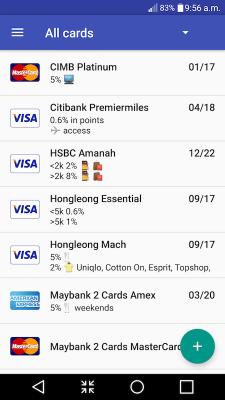

With all the great rebate cards available in Malaysia, I think most forumer in lowyat.net would have at least a few cards in hand to enjoy all the points and cash rebates in different categories

I am one of them but I find that it is very hard to keep track of due dates and transactions.

I needed an app to:

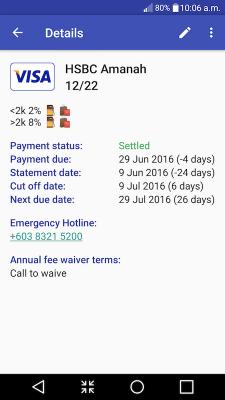

- Keep track of due dates to settle debts before due date, so not to kena any interest

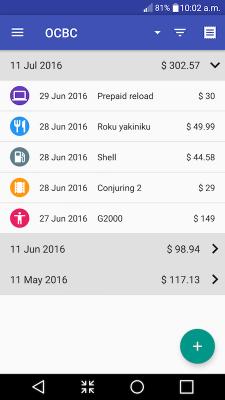

- Keep track of transactions so that I know which card had already maxed out cash rebate (usually rm50 per statement/month cycle)

- One glance to see card benefits and terms/conditions, whether it is 5% on dining on weekend or 2% on weekday or selected days..

Searched on app store and couldn't find one that does what I need, especially for Malaysian usage (I think other countries don't have as much cash rebates cards as us, but not sure)

Only paid version available for now. I'm giving out promo codes for early adopters so do PM me to request for one, in exchange I just ask for your feedback and any feature requests XD

Here is the Google Play link: https://play.google.com/store/apps/details?...itcardinstantly

Thanks for listening

Jul 3 2016, 10:45 PM

Jul 3 2016, 10:45 PM

Quote

Quote

0.0685sec

0.0685sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled