investors on stocks such as AnGes or Avigan maker Fujifilm Holdings Corp. In the U.S., Robinhood and the Reddit forum called r/wallstreetbets have become a dominant force in the market, boosting everything from the stocks of bankrupt companies such as Hertz Global Holdings Inc. to revenue-less start-ups like truck maker Nikola Corp. That pattern has been repeated in Europe with brokerages in Germany, the U.K. and France all reporting a jump in participation by individual investors, fueled by a fear of missing out. And while the names may be less familiar, the same picture appears across countries in Asia that imposed lockdowns. ... https://www.bloomberg.com/asia #ddtg rule This post has been edited by icemanfx: Jun 27 2020, 08:55 PM |

|

|

Jun 27 2020, 08:32 PM Jun 27 2020, 08:32 PM

|

Junior Member

214 posts Joined: Jan 2016 |

QUOTE(icemanfx @ Jun 27 2020, 08:24 PM) The can’t-miss rise of equity markets around Asia is fueling the explosion of interest among retail investors in the region, mirroring their exuberance worldwide. Millions of investors who had never so much as opened a trading account before have been piling into the market. This is exactly what happened to glove ctrs.. ride the hype and exit before anyone else. 😎.... The can’t-miss rise of equity markets around Asia is fueling the explosion of interest among retail investors in the region, mirroring their exuberance worldwide. Millions of investors who had never so much as opened a trading account before have been piling into the market. .... In Japan, the Tokyo Stock Exchange Mothers Index, which hosts many tech start-up listings, has soared throughout the pandemic: buying the dip on almost any small-cap stock would make money. All but seven of the 320 companies on the board have gained since April’s start, from vaccine hopeful Agnes Inc., up 235%, to Precision System Science Co., which is developing a virus test and has added more than 480%. Japan's Mothers startup board has outpaced the broader Topix this year “If there’s a report on TV about a coronavirus-related stock that’s going up, they can just buy it the next day and make profit,” said Naoki Murakami, a long-time Japanese day-trader. He points to “simple” bets by amateur investors on stocks such as AnGes or Avigan maker Fujifilm Holdings Corp. In the U.S., Robinhood and the Reddit forum called r/wallstreetbets have become a dominant force in the market, boosting everything from the stocks of bankrupt companies such as Hertz Global Holdings Inc. to revenue-less start-ups like truck maker Nikola Corp. That pattern has been repeated in Europe with brokerages in Germany, the U.K. and France all reporting a jump in participation by individual investors, fueled by a fear of missing out. And while the names may be less familiar, the same picture appears across countries in Asia that imposed lockdowns. ... https://www.bloomberg.com/asia #ddtg rule This post has been edited by goldrush: Jun 27 2020, 08:33 PM |

|

|

Jun 29 2020, 08:05 AM Jun 29 2020, 08:05 AM

Show posts by this member only | IPv6 | Post

#6046

|

Junior Member

627 posts Joined: Jan 2003 |

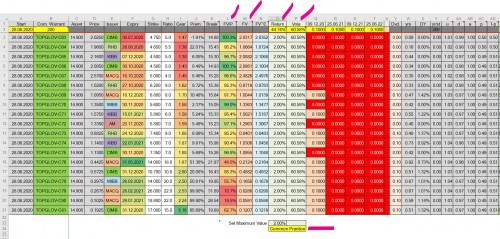

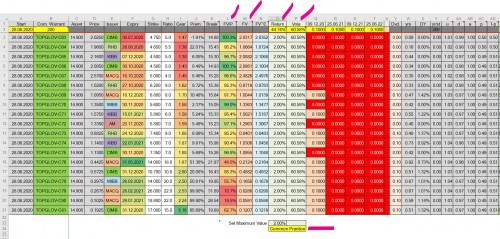

FOR those who like warrants

TOPGLOV-Call Warrants Author: i3gambler  Make reference to the above screen shot. First we look at TOPGLOV target prices given by investment banks. TOPGLOV released their latest quarterly result on 11th June 2020, Therefore I capture only those target prices given on the same day or later, Thanks to i3investor.com for the listing the target prices. The average target price are sky high, an upside room of 44.74%, very rare for a blue chip. Now, to calculate the fair value of call warrants, we need inputs to the calculation, the two critical and arguable inputs are: 1) Interest: Common practice: Input the risk free interest rate, in our current case, should be around 2% My preference: 50% of the upside room of 44.74%, equal to 22.37%, then plus the dividend yield, but subject to a maximum value of 8.00%. 2) Volatility: Common Practice: Calculate from the last 90 trading days, and assume same volatility will be maintained in coming months. My preference: Same calculation, but subject to a maximum value, in this case I choose 30%. Make reference to the following two screen shots: 1) Column C: The middle price at 4.30 pm on Friday, 26th June 2020. 2) Column M: Fair values calculated using 200 steps binomial method. 3) Column L: Fair Value over Market Price.  Discussion: 1) At a very unlikely chance, I could have put wrongly the expiry, exercise price or exercise ratio, so please double check at www.bursamalaysia.com if you want to trade any of call warrants. 2) Currently I do not have any TOPGLOV call warrant, and not like will buy any of them. 3) Trade at your own risk.  |

|

|

|

|

|

Jun 29 2020, 08:45 AM Jun 29 2020, 08:45 AM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

QUOTE(jvcpcv55 @ Jun 29 2020, 08:05 AM) FOR those who like warrants analyse for people but ownself didn't buy TOPGLOV-Call Warrants Author: i3gambler  Make reference to the above screen shot. First we look at TOPGLOV target prices given by investment banks. TOPGLOV released their latest quarterly result on 11th June 2020, Therefore I capture only those target prices given on the same day or later, Thanks to i3investor.com for the listing the target prices. The average target price are sky high, an upside room of 44.74%, very rare for a blue chip. Now, to calculate the fair value of call warrants, we need inputs to the calculation, the two critical and arguable inputs are: 1) Interest: Common practice: Input the risk free interest rate, in our current case, should be around 2% My preference: 50% of the upside room of 44.74%, equal to 22.37%, then plus the dividend yield, but subject to a maximum value of 8.00%. 2) Volatility: Common Practice: Calculate from the last 90 trading days, and assume same volatility will be maintained in coming months. My preference: Same calculation, but subject to a maximum value, in this case I choose 30%. Make reference to the following two screen shots: 1) Column C: The middle price at 4.30 pm on Friday, 26th June 2020. 2) Column M: Fair values calculated using 200 steps binomial method. 3) Column L: Fair Value over Market Price.  Discussion: 1) At a very unlikely chance, I could have put wrongly the expiry, exercise price or exercise ratio, so please double check at www.bursamalaysia.com if you want to trade any of call warrants. 2) Currently I do not have any TOPGLOV call warrant, and not like will buy any of them. 3) Trade at your own risk.  |

|

|

Jun 29 2020, 09:14 AM Jun 29 2020, 09:14 AM

|

Senior Member

3,703 posts Joined: Oct 2005 |

Monday opening...

Expected - KLSE drop around 8 points at beginning. Not expected - glove shares are in green... |

|

|

Jun 29 2020, 09:17 AM Jun 29 2020, 09:17 AM

|

Senior Member

7,617 posts Joined: Mar 2009 |

Banks GG

|

|

|

Jun 29 2020, 09:31 AM Jun 29 2020, 09:31 AM

|

All Stars

24,456 posts Joined: Nov 2010 |

gloves still strong... returning with a vengeance, it appears.

then again, no other sector is making good profits now. O&G, banks, construction, etc.... all declining, making losses... bad QRs coming. |

|

|

Jun 29 2020, 09:46 AM Jun 29 2020, 09:46 AM

|

Senior Member

3,500 posts Joined: Dec 2007 |

The bear is slowly creeping back in.

I'm holding mostly blue chips now and seeing their paper gains getting wipe out day by day. This is the kind of dangers that boils a frog or kill a bull |

|

|

Jun 29 2020, 10:00 AM Jun 29 2020, 10:00 AM

|

All Stars

24,456 posts Joined: Nov 2010 |

|

|

|

Jun 29 2020, 10:02 AM Jun 29 2020, 10:02 AM

|

Senior Member

3,541 posts Joined: Mar 2015 |

Whether the market is doing well or not can be judged by the number of posts appearing in this thread. The number of posts is slowly decreasing...this means that the market is either trading sideways or is slowly sinking... goldrush liked this post

|

|

|

|

|

|

Jun 29 2020, 10:05 AM Jun 29 2020, 10:05 AM

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(Vanguard 2015 @ Jun 29 2020, 10:02 AM) Whether the market is doing well or not can be judged by the number of posts appearing in this thread. People like to post profits... dare not show the bloods they lost in Stock Market.The number of posts is slowly decreasing...this means that the market is either trading sideways or is slowly sinking... |

|

|

Jun 29 2020, 10:12 AM Jun 29 2020, 10:12 AM

|

All Stars

24,456 posts Joined: Nov 2010 |

|

|

|

Jun 29 2020, 10:15 AM Jun 29 2020, 10:15 AM

|

Senior Member

3,514 posts Joined: Oct 2011 |

patiently waiting for another big dip

|

|

|

Jun 29 2020, 10:16 AM Jun 29 2020, 10:16 AM

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Jun 29 2020, 10:17 AM Jun 29 2020, 10:17 AM

|

All Stars

24,456 posts Joined: Nov 2010 |

|

|

|

Jun 29 2020, 10:19 AM Jun 29 2020, 10:19 AM

|

All Stars

24,456 posts Joined: Nov 2010 |

|

|

|

Jun 29 2020, 10:20 AM Jun 29 2020, 10:20 AM

|

Senior Member

3,514 posts Joined: Oct 2011 |

|

| Change to: |  0.0206sec 0.0206sec

0.53 0.53

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 12:31 AM |