MrD reminds me of Haidilao.

There will come a day where overexpansion comes biting them in the back.

STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Aug 8 2021, 06:56 PM Aug 8 2021, 06:56 PM

Return to original view | IPv6 | Post

#121

|

Junior Member

460 posts Joined: Oct 2008 |

MrD reminds me of Haidilao.

There will come a day where overexpansion comes biting them in the back. |

|

|

|

|

|

Aug 17 2021, 02:05 PM Aug 17 2021, 02:05 PM

Return to original view | IPv6 | Post

#122

|

Junior Member

460 posts Joined: Oct 2008 |

China taking a dip again.

Seems like recovery will not be easy. |

|

|

Sep 15 2021, 03:39 PM Sep 15 2021, 03:39 PM

Return to original view | IPv6 | Post

#123

|

Junior Member

460 posts Joined: Oct 2008 |

Anyone looking at Able Global?

|

|

|

Sep 23 2021, 11:08 AM Sep 23 2021, 11:08 AM

Return to original view | IPv6 | Post

#124

|

Junior Member

460 posts Joined: Oct 2008 |

|

|

|

Sep 30 2021, 09:28 PM Sep 30 2021, 09:28 PM

Return to original view | IPv6 | Post

#125

|

Junior Member

460 posts Joined: Oct 2008 |

QUOTE(infested_ysy @ Sep 30 2021, 09:14 PM) Suddenly all Karim's counter reporting loss/low profit.Coincidence? Or scare to cook too much? james.6831 liked this post

|

|

|

Oct 23 2021, 09:27 AM Oct 23 2021, 09:27 AM

Return to original view | IPv6 | Post

#126

|

Junior Member

460 posts Joined: Oct 2008 |

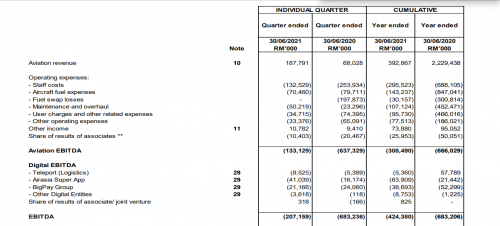

QUOTE(Boon3 @ Oct 23 2021, 09:08 AM) I find it amusing when I look at the last QR and noted the 'digital ebitda'.... cos I remember the AirAsia unicorn thingy the other day... ( https://www.theedgemarkets.com/article/tony...-unicorn-status ) Most if not all unicorns are in loss position for many years. all also losing money ...... I wonder how long AA can last with no big backers. |

|

|

|

|

|

Nov 1 2021, 04:18 PM Nov 1 2021, 04:18 PM

Return to original view | IPv6 | Post

#127

|

Junior Member

460 posts Joined: Oct 2008 |

Operators will need to deal with higher cost and lesser participation from retailers.

Our gov sure is doing great when it comes to self destruction. |

|

|

Nov 11 2021, 02:43 PM Nov 11 2021, 02:43 PM

Return to original view | IPv6 | Post

#128

|

Junior Member

460 posts Joined: Oct 2008 |

|

|

|

Nov 14 2021, 04:29 PM Nov 14 2021, 04:29 PM

Return to original view | IPv6 | Post

#129

|

Junior Member

460 posts Joined: Oct 2008 |

|

|

|

Nov 23 2021, 10:39 PM Nov 23 2021, 10:39 PM

Return to original view | IPv6 | Post

#130

|

Junior Member

460 posts Joined: Oct 2008 |

QUOTE(ChAOoz @ Nov 23 2021, 10:18 PM) Yeah yeah that why most sold out liao cause China don't want baba just continue sucking chinese domestic market and reward foreign share holders. I thought baba is doing that via Lazada?For me i still cling on to the hope that Alibaba will one day help Chinese businesses sell abroad like what shopee did for China merchant in Malaysia. But that hope not very bright now, as can see Alibaba really not good in international market expansion. But one can hope |

|

|

Nov 26 2021, 10:51 AM Nov 26 2021, 10:51 AM

Return to original view | IPv6 | Post

#131

|

Junior Member

460 posts Joined: Oct 2008 |

Looks like Covid is back in the menu for the market.

|

|

|

Nov 27 2021, 12:25 AM Nov 27 2021, 12:25 AM

Return to original view | IPv6 | Post

#132

|

Junior Member

460 posts Joined: Oct 2008 |

As the world markets implode again because of Covid, any strategy this time around?

|

|

|

Nov 30 2021, 07:42 PM Nov 30 2021, 07:42 PM

Return to original view | IPv6 | Post

#133

|

Junior Member

460 posts Joined: Oct 2008 |

QUOTE(Boon3 @ Nov 30 2021, 07:07 PM) And SD reported big losses !!! So, after SIR still find anomalies and can't verify.but this one.... https://www.bursamalaysia.com/market_inform...?ann_id=3214797 Means KPMG was right? Good show along with Omicron. |

|

|

|

|

|

Nov 30 2021, 07:57 PM Nov 30 2021, 07:57 PM

Return to original view | IPv6 | Post

#134

|

Junior Member

460 posts Joined: Oct 2008 |

|

|

|

Nov 30 2021, 08:25 PM Nov 30 2021, 08:25 PM

Return to original view | IPv6 | Post

#135

|

Junior Member

460 posts Joined: Oct 2008 |

QUOTE(ChAOoz @ Nov 30 2021, 08:17 PM) Revenue goes back 2018 level but debt and interest payment still at 2021 level. So profit is gonna be dont know what level. Tbh, they will be considered VERY lucky if still manage to stay listed after this.But boss still rich share holders foot the bill only. They no longer able to cover holes with continuous new debts and placements. Boss better hope he won't get jailed. |

|

|

Nov 30 2021, 10:54 PM Nov 30 2021, 10:54 PM

Return to original view | IPv6 | Post

#136

|

Junior Member

460 posts Joined: Oct 2008 |

Just noticed SCIB result.

Seems like all the goreng hangus already. Back to 2018 level revenue also. |

|

|

Dec 1 2021, 10:07 AM Dec 1 2021, 10:07 AM

Return to original view | IPv6 | Post

#137

|

Junior Member

460 posts Joined: Oct 2008 |

|

|

|

Dec 2 2021, 12:16 PM Dec 2 2021, 12:16 PM

Return to original view | IPv6 | Post

#138

|

Junior Member

460 posts Joined: Oct 2008 |

What happened to BABA?

This post has been edited by Randomization: Dec 2 2021, 12:16 PM |

|

|

Dec 2 2021, 11:47 PM Dec 2 2021, 11:47 PM

Return to original view | IPv6 | Post

#139

|

Junior Member

460 posts Joined: Oct 2008 |

Now that Grab is listed, they got more money in the war chest to expand their market share.

|

|

|

Dec 10 2021, 02:19 PM Dec 10 2021, 02:19 PM

Return to original view | IPv6 | Post

#140

|

Junior Member

460 posts Joined: Oct 2008 |

TG back to pre-pandemic range.

Serba non-payment, going to cross-default. KLSE going to the dump. |

| Change to: |  1.4382sec 1.4382sec

1.78 1.78

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 03:07 AM |