Outline ·

[ Standard ] ·

Linear+

STOCK MARKET DISCUSSION V150

|

Randomization

|

Mar 24 2021, 05:55 PM Mar 24 2021, 05:55 PM

|

|

QUOTE(AVFAN @ Mar 24 2021, 05:43 PM) maybe counting on i-sinar EPF withdrawls to buy houses and cars?!  check yrself... what r u spending yr money on? me,... i havent bought even one T-shirt, haven't eaten in a proper restaurant in 1 yr!  haven't been to a doctor or dentist or car workshop for 1 yr... but did order McD la... like that can get 7% GDP growth?!!  Aiyo, earn so much must spend on yourself la. Minimum also splurge on some good food.  |

|

|

|

|

|

Randomization

|

Mar 24 2021, 07:08 PM Mar 24 2021, 07:08 PM

|

|

QUOTE(squarepilot @ Mar 24 2021, 06:50 PM) Intel ok, but in ireland? Sorry, but i don't think gonna work Foundry business is like steel and airline business if efficiency and productivity is not there, you are going to lose out just calculate how many leave entitled by Taiwanese employee and compare to the holiday leave given to Irish They're expanding rather than trying it out in a new region. Pretty sure they already done their homework on the productivity. |

|

|

|

|

|

Randomization

|

Mar 26 2021, 05:36 PM Mar 26 2021, 05:36 PM

|

|

QUOTE(Kar Weng @ Mar 26 2021, 05:24 PM) The mood’s been really quiet here You found any exciting stock to share? This post has been edited by Randomization: Mar 26 2021, 05:36 PM |

|

|

|

|

|

Randomization

|

Mar 29 2021, 10:46 PM Mar 29 2021, 10:46 PM

|

|

AA result.

What a surprise. Negative net asset.

|

|

|

|

|

|

Randomization

|

Mar 30 2021, 11:06 PM Mar 30 2021, 11:06 PM

|

|

QUOTE(skulless @ Mar 30 2021, 10:06 PM) 1MDB also many billions.  |

|

|

|

|

|

Randomization

|

Mar 31 2021, 01:59 PM Mar 31 2021, 01:59 PM

|

|

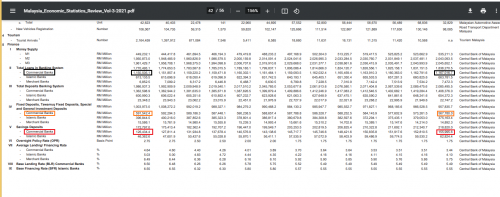

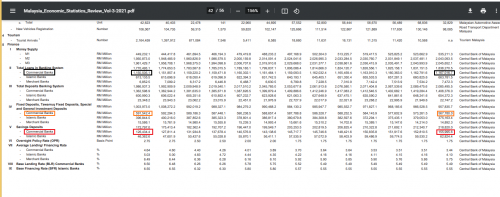

QUOTE(lopo90 @ Mar 31 2021, 01:39 PM)  Just sharing some relevant data I found from DOSM Very intriguing. Cash deposit at banks has increase tremendously while FD decreased. Commercial Loans in banking system only grew like 1% despite low interest rates environment. From what I understand, commercial loans are catered towards small businesses. So looks like business expansion still low and slow. Funny, Islamic and merchant bank showed an 8% increase. My suspicion is that those loaned money went into stock market No surprise on the increase in cash deposit. Not much to spend and most are saving up during the pandemic. |

|

|

|

|

|

Randomization

|

Mar 31 2021, 05:15 PM Mar 31 2021, 05:15 PM

|

|

QUOTE(lopo90 @ Mar 31 2021, 05:09 PM) Well on the bright side, they aren't printing money out of thin air yet. Now just taking money from their piggy bank without any need for approval. There is nothing left in piggy bank. Mostly taking from lender  |

|

|

|

|

|

Randomization

|

Apr 4 2021, 04:37 PM Apr 4 2021, 04:37 PM

|

|

QUOTE(mujinkun @ Apr 4 2021, 04:00 PM) Dear Sifus. Please do teach us what counter to avoid, so far I learned a high price lesson by below counter 1) XOX I don't know why you picked XOX in the first place but if you don't have any investing knowledge, the most basic would be at least invest in profitable counters. |

|

|

|

|

|

Randomization

|

Apr 4 2021, 07:48 PM Apr 4 2021, 07:48 PM

|

|

QUOTE(skty @ Apr 4 2021, 07:36 PM) suffering weekend. double works and time spent to add potential counters into my watchlist for preparation of upcoming melt-up and subsequent crash. This CA divergence really f up my schedule.  Any tips?  |

|

|

|

|

|

Randomization

|

Apr 8 2021, 04:50 PM Apr 8 2021, 04:50 PM

|

|

QUOTE(Vanguard 2015 @ Apr 8 2021, 04:40 PM) When I was younger, I used to gamble in the Genting casino. My favourite game was Blackjack, where the odds were better. When Genting abolished Blackjack and substituted it with Pontoon, I stayed away. So, it is the same with the stock market. Just a matter of calculating the odds and risks. And wait. The main advantage I see with retail investors is that we can choose to make a few decent kills a year and go to sleep for 6 months. We only play for ourselves. For fund managers, they have a big problem. Need to stay invested or to make sure that the unit trust keep on performing. Have we ever seen a unit trust with zero shares holding? Hence somebody once compared retail investors to a speed boat whilst the unit trusts to a oil tanker. Difficult for the oil tanker to turn and manoeuvre. Just my kopitiam talk.  Good to see you're back dishing out knowledge. Hope that the market will get better to lure our general back in action  |

|

|

|

|

|

Randomization

|

May 21 2021, 10:26 AM May 21 2021, 10:26 AM

|

|

AAX so quiet today  |

|

|

|

|

|

Randomization

|

May 28 2021, 08:41 PM May 28 2021, 08:41 PM

|

|

QUOTE(andrekua2 @ May 28 2021, 08:39 PM) Conlanfirm besok merah liao... Luckily sold all my homeritz warrants since foresee this is coming. Still holding mothershare. Besok saturday my friend.  |

|

|

|

|

|

Randomization

|

May 28 2021, 08:55 PM May 28 2021, 08:55 PM

|

|

I think will definitely fall but not as severe as before.

People roughly know how to gauge the impact on their counters.

Plus some already priced in for lockdown.

|

|

|

|

|

|

Randomization

|

May 29 2021, 04:00 PM May 29 2021, 04:00 PM

|

|

QUOTE(rapple @ May 29 2021, 12:21 PM) Sometimes I wonder what's the intention of this people, why the need to manipulate account to pay more taxes? to get more funding from existing loan? to pay more dividends? My view last time was, a) is normal to have businesses roll on credit/financing to sustain their operations. Not healthy but they don't have a choice because there are already in it. b) increase in sales & in receivables is kind of normal for most business because there's always a few bad pay master and in pandemic this is even worse, collection can be drag until 180 days instead of the usual 90 days. Lucky that I don't have significant holding here, but at least i learn something from this losses.. really appreciate your view on serba account. Need good numbers to lure people to subscribe their private placement. Then keep rolling from there.  |

|

|

|

|

|

Randomization

|

May 30 2021, 10:54 AM May 30 2021, 10:54 AM

|

|

Reminds me of CSL.

|

|

|

|

|

|

Randomization

|

May 31 2021, 09:01 PM May 31 2021, 09:01 PM

|

|

QUOTE(Deathscythe@@ @ May 31 2021, 08:30 PM) I thought today RSS for sure attacking Serbadk. Ended up they haven’t started any.. omg… https://www.bursamalaysia.com/misc/missftp/..._2021-05-31.pdfSo big queue, maybe didn't reach their shorts. |

|

|

|

|

|

Randomization

|

Jun 4 2021, 07:50 PM Jun 4 2021, 07:50 PM

|

|

QUOTE(greyPJ @ Jun 4 2021, 07:48 PM) is it tech to 100? yea posted many times already. u also reply many times  |

|

|

|

|

|

Randomization

|

Jun 15 2021, 12:44 PM Jun 15 2021, 12:44 PM

|

|

QUOTE(squarepilot @ Jun 15 2021, 12:11 PM) sudah tarak 8 4 6. 8 4 1 saya tarak mahu  probably you see things that i don't. well... i choose to hold. TG ban will benefit harta  harta is worth PE50 before pandemic, why it cannot worth even at PE 30 post pandemic? i no understand Simple lazy 2 cents answer - Before pandemic, whole world didn't increase capacity like crazy. |

|

|

|

|

|

Randomization

|

Jul 19 2021, 10:37 AM Jul 19 2021, 10:37 AM

|

|

QUOTE(ChAOoz @ Jul 15 2021, 11:15 AM) Portfolio already switch to defensive LOW P/E export counter so nothing much to post. Not in those Serba, Glove or what. Only left 1 Bursa Tech in my portfolio. So nothing much to see each other. Focus shifted to China Tech now  How's your China holding? HSI waterfall again  |

|

|

|

|

|

Randomization

|

Jul 24 2021, 03:44 PM Jul 24 2021, 03:44 PM

|

|

QUOTE(statikinetic @ Jul 24 2021, 03:39 PM) Incredible. Thread moving on a Saturday compared to a business day yesterday. Bulls are all gone.  Not surprising. But if the covid situation in MY gets better, the retailer might join in again expecting similar recovery like last year. |

|

|

|

|

Mar 24 2021, 05:55 PM

Mar 24 2021, 05:55 PM

Quote

Quote

0.1367sec

0.1367sec

0.90

0.90

7 queries

7 queries

GZIP Disabled

GZIP Disabled