QUOTE(Boon3 @ Nov 26 2020, 09:39 AM)

Here is what 5 minutes of work can do ...

This exercise is to test out the theory of the risk on the buybacks...

See we understand and know that TopGlove has bought a shit load of shares. Day in day out buyback, continuously for so many days...

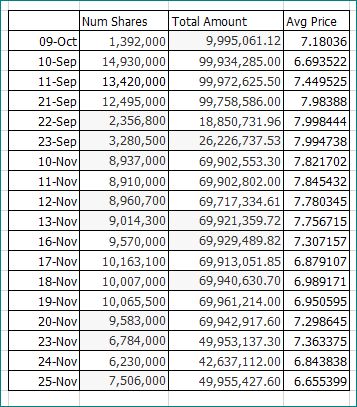

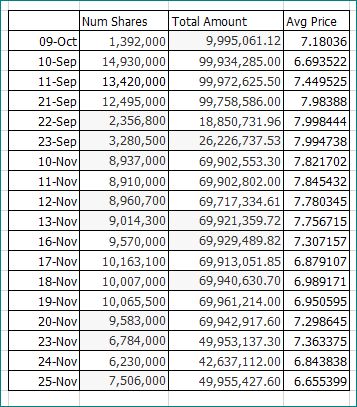

So it would be good that we tabulate out the number of shares they bought and the monetary value of the shares it bought....

p/s do double check and verify... ppl like me can make mistakes. I am only human.

What I got so far is ....

Total number shares bought during this period.... 153,604,900

Sum paid for these shares = RM1,116,419,996.49

.... and the average price for these shares is ... 7.268127

woooooo..... paper loss when based on yesterday closing price of 6.65

Based on 6.65, these treasury shares is only worth 1,021,472,585.00

Which means a paper loss of RM94,947,411.49

Paper loss of 94.9 million.

Yes, I have been calling it out loud that Top Glove share buyback's is way too aggressive and reckless.

Sadly, as mention b4, in the market, ppl see what they want to see and hear what they want to hear.

Of course, yes OF COURSE ... Top Glove share price could recover back. 6.65 was just yesterday low. Top Glove could easily trade back up to 9.50 and above. Heck, maybe 10 or 11.

That of course is possible. But what if it doesn't.

When the share falls, you buyback, no problem. That's understandable.

But look at Top Glove style...

Share goes up, it sill buys by the truckoad.

This is reckless. This is trying to jack up the price of the share.

well, look at the consequences....

buy back so much... 1 billion worth of shares... and yet the shares is LOWER than the buyback prices.

and yeah.... TOP GLOVE got so much money....but do remember at this moment, the buybacks has drained out heck a lot of money from its working capital. What about its other plans?

Like I said.... if Top Glove wanted to reward its shareholders, no need so many pattern la, just give out plain cash back to the shareholders. No need all these RECKLESS share buybacks.

Tan Sri Lim said they have got enough cash to do all the things they need.This exercise is to test out the theory of the risk on the buybacks...

See we understand and know that TopGlove has bought a shit load of shares. Day in day out buyback, continuously for so many days...

So it would be good that we tabulate out the number of shares they bought and the monetary value of the shares it bought....

p/s do double check and verify... ppl like me can make mistakes. I am only human.

What I got so far is ....

Total number shares bought during this period.... 153,604,900

Sum paid for these shares = RM1,116,419,996.49

.... and the average price for these shares is ... 7.268127

woooooo..... paper loss when based on yesterday closing price of 6.65

Based on 6.65, these treasury shares is only worth 1,021,472,585.00

Which means a paper loss of RM94,947,411.49

Paper loss of 94.9 million.

Yes, I have been calling it out loud that Top Glove share buyback's is way too aggressive and reckless.

Sadly, as mention b4, in the market, ppl see what they want to see and hear what they want to hear.

Of course, yes OF COURSE ... Top Glove share price could recover back. 6.65 was just yesterday low. Top Glove could easily trade back up to 9.50 and above. Heck, maybe 10 or 11.

That of course is possible. But what if it doesn't.

When the share falls, you buyback, no problem. That's understandable.

But look at Top Glove style...

Share goes up, it sill buys by the truckoad.

This is reckless. This is trying to jack up the price of the share.

well, look at the consequences....

buy back so much... 1 billion worth of shares... and yet the shares is LOWER than the buyback prices.

and yeah.... TOP GLOVE got so much money....but do remember at this moment, the buybacks has drained out heck a lot of money from its working capital. What about its other plans?

Like I said.... if Top Glove wanted to reward its shareholders, no need so many pattern la, just give out plain cash back to the shareholders. No need all these RECKLESS share buybacks.

the share buy-back is what they learnt from apple, amazon, google, warren buffet's berkshire hartaway.....

Nov 26 2020, 09:46 AM

Nov 26 2020, 09:46 AM

Quote

Quote 0.0858sec

0.0858sec

0.82

0.82

7 queries

7 queries

GZIP Disabled

GZIP Disabled