QUOTE(Boon3 @ Jan 20 2022, 11:31 AM)

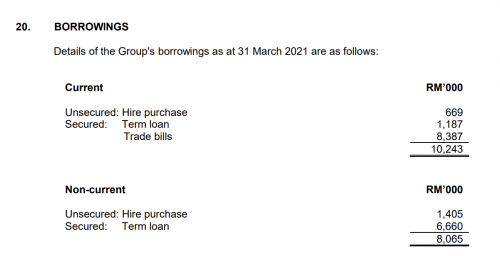

happy chinese new year with a red tanglung

STOCK MARKET DISCUSSION V150

|

|

Jan 20 2022, 07:18 PM Jan 20 2022, 07:18 PM

Return to original view | Post

#361

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

|

|

|

Jan 24 2022, 03:40 PM Jan 24 2022, 03:40 PM

Return to original view | Post

#362

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Jan 21 2022, 09:18 AM) Mana rotan? If you are really interested, best is to wait for the 'unwanted dead fish' strategy.... which requires time and lotsa patience....  happy chinese new year in china style. red up green down again, i xdak. and to use the unwanted dead fish, need to wait long long during the consolidation sometimes boleh, sometimes just lagi dead  long until xmau mana pigi now maybe starting to get interesting biz wise so so fish cake so so cpo ok ok but supply issues + weather + labour eggs pun so so family mart? udon sibeh expensive |

|

|

Jan 24 2022, 09:45 PM Jan 24 2022, 09:45 PM

Return to original view | Post

#363

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Jan 24 2022, 04:42 PM) Well... this is what it is....unless of course, you like to hantam buta buta based on momentum this morning... nope, no time to monitor at all at work hence need someone's 555 QL? This one is a no-no for me. See also I tak mau. If look at historical events, you can understand how it grew... 'Purchase' engineering .... such business I tak minat. QL has been good for me before this although I dont particularly like the business model margin is super low with many hands in many things well, people go 'values' on it since years back |

|

|

Jan 25 2022, 04:51 PM Jan 25 2022, 04:51 PM

Return to original view | Post

#364

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(statikinetic @ Jan 25 2022, 12:36 PM) In the Stock forums, it's Billy's fault. In Kopitiam, that changes. The S&P shed almost 5% in a single day. Some green support doesn't mean a turnaround though. In other news, SG tightens SGD policy. QUOTE(Boon3 @ Jan 25 2022, 12:53 PM) alaaaa chinese new year mahhhhhjom buy appliances  |

|

|

Jan 25 2022, 04:56 PM Jan 25 2022, 04:56 PM

Return to original view | Post

#365

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

Jan 26 2022, 03:02 PM Jan 26 2022, 03:02 PM

Return to original view | Post

#366

|

Senior Member

3,373 posts Joined: Nov 2008 |

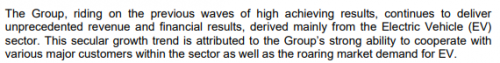

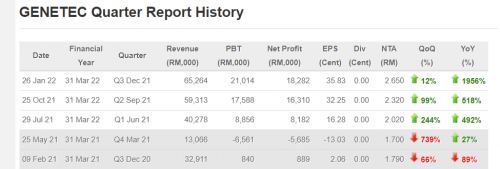

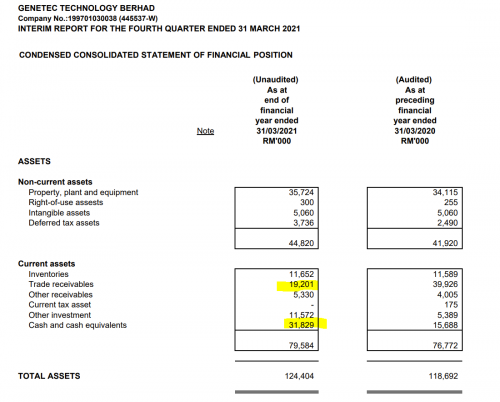

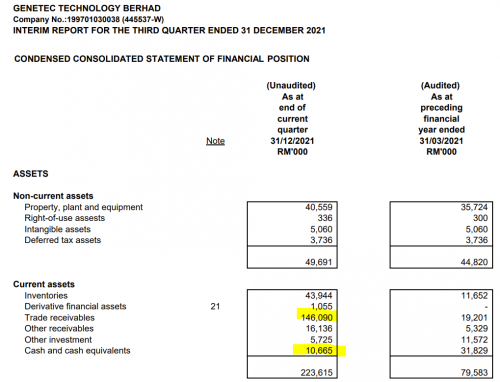

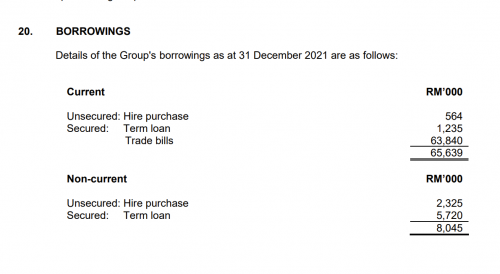

QUOTE(Boon3 @ Jan 26 2022, 02:25 PM) Profits boomed.... Receivables lagi boom boom... Borrowings boom boom... Cash shrunk!!! * receivables at 146 million. Lol.. do business no need collect money one ah?  EV!! BOOM!! profit (receivables) gao gaoooo!! stage for reversal!! BUY!! ps: divers, don't buy none of us are pros we dont do buy calls except for some |

|

|

|

|

|

Jan 26 2022, 05:32 PM Jan 26 2022, 05:32 PM

Return to original view | Post

#367

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Jan 26 2022, 04:13 PM) And this is where it doesn't make sense... i didn't check the history of this companyif it's supplied for the EV market... surely we are talking about the goods being exported. and if that's the case.... how and why could the receivables be but upon peeping hdd in 06 automation and inspection in 15 now in 22 hit the sweet spot of ev and trying to give leeway in order to build customer base so 'cooperate'  no idea, i was just blowing water |

|

|

Jan 27 2022, 07:09 AM Jan 27 2022, 07:09 AM

Return to original view | Post

#368

|

Senior Member

3,373 posts Joined: Nov 2008 |

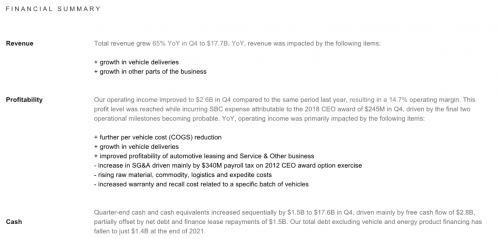

QUOTE(Boon3 @ Jan 26 2022, 06:17 PM) Giving leeway? If your brother ever run your family business like this, what would you do? Rotan? pretty much summed up all the things i thought Anyway... all this... is important... If one wants to be in control of the risk in our trade, one needs to understand what exactly one is trading and one certainly does not ever want to be in a position in a trade when the floor suddenly caves in and one loses total control of the trade, leaving the fate of the trade to the Hantu of the stock market. That's a no no for me. That's why stuff like this is important... cos ... the main selling point for Genetec is that the company has struck gold in the EV market... And here's yet another comparison... the BEFORE and AFTER....  From the above we can 'see' that it struck gold since fy 2022 Q1 so compare the Q before it struck gold and compare to the latest... so the before is as follows  One can see.. receivables is at 19.2 million and G has cash balance of 31.8 million. and the borrowings is as follows...  Not bad what.... despite losing money (G lost 4.2 million for the fiscal year) , the company is in a net cash position... Now look at the AFTER... ie the impact of the EV Boom... in which the company has reported a current ytd profits of 42.7 million...  Receivables is now at 146 million!!! ( ya... if receivables remain high too long...it runs the risk of being classified as bad debts!!!) And cash balances is now 10.6 million only. (remember previously cash balances was 31.8 million!!!) and the borrowings is as follows....  borrowings has exploded!! Well... here's the stupid question.... was the company in a better shape when it was losing money or is the company in a better shape now when it is said to be making millions and millions??  when even tsla can do so much better while increasing cash AND reducing debt AND increasing production now why G's receivables increase so much cash decreases and borrowing increases (not an apple to apple comparison though, i was putting everything under the umbrella of the glorified word of year 21/22- EV) nah, pinjam you nunchucks This post has been edited by billy_overheat: Jan 27 2022, 07:10 AM |

|

|

Feb 11 2022, 10:26 AM Feb 11 2022, 10:26 AM

Return to original view | Post

#369

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(icemanfx @ Feb 10 2022, 04:36 PM) Hot money is likely to chase after commodity, commodity price likely to rise higher. Also mean inflation rate could rise faster and higher than most expected. Understood your stand but you did buy grab right? If there's a crash, grab will not survive too. So, was that your first buy and you will top up more in case there's a crash or? These few days super green though for grab |

|

|

Feb 11 2022, 11:07 AM Feb 11 2022, 11:07 AM

Return to original view | Post

#370

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

Feb 16 2022, 12:00 PM Feb 16 2022, 12:00 PM

Return to original view | Post

#371

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(livefree89 @ Feb 16 2022, 10:31 AM) JP Morgan call buy on plantation stock all thanks to Ng upgraded to “overweight” calls for Sime Darby Plantation Bhd (target price: RM6.80), Kuala Lumpur Kepong Bhd (TP: RM30), and Genting Plantations Bhd (TP: RM12). Woah, suddenly ESG issue all gone  co and cpo are abang adik but then these are my weak points so watch wayang |

|

|

Feb 17 2022, 10:33 AM Feb 17 2022, 10:33 AM

Return to original view | Post

#372

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

Feb 17 2022, 10:51 AM Feb 17 2022, 10:51 AM

Return to original view | Post

#373

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

|

|

|

Feb 17 2022, 10:57 AM Feb 17 2022, 10:57 AM

Return to original view | Post

#374

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

Feb 17 2022, 03:05 PM Feb 17 2022, 03:05 PM

Return to original view | Post

#375

|

Senior Member

3,373 posts Joined: Nov 2008 |

He's gonna give me PowerPoints consisting of his 555 list

Need to wallop kawkawlat Must get back to work already. Have been lazing around for quite some time. Need to fire my boss d. |

|

|

Mar 7 2022, 03:26 PM Mar 7 2022, 03:26 PM

Return to original view | Post

#376

|

Senior Member

3,373 posts Joined: Nov 2008 |

fuiyoh

active threads! bull in commodities how are you guys doing ehh |

|

|

Mar 18 2022, 09:12 AM Mar 18 2022, 09:12 AM

Return to original view | Post

#377

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(thkent91 @ Mar 18 2022, 08:48 AM) Alright. Thank you for the input. Looks like the strong balance sheet of a company is not so important to look. It's the forward PE that counts The war chest is important to fight the war and win it. And the comparison between charts just tells you that there are better options out there. The balance sheet is strong? Well, there are stronger companies. Always go for the best choice of the bunch. |

|

|

Mar 18 2022, 09:57 AM Mar 18 2022, 09:57 AM

Return to original view | Post

#378

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Mar 18 2022, 09:24 AM) Strong balance sheet or being cash rich is important but the danger of such company is one gets a company which is just contended. Some would call it company without any motivation to strive/improve. There are many such companies around. Where the boss/owners just collect their annuals and they are satisfied. Eat pau sell pau. Lack of ambition. Many such companies around.... I am sure you have encountered some yourself. Ask yourself ... if you are face with a real life opportunity to buy a business... which would you choose? A company that is just cash rich or a company which is making more and more money each year? QUOTE(Smurfs @ Mar 18 2022, 09:28 AM) genetec This post has been edited by billy_overheat: Mar 18 2022, 09:58 AM |

|

|

Mar 18 2022, 04:39 PM Mar 18 2022, 04:39 PM

Return to original view | Post

#379

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Mar 18 2022, 10:38 AM) i kena rotan at work, come here kena rotan again by you apahal? others shake you for coconot leh, you shake me buat apa? no tipsy weyy banking? just because of rate hike so it goes north? earnings can really be that great? ong? skjp war, skjp ceasefire, and the boat is long sailed away cpo? susah ni, can sustain 6k and go beyond mehh and i remain my opinion as before choppy, dont do anything tech? rebound? or go back to where it should? now mana tipsy saya |

|

|

Mar 18 2022, 04:41 PM Mar 18 2022, 04:41 PM

Return to original view | Post

#380

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(icemanfx @ Mar 18 2022, 03:46 PM) There are many schools of thought, whether strong balance sheet is favourable or not depends on industry and market sentiment. sometime, light balance sheet is preferred e.g return on shareholders equity and some abused this preference by over gearing. it depends on what people likesome even use nta as the yardstick price < nta? BUY! undervalued kononnya |

| Change to: |  0.0997sec 0.0997sec

0.58 0.58

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 04:30 AM |