Can tell me which car insurance company is the best?

Which car insurance company is the best, Comment please

Which car insurance company is the best, Comment please

|

|

Nov 24 2015, 12:45 PM, updated 11y ago Nov 24 2015, 12:45 PM, updated 11y ago

Show posts by this member only | Post

#1

|

Senior Member

1,310 posts Joined: Sep 2006 |

Can tell me which car insurance company is the best?

|

|

|

|

|

|

Nov 24 2015, 01:05 PM Nov 24 2015, 01:05 PM

Show posts by this member only | Post

#2

|

Senior Member

1,335 posts Joined: Nov 2008 |

There's no best company lah.

However, my company has 7 insurers to pick from, i myself use allianz because of their very good and reliable roadside assistance (personal experience). |

|

|

Nov 24 2015, 01:40 PM Nov 24 2015, 01:40 PM

Show posts by this member only | Post

#3

|

Junior Member

140 posts Joined: Jun 2005 |

yup, i heard allianz is good in road assistance, i think they provide 100km free towing.

i myself have been using motortakaful/etiqa for the past years.. they provide free 50km towing, more than that is chargeable per km. i have been receiving money (dividend?) every year as well, more than 200+ for this year. more importantly, i can renew my insurance online with additional 10% discount, on top of NCD. |

|

|

Nov 25 2015, 02:34 AM Nov 25 2015, 02:34 AM

Show posts by this member only | Post

#4

|

Junior Member

114 posts Joined: Jan 2012 |

For me, the definition of good insurance consist of

1. Fast/easy approval on claim 2. Accept by majority workshop as what i know, Alliance, Tokyo marine and another 2 company (i forget the name) are quite prefer by most workshop. Try avoid jerneh, when you got accident, very hard to find workshop to do jerneh claim |

|

|

Nov 25 2015, 08:46 AM Nov 25 2015, 08:46 AM

Show posts by this member only | Post

#5

|

Senior Member

2,618 posts Joined: Apr 2012 |

Which insurance can renew online or at branch to take advantage of the 10% discount ?

At present renewed online at Kurnia but car must below 10 years , @ discount 10 % and also at branch for 10% discount. Allianz easier, faster to claim, Kurnia slower . Done claim with both before. Allianz, Kurnia, Axa free limited towing. Kurnia unlimited towing with a small fee. This post has been edited by magika: Nov 25 2015, 08:52 AM |

|

|

Nov 25 2015, 10:45 AM Nov 25 2015, 10:45 AM

Show posts by this member only | Post

#6

|

Senior Member

2,618 posts Joined: Apr 2012 |

Not all car insurance company is the same. Some have free limited towing others have 24 hours assist only. Kurnia claims slow , Allianz faster. I have claims before from Kurnia and Allianz and still have a pending theft claim from Kurnia.

|

|

|

|

|

|

Nov 25 2015, 11:41 AM Nov 25 2015, 11:41 AM

Show posts by this member only | Post

#7

|

Senior Member

4,726 posts Joined: Jul 2013 |

QUOTE(magika @ Nov 25 2015, 08:46 AM) as far as i know, all insurance companies will give you the discount if you renew at the branches. reason being the discount is actually the commission given to those runners/agents. note aside: i think without knowing how fast their claim processing is, one can check which insurance company has the best free towing service... |

|

|

Dec 8 2015, 05:36 PM Dec 8 2015, 05:36 PM

Show posts by this member only | Post

#8

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

any recommendation on good 3rd party insurance?

|

|

|

Dec 8 2015, 05:37 PM Dec 8 2015, 05:37 PM

Show posts by this member only | Post

#9

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

QUOTE(skyvampire @ Nov 25 2015, 02:34 AM) For me, the definition of good insurance consist of experienced AIG before, not bad though. can try.1. Fast/easy approval on claim 2. Accept by majority workshop as what i know, Alliance, Tokyo marine and another 2 company (i forget the name) are quite prefer by most workshop. Try avoid jerneh, when you got accident, very hard to find workshop to do jerneh claim |

|

|

Dec 9 2015, 09:42 AM Dec 9 2015, 09:42 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

does road tax expiry date same with insurance expiry date?

|

|

|

Dec 9 2015, 09:48 AM Dec 9 2015, 09:48 AM

|

Senior Member

1,335 posts Joined: Nov 2008 |

|

|

|

Dec 9 2015, 10:00 AM Dec 9 2015, 10:00 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

|

|

|

Dec 9 2015, 10:10 AM Dec 9 2015, 10:10 AM

|

Senior Member

1,335 posts Joined: Nov 2008 |

Market Value Purchasing your Motor Insurance on Market Value would be like the name itself, paid upon the most current market value of your car. Take for example: My car is worth 100k now. So I buy the insurance on the current market value at 100k. At the end of the year, I get into an accident and experience a total lost. I want to claim my car insurance. At the same time, my car is now only worth 75k on average in the market. Insurance will also pay at the market value and that is 75k. Agreed Value Purchasing your Motor Insurance on Agreed Value would be more straight forward. However, I will be insuring my car at a higher value. Take for example: My car is worth 100k now. The Agreed Value given to my car is 107k, at a slightly higher premium. So I insure my car for 107k. At the end of the year, I get into an accident and experience a total lost. I want to claim my car insurance. At the same time, my car is now only worth 75k on average in the market. Fortunately for me, I insured my car at an agreed value of 107k. So the insurance will pay at the Agreed Value of 107k. Floor Limit would generally mean the minimum amount to insure. This is usually at RM10,000, for cars valued below RM10,000. TheLoneWolf07 liked this post

|

|

|

|

|

|

Dec 9 2015, 10:17 AM Dec 9 2015, 10:17 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

QUOTE(JIUHWEI @ Dec 9 2015, 10:10 AM) Market Value 10q for the detailed info!Purchasing your Motor Insurance on Market Value would be like the name itself, paid upon the most current market value of your car. Take for example: My car is worth 100k now. So I buy the insurance on the current market value at 100k. At the end of the year, I get into an accident and experience a total lost. I want to claim my car insurance. At the same time, my car is now only worth 75k on average in the market. Insurance will also pay at the market value and that is 75k. Agreed Value Purchasing your Motor Insurance on Agreed Value would be more straight forward. However, I will be insuring my car at a higher value. Take for example: My car is worth 100k now. The Agreed Value given to my car is 107k, at a slightly higher premium. So I insure my car for 107k. At the end of the year, I get into an accident and experience a total lost. I want to claim my car insurance. At the same time, my car is now only worth 75k on average in the market. Fortunately for me, I insured my car at an agreed value of 107k. So the insurance will pay at the Agreed Value of 107k. Floor Limit would generally mean the minimum amount to insure. This is usually at RM10,000, for cars valued below RM10,000. |

|

|

Dec 9 2015, 11:07 AM Dec 9 2015, 11:07 AM

|

Senior Member

2,215 posts Joined: Nov 2007 From: Cheras, KL. |

Jiuhwei, can list which insurer company provides Agreed Value? thanks » Click to show Spoiler - click again to hide... «

|

|

|

Dec 9 2015, 11:40 AM Dec 9 2015, 11:40 AM

|

Senior Member

1,335 posts Joined: Nov 2008 |

I provide agreed value

This post has been edited by JIUHWEI: Dec 9 2015, 11:41 AM |

|

|

Dec 9 2015, 11:59 AM Dec 9 2015, 11:59 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

one more ques, i wonder floor limit is classed at market value or agreed value?

|

|

|

Dec 9 2015, 12:31 PM Dec 9 2015, 12:31 PM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

anything like so called recommended insurance company for particular brand of car?

ppls said like local car, better go for Company A. German car go for Company B, and so on. |

|

|

Dec 9 2015, 02:20 PM Dec 9 2015, 02:20 PM

|

Senior Member

1,010 posts Joined: Jan 2011 |

QUOTE(adele123 @ Nov 25 2015, 11:41 AM) as far as i know, all insurance companies will give you the discount if you renew at the branches. reason being the discount is actually the commission given to those runners/agents. Allianz does not give the discount at their branch for walk-in customers. So, I had to get AXA instead. note aside: i think without knowing how fast their claim processing is, one can check which insurance company has the best free towing service... Have been using mostly Etiqa previously due to the 10% discount. Wouldn't recommend them due to their poor towing terms and customer support. |

|

|

Dec 9 2015, 04:23 PM Dec 9 2015, 04:23 PM

|

Senior Member

1,335 posts Joined: Nov 2008 |

QUOTE(spreeeee @ Dec 9 2015, 11:59 AM) Usually none of my customers reach floor limit yet... Floor limit - market value. It's a minimum to even quote anything otherwise the insurance company actually lose money from just taking your business. The moment you sign, they lose money just to process your file. QUOTE(spreeeee @ Dec 9 2015, 12:31 PM) anything like so called recommended insurance company for particular brand of car? No such thing. All still pay with Ringgit. ppls said like local car, better go for Company A. German car go for Company B, and so on. |

|

|

Dec 9 2015, 04:58 PM Dec 9 2015, 04:58 PM

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(jdgobio @ Dec 9 2015, 02:20 PM) Allianz does not give the discount at their branch for walk-in customers. So, I had to get AXA instead. I have AXA (3rd party) , excellent towing service, tow a few times a year due to old car. All paid by AXA, wonder what is your issues .....Have been using mostly Etiqa previously due to the 10% discount. Wouldn't recommend them due to their poor towing terms and customer support. I would recommend AXA due to free towing and 3rd party coverage. So those insurance renewal online is Kurnia only plus 10% discount also at branch office. Etika also 10% discount at branch but online renewal, free towing ? This post has been edited by magika: Dec 9 2015, 05:03 PM |

|

|

Dec 9 2015, 05:14 PM Dec 9 2015, 05:14 PM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

QUOTE(JIUHWEI @ Dec 9 2015, 04:23 PM) Usually none of my customers reach floor limit yet... Floor limit - market value. It's a minimum to even quote anything otherwise the insurance company actually lose money from just taking your business. The moment you sign, they lose money just to process your file. No such thing. All still pay with Ringgit. reason on acquiring floor limit is for very old car, more than 15 yrs. anyway, does 3rd party insurance, cover towing for own car in case of accident? or everything is about 3rd party only? |

|

|

Dec 9 2015, 05:15 PM Dec 9 2015, 05:15 PM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

QUOTE(magika @ Dec 9 2015, 04:58 PM) I have AXA (3rd party) , excellent towing service, tow a few times a year due to old car. All paid by AXA, wonder what is your issues ..... do u mean AXA Affin General Insurance?I would recommend AXA due to free towing and 3rd party coverage. So those insurance renewal online is Kurnia only plus 10% discount also at branch office. Etika also 10% discount at branch but online renewal, free towing ? where to apply? pos office? http://www.pos.com.my/post-offices/financi...ices/?insurance |

|

|

Dec 9 2015, 05:51 PM Dec 9 2015, 05:51 PM

|

Senior Member

1,335 posts Joined: Nov 2008 |

|

|

|

Dec 10 2015, 08:38 AM Dec 10 2015, 08:38 AM

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(spreeeee @ Dec 9 2015, 05:14 PM) reason on acquiring floor limit is for very old car, more than 15 yrs. anyway, does 3rd party insurance, cover towing for own car in case of accident? or everything is about 3rd party only? QUOTE(spreeeee @ Dec 9 2015, 05:15 PM) do u mean AXA Affin General Insurance? Insurance agencies should have it. My insurance agency says its the cheapest and no need PA.where to apply? pos office? http://www.pos.com.my/post-offices/financi...ices/?insurance I recently cancelled the insurance as i have sold of the old car and the refund process takes more than a month. |

|

|

Dec 10 2015, 08:40 AM Dec 10 2015, 08:40 AM

|

Senior Member

2,618 posts Joined: Apr 2012 |

|

|

|

Dec 10 2015, 09:36 AM Dec 10 2015, 09:36 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

QUOTE(magika @ Dec 10 2015, 08:38 AM) Not all company give free towing, some say 24 hours hotline, but not free towing. AXA provides 3rd party but free towing included. i thought of walk-in to pos office to renew with AXA 3rd party.Insurance agencies should have it. My insurance agency says its the cheapest and no need PA. I recently cancelled the insurance as i have sold of the old car and the refund process takes more than a month. btw, do u know what documents they will need? |

|

|

Dec 10 2015, 09:37 AM Dec 10 2015, 09:37 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

|

|

|

Dec 10 2015, 09:47 AM Dec 10 2015, 09:47 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

is the free towing service provided by insurance company, limited to per trip? or can max up the number of KM defined regardless of how many trips?

there was a scenario where my friend car involved in an accident in the midnight, and the car needed to be towed to police station for report and photo-shoot, but the police camera-man was not around (went out for case), so no choice the car needed to be towed back to workshop and have to come back again another day for police camera-man to take photo. the workshop person in charge mentioned, only 1 trip included, more than that they charged. my friend paid additional rm100 to the workshop for the 2nd tow service. FYI, the insurance company was AIG, applied from MyEG. |

|

|

Dec 10 2015, 10:06 AM Dec 10 2015, 10:06 AM

|

Senior Member

1,010 posts Joined: Jan 2011 |

QUOTE(magika @ Dec 9 2015, 04:58 PM) I have AXA (3rd party) , excellent towing service, tow a few times a year due to old car. All paid by AXA, wonder what is your issues ..... Err, I didn't say I had any issues with AXA, only that I prefer Allianz.I would recommend AXA due to free towing and 3rd party coverage. So those insurance renewal online is Kurnia only plus 10% discount also at branch office. Etika also 10% discount at branch but online renewal, free towing ? Etiqa only can tow 1 time per incident. Either tow to home or to workshop. Getting their customer service on phone is difficult and their service is slow. They also have very high market value on the cars compared to some other insurers. Very high and unreasonable. If you choose lower amount, they will consider you as self-insured and will only honour partial claim. Allianz uses agreed value, which is a great thing. |

|

|

Dec 10 2015, 10:09 AM Dec 10 2015, 10:09 AM

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(spreeeee @ Dec 10 2015, 09:36 AM) i thought of walk-in to pos office to renew with AXA 3rd party. Only need geran will do. In case of Kurnia branch renewal , need photocopy of IC.btw, do u know what documents they will need? QUOTE(spreeeee @ Dec 10 2015, 09:47 AM) is the free towing service provided by insurance company, limited to per trip? or can max up the number of KM defined regardless of how many trips? AXA, Kurnia free towing limited distance around 50km not included toll charges. If pay extra insurance charges, for towing I believe around 600km roundtrip. So far, tried towing 3 or 4 times per year still no problem. Kurnia, once I tow back home during night. Next day request tow to workshop still free.there was a scenario where my friend car involved in an accident in the midnight, and the car needed to be towed to police station for report and photo-shoot, but the police camera-man was not around (went out for case), so no choice the car needed to be towed back to workshop and have to come back again another day for police camera-man to take photo. the workshop person in charge mentioned, only 1 trip included, more than that they charged. my friend paid additional rm100 to the workshop for the 2nd tow service. FYI, the insurance company was AIG, applied from MyEG. Accident towing, this one a bit complicated. Why need pay workshop for additional towing ? If involved in accident, call insurance company to request for towing, usually tow truck wil be around, can request insurance company to allow the onsite tow truck service. Usually before allowing towing at accident site, make sure negotiate every details with tow truck before allowing towing. In one case, I refused the onsite tow truck services. In another case, I was practically threatened by the onsite police officers to allow the onsite tow truck to tow. One must know ones right in all scenarios. In my case I told the police that if they want, they can tow but I am not paying. |

|

|

Dec 10 2015, 10:24 AM Dec 10 2015, 10:24 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

QUOTE(magika @ Dec 10 2015, 10:09 AM) Only need geran will do. In case of Kurnia branch renewal , need photocopy of IC. AIG only covers one trip. Additional towing need to pay directly to towing company AXA, Kurnia free towing limited distance around 50km not included toll charges. If pay extra insurance charges, for towing I believe around 600km roundtrip. So far, tried towing 3 or 4 times per year still no problem. Kurnia, once I tow back home during night. Next day request tow to workshop still free. Accident towing, this one a bit complicated. Why need pay workshop for additional towing ? If involved in accident, call insurance company to request for towing, usually tow truck wil be around, can request insurance company to allow the onsite tow truck service. Usually before allowing towing at accident site, make sure negotiate every details with tow truck before allowing towing. In one case, I refused the onsite tow truck services. In another case, I was practically threatened by the onsite police officers to allow the onsite tow truck to tow. One must know ones right in all scenarios. In my case I told the police that if they want, they can tow but I am not paying. |

|

|

Dec 10 2015, 10:25 AM Dec 10 2015, 10:25 AM

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(spreeeee @ Dec 10 2015, 09:36 AM) Post office, remind me of an incident a few years back. I told my son to renew at a local post office, Twice he went, and post office esay system offline. I went personally, and was also told system offline. I demanded to know why no notices has been displayed of system offline as I queued for half an hour. Then was told because of too many customers, they decided not to do insurance renewal. I say no problem, I insist and say will put in my application and come back later in the afternoon to collect. Faced with such a customer they reluctantly agreed. So I wnet back to my office, before I reached it, their staff discussed among themselves and decided to be little Napoleons, they call me and refused to renew my insurance. Simple matter to me , as I called their HQ and lodged an official complaint. A few minutes later, their officers at their local HQ called me and will attend to me personally at my office. Later I went back to collect, and the staff was stone faced all around.QUOTE(jdgobio @ Dec 10 2015, 10:06 AM) Err, I didn't say I had any issues with AXA, only that I prefer Allianz. Allianz claims are very fast as they don't need physical inspection by their adjuster. Did a claim with them on my daughter's car and was impressed. Pity no 10% discount at branch for renewal.Etiqa only can tow 1 time per incident. Either tow to home or to workshop. Getting their customer service on phone is difficult and their service is slow. They also have very high market value on the cars compared to some other insurers. Very high and unreasonable. If you choose lower amount, they will consider you as self-insured and will only honour partial claim. Allianz uses agreed value, which is a great thing. |

|

|

Dec 10 2015, 10:31 AM Dec 10 2015, 10:31 AM

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(spreeeee @ Dec 10 2015, 10:24 AM) For me I wont pay, as not my problem. All insurance company clause stated 1 trip only. For that particular accident case, its not your problem as the tow truck should tow and leave it at the police station and then after all procces has been completed , tow it to your workshop.Here I would like to info a bit, do not allow the tow trucks to dealt with two parties of the accident. 99% of the time , they will claim own damages so will lose NCB. If at fault then no problem. |

|

|

Dec 10 2015, 10:33 AM Dec 10 2015, 10:33 AM

|

Senior Member

1,335 posts Joined: Nov 2008 |

There's no such thing as "free". Let's get this right.

Whatever offered such as a 50km towing is a value-added benefit, and frankly 50km is hardly any distance to boast about. Seriously. It is included for consumers to think about towing, and include more towing distance. Service providers are actually already charging the insurance companies a much cheaper rate in exchange for business volume. Let's be real. In an unfortunate situation, the amount of time & expenses on you is way more than the 10% discount you apparently "saved". |

|

|

Dec 10 2015, 10:36 AM Dec 10 2015, 10:36 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

QUOTE(magika @ Dec 10 2015, 10:31 AM) For me I wont pay, as not my problem. All insurance company clause stated 1 trip only. For that particular accident case, its not your problem as the tow truck should tow and leave it at the police station and then after all procces has been completed , tow it to your workshop. i think, policeman will not allow the car parked there overnight, right? the tow-man mentioned they will not be responsible on the car if it is not tow back to the workshop.Here I would like to info a bit, do not allow the tow trucks to dealt with two parties of the accident. 99% of the time , they will claim own damages so will lose NCB. If at fault then no problem. u see, most of this ppls are some kind of rude ppls (sorry i don't mean all of them, u know i know we know), normally can't talk nicely with them and usually will feel threaten also. |

|

|

Dec 10 2015, 10:50 AM Dec 10 2015, 10:50 AM

|

Senior Member

1,335 posts Joined: Nov 2008 |

QUOTE(spreeeee @ Dec 10 2015, 10:36 AM) i think, policeman will not allow the car parked there overnight, right? the tow-man mentioned they will not be responsible on the car if it is not tow back to the workshop. Usually upon renewing/purchasing your car insurance, you should be receiving a car sticker (transparent road tax protector film) with some info behind it for the driver/passenger to see such as a roadside assistance hotline. u see, most of this ppls are some kind of rude ppls (sorry i don't mean all of them, u know i know we know), normally can't talk nicely with them and usually will feel threaten also. Any towing service or roadside assistance is all through that hotline. Any other tow truck that magically appears in a matter of minutes/seconds, we call them scavengers. Don't entertain them. Wait for your service provider to arrive. In an accident involving another vehicle or loss/theft, please call the agent to help you taichi with the police report. We practice every day. |

|

|

Dec 10 2015, 10:54 AM Dec 10 2015, 10:54 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

QUOTE(JIUHWEI @ Dec 10 2015, 10:50 AM) Usually upon renewing/purchasing your car insurance, you should be receiving a car sticker (transparent road tax protector film) with some info behind it for the driver/passenger to see such as a roadside assistance hotline. even the tow service assigned by insurance company, also some kind of ppl. Any towing service or roadside assistance is all through that hotline. Any other tow truck that magically appears in a matter of minutes/seconds, we call them scavengers. Don't entertain them. Wait for your service provider to arrive. In an accident involving another vehicle or loss/theft, please call the agent to help you taichi with the police report. We practice every day. again, i don't mean all of them. i personally experienced also, maybe i was bad luck to receive such service, and i didn't lodge a complain to insurance company too. |

|

|

Dec 10 2015, 10:57 AM Dec 10 2015, 10:57 AM

|

Senior Member

415 posts Joined: Jan 2003 From: Petaling Jaya |

QUOTE(magika @ Nov 25 2015, 08:46 AM) Which insurance can renew online or at branch to take advantage of the 10% discount ? Agreed, I use etiqa/motor takaful from maybank. 10% off and they also payback to you. I only wish there can provide 12 month interest free.At present renewed online at Kurnia but car must below 10 years , @ discount 10 % and also at branch for 10% discount. Allianz easier, faster to claim, Kurnia slower . Done claim with both before. Allianz, Kurnia, Axa free limited towing. Kurnia unlimited towing with a small fee. |

|

|

Dec 10 2015, 11:19 AM Dec 10 2015, 11:19 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

how cheap is 3rd party insurance compare with comprehensive one?

50% cheaper? |

|

|

Dec 10 2015, 11:22 AM Dec 10 2015, 11:22 AM

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(JIUHWEI @ Dec 10 2015, 10:33 AM) There's no such thing as "free". Let's get this right. For cars that used for working purposes (within city) 50KM is more than enough. In an unfortunate experience , some of my car are insure thru agency, none have been able to help save for some common info.Whatever offered such as a 50km towing is a value-added benefit, and frankly 50km is hardly any distance to boast about. Seriously. It is included for consumers to think about towing, and include more towing distance. Service providers are actually already charging the insurance companies a much cheaper rate in exchange for business volume. Let's be real. In an unfortunate situation, the amount of time & expenses on you is way more than the 10% discount you apparently "saved". QUOTE(spreeeee @ Dec 10 2015, 10:36 AM) i think, policeman will not allow the car parked there overnight, right? the tow-man mentioned they will not be responsible on the car if it is not tow back to the workshop. I have a number of experiences with tow truck, as I have always says, their policy is to squeeze whatever profit they can. That's why nowadays I told my friends, always tow back for repairs to respective franchise workshop such as Perodua, Proton or Toyota, etc. My experience is that it will be better and wont lose out as genuine parts are used. u see, most of this ppls are some kind of rude ppls (sorry i don't mean all of them, u know i know we know), normally can't talk nicely with them and usually will feel threaten also. Just refused their services nicely and call the insurance company for help. QUOTE(JIUHWEI @ Dec 10 2015, 10:50 AM) Usually upon renewing/purchasing your car insurance, you should be receiving a car sticker (transparent road tax protector film) with some info behind it for the driver/passenger to see such as a roadside assistance hotline. You have good service mentality. However it cant be said for the number of times that when I requested help insurance branch personnel. Just a word of caution, don't lie in the police report. Any towing service or roadside assistance is all through that hotline. Any other tow truck that magically appears in a matter of minutes/seconds, we call them scavengers. Don't entertain them. Wait for your service provider to arrive. In an accident involving another vehicle or loss/theft, please call the agent to help you taichi with the police report. We practice every day. QUOTE(dchk @ Dec 10 2015, 10:57 AM) Agreed, I use etiqa/motor takaful from maybank. 10% off and they also payback to you. I only wish there can provide 12 month interest free. One of my cars is due for renewal. I did online compare just now with quotation from Kurnia and Etika. Etika is relative to kurnia 11% more expensive. |

|

|

Dec 10 2015, 11:33 AM Dec 10 2015, 11:33 AM

|

Senior Member

2,618 posts Joined: Apr 2012 |

|

|

|

Dec 10 2015, 11:46 AM Dec 10 2015, 11:46 AM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

|

|

|

Dec 10 2015, 11:49 AM Dec 10 2015, 11:49 AM

|

Senior Member

2,618 posts Joined: Apr 2012 |

|

|

|

Dec 10 2015, 11:59 AM Dec 10 2015, 11:59 AM

|

Senior Member

1,335 posts Joined: Nov 2008 |

QUOTE(spreeeee @ Dec 10 2015, 10:54 AM) even the tow service assigned by insurance company, also some kind of ppl. I personally use Allianz. For few years no more complaints from my clients and myself too again, i don't mean all of them. i personally experienced also, maybe i was bad luck to receive such service, and i didn't lodge a complain to insurance company too. |

|

|

Dec 10 2015, 12:04 PM Dec 10 2015, 12:04 PM

|

Senior Member

1,335 posts Joined: Nov 2008 |

QUOTE(magika @ Dec 10 2015, 11:22 AM) For cars that used for working purposes (within city) 50KM is more than enough. In an unfortunate experience , some of my car are insure thru agency, none have been able to help save for some common info. 50km is from the moment the tow truck leave their premises. Even in city, it's pushing it. I have a number of experiences with tow truck, as I have always says, their policy is to squeeze whatever profit they can. That's why nowadays I told my friends, always tow back for repairs to respective franchise workshop such as Perodua, Proton or Toyota, etc. My experience is that it will be better and wont lose out as genuine parts are used. Just refused their services nicely and call the insurance company for help. You have good service mentality. However it cant be said for the number of times that when I requested help insurance branch personnel. Just a word of caution, don't lie in the police report. One of my cars is due for renewal. I did online compare just now with quotation from Kurnia and Etika. Etika is relative to kurnia 11% more expensive. Who said anything about lying in police report? |

|

|

Dec 10 2015, 01:47 PM Dec 10 2015, 01:47 PM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

i got a quick quote from post office jz now on 3rd party insurance. minimum sum assured is 8K, UniAsia/Zurich around RM483.00 - for a 15 yrs old local car. if want to add towing service, surcharge of RM50 is applicable.

with the same sum assured, from AXA online, only 510.05 - COMPREHENSIVE! why the hell 3rd party is more expensive then?!?! note: ncd = 0% This post has been edited by spreeeee: Dec 10 2015, 01:53 PM |

|

|

Dec 10 2015, 05:33 PM Dec 10 2015, 05:33 PM

|

Senior Member

1,335 posts Joined: Nov 2008 |

QUOTE(spreeeee @ Dec 10 2015, 01:47 PM) i got a quick quote from post office jz now on 3rd party insurance. minimum sum assured is 8K, UniAsia/Zurich around RM483.00 - for a 15 yrs old local car. if want to add towing service, surcharge of RM50 is applicable. To be frank, the personnel at the post office might not know what they are doing. with the same sum assured, from AXA online, only 510.05 - COMPREHENSIVE! why the hell 3rd party is more expensive then?!?! note: ncd = 0% |

|

|

Dec 10 2015, 11:00 PM Dec 10 2015, 11:00 PM

|

All Stars

48,529 posts Joined: Sep 2014 From: REality |

nowadays still got 3rd party insurance meh?

|

|

|

Dec 11 2015, 07:32 AM Dec 11 2015, 07:32 AM

Show posts by this member only | IPv6 | Post

#50

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

Dec 11 2015, 11:27 AM Dec 11 2015, 11:27 AM

|

Senior Member

1,335 posts Joined: Nov 2008 |

I think this information is for the benefit of everyone here.

Tell your friends too! http://www.themalaysianinsider.com/citynew...s-says-pj-mayor |

|

|

Dec 12 2015, 09:58 PM Dec 12 2015, 09:58 PM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

|

|

|

Dec 12 2015, 10:00 PM Dec 12 2015, 10:00 PM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

|

|

|

Dec 12 2015, 10:17 PM Dec 12 2015, 10:17 PM

|

All Stars

48,529 posts Joined: Sep 2014 From: REality |

QUOTE(spreeeee @ Dec 12 2015, 09:58 PM) QUOTE(spreeeee @ Dec 12 2015, 10:00 PM) thanks for sharing info |

|

|

Sep 16 2017, 10:18 AM Sep 16 2017, 10:18 AM

Show posts by this member only | IPv6 | Post

#55

|

Junior Member

334 posts Joined: Oct 2009 |

QUOTE(jdgobio @ Dec 9 2015, 02:20 PM) Allianz does not give the discount at their branch for walk-in customers. So, I had to get AXA instead. May I know where to get AXA for 10% discount with agreed value? From online, it seem quote for insured amount only.Have been using mostly Etiqa previously due to the 10% discount. Wouldn't recommend them due to their poor towing terms and customer support. |

|

|

Sep 17 2017, 11:18 AM Sep 17 2017, 11:18 AM

|

Senior Member

529 posts Joined: Feb 2008 From: Cheras |

Allianz

|

|

|

Sep 17 2017, 02:03 PM Sep 17 2017, 02:03 PM

|

All Stars

11,954 posts Joined: May 2007 |

takaful malaysia

|

|

|

Sep 17 2017, 02:32 PM Sep 17 2017, 02:32 PM

|

Senior Member

1,039 posts Joined: Aug 2013 |

For me, Tokyo Marine

|

|

|

Sep 17 2017, 05:09 PM Sep 17 2017, 05:09 PM

|

Junior Member

343 posts Joined: Jul 2014 |

Why Honda car insurance must be with MSIG? Any reason or extra benefit? Can i switch to other insurance?

|

|

|

Sep 17 2017, 06:36 PM Sep 17 2017, 06:36 PM

|

Senior Member

1,039 posts Joined: Aug 2013 |

QUOTE(commtrader @ Sep 17 2017, 05:09 PM) Why Honda car insurance must be with MSIG? Any reason or extra benefit? Can i switch to other insurance? It's not a must. You can opt for other insurance companies. As for whether there are other added benefits, you may have to compare different insurance companies as under the current de-tariff regime, motor insurance offered by different insurance companies may have different added on benefits. |

|

|

Sep 17 2017, 09:38 PM Sep 17 2017, 09:38 PM

|

Senior Member

1,010 posts Joined: Jan 2011 |

|

|

|

Sep 18 2017, 12:36 AM Sep 18 2017, 12:36 AM

|

Junior Member

334 posts Joined: Oct 2009 |

QUOTE(jdgobio @ Sep 17 2017, 09:38 PM) Yes, I go there the quote button end up with insured value only. I don't see option for agreed value til the payment process.😖This post has been edited by reeve-826: Sep 18 2017, 01:57 AM |

|

|

Sep 18 2017, 06:52 AM Sep 18 2017, 06:52 AM

|

Senior Member

549 posts Joined: Jan 2009 |

Going to have my 1st car anniversary soon on Feb. I already saving for it haha

|

|

|

Sep 18 2017, 10:21 PM Sep 18 2017, 10:21 PM

|

Senior Member

1,010 posts Joined: Jan 2011 |

|

|

|

Sep 18 2017, 10:32 PM Sep 18 2017, 10:32 PM

|

Junior Member

334 posts Joined: Oct 2009 |

|

|

|

Sep 19 2017, 12:02 PM Sep 19 2017, 12:02 PM

|

Senior Member

1,010 posts Joined: Jan 2011 |

|

|

|

Sep 19 2017, 12:22 PM Sep 19 2017, 12:22 PM

|

Junior Member

26 posts Joined: Feb 2017 |

|

|

|

Sep 19 2017, 01:43 PM Sep 19 2017, 01:43 PM

|

Junior Member

355 posts Joined: May 2007 |

I have a question, i have ask for the quotation from Etiqa(My current insurance), they do offer the 10% off discount, after trying AXA, i have put thru the same computation to AXA. The insurance to pay is actually RM100+ less, could there be something that i miss or omitted in the insurance calculation?

As AXA is done manually thru online. Thanks. This post has been edited by haru20: Sep 19 2017, 01:43 PM |

|

|

Sep 19 2017, 01:48 PM Sep 19 2017, 01:48 PM

|

Junior Member

26 posts Joined: Feb 2017 |

I have the same problem too...I got quotation from Allianz and Tokio Marine..both premiums quoted are higher than AXA.. and even higher than last year's premium although the sum insured is lower this year than last year..don't know how they calculate . Not transparent now with the detariff in place effective 1st July 2017.

|

|

|

Sep 19 2017, 01:50 PM Sep 19 2017, 01:50 PM

|

Junior Member

355 posts Joined: May 2007 |

QUOTE(happying @ Sep 19 2017, 01:48 PM) I have the same problem too...I got quotation from Allianz and Tokio Marine..both premiums quoted are higher than AXA.. and even higher than last year's premium although the sum insured is lower this year than last year..don't know how they calculate . Not transparent now with the detariff in place effective 1st July 2017. Are u planning to jump ship and opt from AXA instead? Anyone have used and transacted with AXA any comments is much appreciated. Thank you. |

|

|

Sep 19 2017, 04:18 PM Sep 19 2017, 04:18 PM

|

Junior Member

26 posts Joined: Feb 2017 |

With the detariff, BNM hopes that insurers will come up with competitive (additional benefits/service) and fair pricing but actually let the insurers decide on the premium based on the risk profiles of the drivers. So technically, the price will go up instead of down...Allianz and Tokio Marine as I know offer no additional benefits after detariff( same as tariff) but the premium actually went up 10%. I did ask them and they replied its based on your age, location and car model..full of B.S..My age will go up, location is the same, no accident claims, car market value went down - premium increase 10%. So how is it fair for consumers?Only burden us more...

|

|

|

Sep 19 2017, 04:20 PM Sep 19 2017, 04:20 PM

|

Junior Member

26 posts Joined: Feb 2017 |

|

|

|

Sep 19 2017, 09:21 PM Sep 19 2017, 09:21 PM

|

Junior Member

334 posts Joined: Oct 2009 |

want to ask everyone on NCD , currently insurance policy with 0% NCD where the policy will be expired on 29 Sept 2017. If i sell the car now and transfer ownership at JPJ completed on 20th Sept 2017. However there is 9 days more to reach 1 year, i don't cancel the policy and let it til expiration date.

Will i have 2nd year NCD of 25% when i buy a new car next month? |

|

|

Sep 19 2017, 09:21 PM Sep 19 2017, 09:21 PM

|

Junior Member

334 posts Joined: Oct 2009 |

|

|

|

Sep 20 2017, 12:15 AM Sep 20 2017, 12:15 AM

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(haru20 @ Sep 19 2017, 01:50 PM) Are u planning to jump ship and opt from AXA instead? I have used AXA insurance for a while now and its based on agreed value (wording used in the renewal policy). When I renew my insurance, will update whether the cost is higher as compared to previous year.Anyone have used and transacted with AXA any comments is much appreciated. Thank you. Hmmm... Noticed that the agreed value has declined from 1 year to another. So I guess the agreed value may be the market value at the time of renewal This post has been edited by abcn1n: Sep 20 2017, 01:01 AM |

|

|

Sep 20 2017, 12:21 AM Sep 20 2017, 12:21 AM

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(spreeeee @ Dec 10 2015, 09:37 AM) Thanks |

|

|

Sep 20 2017, 10:25 AM Sep 20 2017, 10:25 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(abcn1n @ Sep 20 2017, 12:15 AM) I have used AXA insurance for a while now and its based on agreed value (wording used in the renewal policy). When I renew my insurance, will update whether the cost is higher as compared to previous year. Agreed value is the consensus market value of the car.Hmmm... Noticed that the agreed value has declined from 1 year to another. So I guess the agreed value may be the market value at the time of renewal As we know value of the car goes down when it is getting old. |

|

|

Sep 20 2017, 11:56 AM Sep 20 2017, 11:56 AM

|

Junior Member

355 posts Joined: May 2007 |

Actually i try proceeding with the quotation for AXA, by proceeding further adding in the addition named driver and etc. The price actually come out the quite close to Etiqa quotation, just cheaper by Rm10-30.

Since the hassle of need to change provider and notify the NCD amt, i think i will still continue with my current insurance provider. |

|

|

Sep 20 2017, 03:13 PM Sep 20 2017, 03:13 PM

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(cherroy @ Sep 20 2017, 10:25 AM) Agreed value is the consensus market value of the car. Thanks Cherroy.As we know value of the car goes down when it is getting old. For any who are interested, renewed my car insurance with lower cost. The new ruling don't seem to have caused any increase in insurance cost |

|

|

Sep 21 2017, 05:29 PM Sep 21 2017, 05:29 PM

|

Junior Member

26 posts Joined: Feb 2017 |

called AXA to ask and the customer service said online quotation is based on sum insured. So need to double confirm on that.

I think for online renewal - AXA has the best online platform whereby you can get instant quotation for comparison. For your car latest market value: https://www.mycarinfo.com.my/Valuation/Free...rt?version=free After comparing Allianz, Tokio Marine and AXA, I find AXA offers the best rate with the same kind of coverage.The difference is about 10%. |

|

|

Sep 21 2017, 06:05 PM Sep 21 2017, 06:05 PM

|

Junior Member

26 posts Joined: Feb 2017 |

BTW, Allianz provides agreed value by default. So it is reasonable to find that premium quoted is higher than your car market value.

|

|

|

Sep 25 2017, 07:45 AM Sep 25 2017, 07:45 AM

|

Senior Member

520 posts Joined: Jul 2015 |

Looking at the competitive price, anyone used AXA before n can share experiences here. Thx

|

|

|

Sep 26 2017, 02:09 PM Sep 26 2017, 02:09 PM

Show posts by this member only | IPv6 | Post

#83

|

Senior Member

756 posts Joined: Dec 2016 |

I thought all companies are the same, rates are regulated by BNM, except when you purchase value-added products, which does not make sense because you already rich enough to afford a premium-grade insurance compared to the minimum required insurance, because you likely own a more expensive car to require the value-added insurance, price should not be your concern.

|

|

|

Sep 27 2017, 05:26 PM Sep 27 2017, 05:26 PM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

QUOTE(LNYC @ Sep 25 2017, 07:45 AM) AXA is a good company, road assist and claims are reputable. The only thing would be the market value of certain make/model of cars. Now in the market you can compare for market value and premium pricing. Unless you have been renewing your insurance with Tan Chong then the value would be as what TC suggests. |

|

|

Sep 27 2017, 05:28 PM Sep 27 2017, 05:28 PM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

QUOTE(2387581 @ Sep 26 2017, 02:09 PM) I thought all companies are the same, rates are regulated by BNM, except when you purchase value-added products, which does not make sense because you already rich enough to afford a premium-grade insurance compared to the minimum required insurance, because you likely own a more expensive car to require the value-added insurance, price should not be your concern. Hi Bro, the premium rates are not different across all companies as well as the perks. The motor insurance market is facing de-tariffication so it is ideal to shop around. Try to avoid a few not reputable among workshops then you are safe. |

|

|

Sep 28 2017, 09:28 PM Sep 28 2017, 09:28 PM

|

Junior Member

26 posts Joined: Feb 2017 |

QUOTE(bryancsk @ Sep 27 2017, 05:26 PM) AXA is a good company, road assist and claims are reputable. The only thing would be the market value of certain make/model of cars. Now in the market you can compare for market value and premium pricing. I have renewed my AXA insurance with Tan Chong and forgo the 10% online renewal discount from AXA because Tan Chong offers 'no betterment' for up to 10 years old car.Unless you have been renewing your insurance with Tan Chong then the value would be as what TC suggests. And with Tan Chong, it is based on Agreed Value and not Sum Insured value. |

|

|

Sep 29 2017, 02:26 PM Sep 29 2017, 02:26 PM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

QUOTE(happying @ Sep 28 2017, 09:28 PM) I have renewed my AXA insurance with Tan Chong and forgo the 10% online renewal discount from AXA because Tan Chong offers 'no betterment' for up to 10 years old car. That's great ! betterment up to 10 years is very important. and TC normally recommend a high agreed value for Nissan/ Inifiniti cars.And with Tan Chong, it is based on Agreed Value and not Sum Insured value. |

|

|

Oct 3 2017, 02:21 PM Oct 3 2017, 02:21 PM

|

Senior Member

520 posts Joined: Jul 2015 |

QUOTE(bryancsk @ Sep 27 2017, 05:26 PM) AXA is a good company, road assist and claims are reputable. The only thing would be the market value of certain make/model of cars. Now in the market you can compare for market value and premium pricing. Thx for the infor.Unless you have been renewing your insurance with Tan Chong then the value would be as what TC suggests. So far no complaints and ez to claim? |

|

|

Oct 3 2017, 02:22 PM Oct 3 2017, 02:22 PM

|

Senior Member

520 posts Joined: Jul 2015 |

|

|

|

Oct 5 2017, 10:08 AM Oct 5 2017, 10:08 AM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

QUOTE(LNYC @ Oct 3 2017, 02:22 PM) Normally if you do not renew with franchise the betterment for spare parts would be 5 years while franchise can offer up to 10 years. It means that up to 10 years you are entitled to new parts replacement in the event of a claim. |

|

|

Oct 5 2017, 10:08 AM Oct 5 2017, 10:08 AM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

|

|

|

Oct 5 2017, 10:14 AM Oct 5 2017, 10:14 AM

|

Senior Member

520 posts Joined: Jul 2015 |

QUOTE(bryancsk @ Oct 5 2017, 10:08 AM) Normally if you do not renew with franchise the betterment for spare parts would be 5 years while franchise can offer up to 10 years. It means that up to 10 years you are entitled to new parts replacement in the event of a claim. Means with the same insurance company? not with the service workshop ho. Sorry if I misunderstood you ya. |

|

|

Oct 5 2017, 11:10 AM Oct 5 2017, 11:10 AM

|

Junior Member

342 posts Joined: Mar 2008 |

QUOTE(bryancsk @ Oct 5 2017, 10:08 AM) Normally if you do not renew with franchise the betterment for spare parts would be 5 years while franchise can offer up to 10 years. It means that up to 10 years you are entitled to new parts replacement in the event of a claim. Found this in AXA website;"No extra costs No loading for cars up to 10 years old and insured value between RM20,000 to RM300,000" so meaning no loading is better? |

|

|

Oct 5 2017, 11:25 AM Oct 5 2017, 11:25 AM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

QUOTE(LNYC @ Oct 5 2017, 10:14 AM) Means with the same insurance company? not with the service workshop ho. Different insurance companies will have their own betterment guidelines. In many cases, if you renew with agents, your betterment for new parts is only up to 5 years. While if you renew with franchise car dealerships, they normally offer up to 10 years to be more competitive in the market. Sorry if I misunderstood you ya. |

|

|

Oct 5 2017, 11:27 AM Oct 5 2017, 11:27 AM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

QUOTE(spiderwick @ Oct 5 2017, 11:10 AM) Found this in AXA website; This means that as long as your car is within the 10 years old mark, you are not subjected to loading but your sum insured has to be wthin 20K to 300K. If it goes below 20K then you are subjected to additional loading."No extra costs No loading for cars up to 10 years old and insured value between RM20,000 to RM300,000" so meaning no loading is better? |

|

|

Oct 5 2017, 01:44 PM Oct 5 2017, 01:44 PM

|

Senior Member

520 posts Joined: Jul 2015 |

QUOTE(bryancsk @ Oct 5 2017, 11:25 AM) Different insurance companies will have their own betterment guidelines. In many cases, if you renew with agents, your betterment for new parts is only up to 5 years. While if you renew with franchise car dealerships, they normally offer up to 10 years to be more competitive in the market. Oh.. Okok. Thx thx. Cause I diy Etiqa. So blurr blurr wan. |

|

|

Oct 5 2017, 02:15 PM Oct 5 2017, 02:15 PM

|

Junior Member

342 posts Joined: Mar 2008 |

QUOTE(bryancsk @ Oct 5 2017, 11:27 AM) This means that as long as your car is within the 10 years old mark, you are not subjected to loading but your sum insured has to be wthin 20K to 300K. If it goes below 20K then you are subjected to additional loading. Loading means extra cost incurred ya? sorry for asking simple question..another thing is if car is more than 10 years, buy from dealer is better than online platform, because of 10 years betterment (new parts)? |

|

|

Oct 5 2017, 03:10 PM Oct 5 2017, 03:10 PM

|

Junior Member

113 posts Joined: Mar 2009 |

Among Etiqa, AXA, Allianz and Takaful Malaysia, I got the lowest quote from Takaful when compared with same amount of sum insured.

|

|

|

Oct 5 2017, 04:51 PM Oct 5 2017, 04:51 PM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

|

|

|

Oct 5 2017, 04:52 PM Oct 5 2017, 04:52 PM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

QUOTE(spiderwick @ Oct 5 2017, 02:15 PM) Loading means extra cost incurred ya? sorry for asking simple question.. Yes loading is extra cost, normally insurance companies would give an age loading for vehicles more than 10 years old. So after 10 years old, there is no difference buying from franchise or agent. Because insurers will not cover you for new parts.another thing is if car is more than 10 years, buy from dealer is better than online platform, because of 10 years betterment (new parts)? |

|

|

Oct 5 2017, 04:53 PM Oct 5 2017, 04:53 PM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

|

|

|

Oct 5 2017, 05:11 PM Oct 5 2017, 05:11 PM

|

Junior Member

342 posts Joined: Mar 2008 |

QUOTE(bryancsk @ Oct 5 2017, 04:52 PM) Yes loading is extra cost, normally insurance companies would give an age loading for vehicles more than 10 years old. So after 10 years old, there is no difference buying from franchise or agent. Because insurers will not cover you for new parts. Oh ok ok..so within 5 to 10 years period, then is important to buy from franchise instead.Just wondering if Toyota, I need to check back with my Toyota sales agent? |

|

|

Oct 5 2017, 05:13 PM Oct 5 2017, 05:13 PM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

QUOTE(spiderwick @ Oct 5 2017, 05:11 PM) Oh ok ok..so within 5 to 10 years period, then is important to buy from franchise instead. It depends, because bringing your car back to franchise for an accident claim takes a much longer time than panel workshops.Just wondering if Toyota, I need to check back with my Toyota sales agent? |

|

|

Oct 5 2017, 05:15 PM Oct 5 2017, 05:15 PM

|

Junior Member

342 posts Joined: Mar 2008 |

|

|

|

Oct 5 2017, 05:15 PM Oct 5 2017, 05:15 PM

|

Junior Member

113 posts Joined: Mar 2009 |

QUOTE(bryancsk @ Oct 5 2017, 04:53 PM) Not because of the 10% rebate since all the company I mentioned offered the 10% rebate online except Allianz.All the quotations basically have diffferent price for the basic premium before any deduction was done. |

|

|

Oct 5 2017, 08:42 PM Oct 5 2017, 08:42 PM

|

Junior Member

266 posts Joined: Jan 2009 From: Kuala Lumpur |

QUOTE(abz @ Oct 5 2017, 05:15 PM) Not because of the 10% rebate since all the company I mentioned offered the 10% rebate online except Allianz. Now the motor insurance market is facing detariffcation hence the premium rates are different across the range. It really depends what car you currently owned. Lets just say I have a customer who has a Honda Civic 1.5 TC, Lonpac rates the car at the same rate as Kurnia but MPI Generali and Etiqa is on the higher side. All the quotations basically have diffferent price for the basic premium before any deduction was done. Nowadays agent cant calculate based on sum insured and cubic capacity, it all depends on the insurance company system. Hope this explains your enquiry. *AXA is currently still based on tariff rates. |

|

|

Oct 6 2017, 08:48 AM Oct 6 2017, 08:48 AM

|

Junior Member

26 posts Joined: Feb 2017 |

QUOTE(bryancsk @ Oct 5 2017, 05:13 PM) It depends, because bringing your car back to franchise for an accident claim takes a much longer time than panel workshops. Not really, i brought back my car to TC for accident claim. The approval is faster because they have all the details already. Plus can get TC original spare parts. |

|

|

Oct 6 2017, 09:34 AM Oct 6 2017, 09:34 AM

|

Junior Member

26 posts Joined: Feb 2017 |

QUOTE(abz @ Oct 5 2017, 05:15 PM) Not because of the 10% rebate since all the company I mentioned offered the 10% rebate online except Allianz. You may need to compare the insurance in terms of what they are offering eg:All the quotations basically have diffferent price for the basic premium before any deduction was done. 1) Allianz - Agreed Value instead of Sum Insured ( that's why no 10% discount) 2) Tokio Marine - Compensation For Assessed Repair Time (CART) is included with no additional charge 3) Towing Service (distance): Kurnia -FREE within a 50km radius (30km for Sabah & Sarawak), with RM2.00 charged per additional km. Allianz - Free Towing Up To RM200 AXA - Free Towing Up To RM200 Takaful - Free up to 50KM, with RM2.00 charged per additional km. 4) Warranty - AXA 6-months repair warranty 5) Roadside Assistance (including minor repair like jump start, change flat tyre) - most insurers offer 24 hours service except Zurich (9AM-6PM) |

|

|

Oct 18 2017, 07:10 PM Oct 18 2017, 07:10 PM

|

Senior Member

1,206 posts Joined: Jan 2008 |

now insurance company has different premium. I just wondering about sum-insured, the agent told me said no point put sum insured very high as the company will follow market value. I thought it should be agreed value rather than market value. hope any expert can clarify this

Some company put maximum value of sum insured that we can put. last year i took honda insurance package their total price 10% higher than normal online insurance. but this year i'm not really sure This post has been edited by cenkudu: Oct 18 2017, 07:22 PM |

|

|

Oct 19 2017, 01:38 PM Oct 19 2017, 01:38 PM

Show posts by this member only | IPv6 | Post

#110

|

Senior Member

1,444 posts Joined: Nov 2005 |

|

|

|

Oct 19 2017, 04:01 PM Oct 19 2017, 04:01 PM

|

Junior Member

113 posts Joined: Mar 2009 |

QUOTE(wan7075 @ Oct 19 2017, 01:38 PM) the comparison is under same condition/service for the company mentioned? Yes, you can try get the quote from Takaful and compare with others.if yes, then I will go for takaful For me, Takaful is the cheapest and is even cheaper if u take account the rebate 15% if no claim done. |

|

|

Oct 19 2017, 05:33 PM Oct 19 2017, 05:33 PM

Show posts by this member only | IPv6 | Post

#112

|

Senior Member

1,444 posts Joined: Nov 2005 |

QUOTE(abz @ Oct 19 2017, 04:01 PM) Yes, you can try get the quote from Takaful and compare with others. account the rebate 15% if no claim doneFor me, Takaful is the cheapest and is even cheaper if u take account the rebate 15% if no claim done. you mean if my quoted fees is rm500, then I pay online get 10% discount = -rm50. if I don't have any claim then I will get back 15% = rm75? mean my insurance = rm375? tq |

|

|

Oct 19 2017, 05:46 PM Oct 19 2017, 05:46 PM

|

Senior Member

1,590 posts Joined: Nov 2006 |

QUOTE(wan7075 @ Oct 19 2017, 05:33 PM) account the rebate 15% if no claim done yes u will get the 15% few months after ur insurance expiredyou mean if my quoted fees is rm500, then I pay online get 10% discount = -rm50. if I don't have any claim then I will get back 15% = rm75? mean my insurance = rm375? tq directly bank in into ur bank account |

|

|

Oct 19 2017, 07:34 PM Oct 19 2017, 07:34 PM

Show posts by this member only | IPv6 | Post

#114

|

Senior Member

1,444 posts Joined: Nov 2005 |

|

|

|

Oct 26 2017, 04:42 PM Oct 26 2017, 04:42 PM

|

Junior Member

15 posts Joined: Mar 2009 |

I've tried Etiqa Takaful Car online insurance. It is good and cheap. 10% discount after NCD. I got some refund when I don't claim any insurance every year.

When I caught an accident, I get full claim with no problem. Heard the workshop staff said their adjustor also quite flexible. So, will continue with it. |

|

|

Nov 2 2017, 04:29 PM Nov 2 2017, 04:29 PM

Show posts by this member only | IPv6 | Post

#116

|

Senior Member

1,444 posts Joined: Nov 2005 |

QUOTE(abz @ Oct 19 2017, 04:01 PM) Yes, you can try get the quote from Takaful and compare with others. may I know it is Etiqah Takaful, or Takaful Malaysia, or Takaful maybank?For me, Takaful is the cheapest and is even cheaper if u take account the rebate 15% if no claim done. any sifu can give me the webpage link? tq |

|

|

Nov 2 2017, 04:36 PM Nov 2 2017, 04:36 PM

Show posts by this member only | IPv6 | Post

#117

|

Senior Member

1,444 posts Joined: Nov 2005 |

QUOTE(clive841202 @ Oct 26 2017, 04:42 PM) I've tried Etiqa Takaful Car online insurance. It is good and cheap. 10% discount after NCD. I got some refund when I don't claim any insurance every year. hi, may I know which link I should use?When I caught an accident, I get full claim with no problem. Heard the workshop staff said their adjustor also quite flexible. So, will continue with it. https://www.motortakaful.com/getonline/SMTt...MT7wjz6pSZphJn/ https://www.etiqa.com.my/getonline/SMinsura...MT7wjz6pSZphJn/ thanks! |

|

|

Nov 2 2017, 07:06 PM Nov 2 2017, 07:06 PM

|

Senior Member

1,524 posts Joined: Apr 2008 |

QUOTE(happying @ Oct 6 2017, 08:48 AM) Not really, i brought back my car to TC for accident claim. The approval is faster because they have all the details already. correct. Plus can get TC original spare parts. and franchise benefits always better than market plan - such as up to 10 years no charge on betterman, no excess, no loading |

|

|

Nov 2 2017, 08:59 PM Nov 2 2017, 08:59 PM

|

Junior Member

113 posts Joined: Mar 2009 |

|

|

|

Dec 30 2017, 10:57 PM Dec 30 2017, 10:57 PM

Show posts by this member only | IPv6 | Post

#120

|

Junior Member

986 posts Joined: Mar 2011 |

|

|

|

Jan 1 2018, 01:07 PM Jan 1 2018, 01:07 PM

|

Senior Member

1,039 posts Joined: Aug 2013 |

QUOTE(cenkudu @ Oct 18 2017, 07:10 PM) now insurance company has different premium. I just wondering about sum-insured, the agent told me said no point put sum insured very high as the company will follow market value. I thought it should be agreed value rather than market value. hope any expert can clarify this I'm not an expert, as far as I know, insurance is working on a reinstatement basis, ie they would compensate you based on the replacement cost, therefore market value is always used as yr sum insured when you purchase any insurance policy.Some company put maximum value of sum insured that we can put. last year i took honda insurance package their total price 10% higher than normal online insurance. but this year i'm not really sure The recent detarriff for motor insurance basically allows insurance companies to calculate yr premium based on yr driving history, age, type of vehicle and other factors. Different insurance co will use different factors in premium calculation. This has resulted in the difference in premium offered by different insurance co for the same sum insured. |

|

|

Jan 11 2018, 01:46 PM Jan 11 2018, 01:46 PM

|

Junior Member

472 posts Joined: Feb 2009 |

takaful malaysia or etiqa takaful, which one better. As i know, in term of price is takaful malaysia more cheaper. Any ideas?

|

|

|

Jan 31 2018, 04:47 PM Jan 31 2018, 04:47 PM

|

Junior Member

7 posts Joined: Jul 2011 |

QUOTE(stereobiru @ Jan 11 2018, 01:46 PM) takaful malaysia or etiqa takaful, which one better. As i know, in term of price is takaful malaysia more cheaper. Any ideas? Takaful malaysia give an attractive offer.. low price and cash back if no claim made. I already used etiqa but this year i want to try Takaful Malaysia.Takaful Malaysia offer : You may be entitled to an estimated Cash Back of RM xx.xx subject to financial performance, applicable tax deductions and no claims incurred during the coverage period. Complimentary Personal Accident coverage of RM15,000 for each driver and passenger. |

|

|

Jan 31 2018, 06:08 PM Jan 31 2018, 06:08 PM

|

Senior Member

2,148 posts Joined: Nov 2007 |

question : driver at fault & met a car accident & make a police report but not owner of the car nor having his name in the insurance as an additional driver. can car owner make an insurance claim ?

|

|

|

Jan 31 2018, 08:05 PM Jan 31 2018, 08:05 PM

|

Senior Member

1,039 posts Joined: Aug 2013 |

QUOTE(smartly @ Jan 31 2018, 06:08 PM) question : driver at fault & met a car accident & make a police report but not owner of the car nor having his name in the insurance as an additional driver. can car owner make an insurance claim ? Yes, as long as there's a valid insurance policy, the owner can make an insurance claim even though he's not the driver at the time of accident.If the driver is not the named driver in the insurance policy, the insurance company will impose an excess when approving a claim. |

|

|

Mar 11 2018, 09:53 PM Mar 11 2018, 09:53 PM

|

Senior Member

3,848 posts Joined: Dec 2009 From: Ampang |

|

|

|

Mar 15 2018, 09:56 AM Mar 15 2018, 09:56 AM

|

Junior Member

149 posts Joined: May 2017 |

Hi, I am a newbie in renewing car insurance.

I just got my car insurance renewed online with AIG ytd. When I filled up my policy details on sum insured, the website wording is "agreed insured value". However when I got my policy, it stated insured amount. Anyone has experience with AIG that knows whether they use sum insured or agreed value? This post has been edited by 7498: Mar 15 2018, 10:07 AM |

|

|

Mar 22 2018, 08:35 PM Mar 22 2018, 08:35 PM

|

Junior Member

168 posts Joined: Sep 2012 |

sorry wrong post

This post has been edited by yandebunena: Mar 22 2018, 08:43 PM |

|

|

Jul 23 2018, 01:30 AM Jul 23 2018, 01:30 AM

|

Junior Member

262 posts Joined: Oct 2009 |

Hi All,

I am planning to renew my car insurance this week. saw etiqa covered for New Spare Parts and Whole Car Repaint. does it mean i can change my whole car sparepart such as absorber/engine mounting/etc and repaint all car body in case of accident? let say, motorcycle hit me and i able to claim this? |

|

|

Jan 29 2019, 10:46 AM Jan 29 2019, 10:46 AM

|

Junior Member

144 posts Joined: Jan 2003 |

Whatever you do, don't get car insurance from MSIG and Berjaya Sompo. They are rogue insurance companies that make it hard for you to claim after an accident.

|

|

|

Feb 23 2019, 07:17 PM Feb 23 2019, 07:17 PM

Show posts by this member only | IPv6 | Post

#131

|

Junior Member

448 posts Joined: Aug 2005 |

PM 019-3399039 (WhatsApp only) for online car insurance renewal.

|

|

|

Feb 23 2019, 07:20 PM Feb 23 2019, 07:20 PM

|

All Stars

11,954 posts Joined: May 2007 |

QUOTE(syahmie @ Jul 23 2018, 01:30 AM) Hi All, Its come with terms and condition on how many % damaged then only can repaintI am planning to renew my car insurance this week. saw etiqa covered for New Spare Parts and Whole Car Repaint. does it mean i can change my whole car sparepart such as absorber/engine mounting/etc and repaint all car body in case of accident? let say, motorcycle hit me and i able to claim this? |

|

|

Apr 16 2019, 05:56 PM Apr 16 2019, 05:56 PM

|

Probation

5 posts Joined: Apr 2019 |

You can compare the several insurance companies and pick the cheapest one or the one who gives the best service. I have done this myself with this website: https://loanstreet.com.my/insurance/car-insurance

I also renewed my road tax at the same time with this website. |

|

|

Apr 17 2019, 09:07 AM Apr 17 2019, 09:07 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(DelawiAwank_1 @ Apr 16 2019, 05:56 PM) You can compare the several insurance companies and pick the cheapest one or the one who gives the best service. I have done this myself with this website: https://loanstreet.com.my/insurance/car-insurance er... only Zurich listed there. Compare what ar?I also renewed my road tax at the same time with this website. |

|

|

Apr 27 2019, 12:37 PM Apr 27 2019, 12:37 PM

|

Junior Member

469 posts Joined: Jan 2013 |

in 2019 ,

which car insurance is the best option ?? my main concern is which car insurance provide more reliable service when your car got issues |

|

|

Apr 27 2019, 07:50 PM Apr 27 2019, 07:50 PM

|

All Stars

11,954 posts Joined: May 2007 |

affin axa does give 30% discount which is the highest

|

|

|

Jun 5 2019, 08:27 AM Jun 5 2019, 08:27 AM

|

Junior Member

212 posts Joined: Apr 2016 |

|

|

|

Jul 26 2019, 01:12 PM Jul 26 2019, 01:12 PM

|

Junior Member

810 posts Joined: Mar 2008 |

hi all,

I had compare my car year 2018 and 2019 insurance premium. Yr 2018 sum insured 54k, premium 1.49k Yr 2019 sum insured 49k, premium 1.7k Both are without NCD factor in. Notice that sum insured drop this year but the premium higher than last year. Is there a premium hike for car insurance also? I just notice there is price hike for medical insurance. |

|

|

Jul 26 2019, 03:46 PM Jul 26 2019, 03:46 PM

Show posts by this member only | IPv6 | Post

#139

|

Senior Member

1,335 posts Joined: Nov 2008 |

QUOTE(alesi616 @ Jul 26 2019, 01:12 PM) hi all, Maybe take your policy schedule for 2018, compare it with the current quotation, see what are the differences? I had compare my car year 2018 and 2019 insurance premium. Yr 2018 sum insured 54k, premium 1.49k Yr 2019 sum insured 49k, premium 1.7k Both are without NCD factor in. Notice that sum insured drop this year but the premium higher than last year. Is there a premium hike for car insurance also? I just notice there is price hike for medical insurance. Doesn't make sense to this insurance man. |

|

|

Jul 26 2019, 04:24 PM Jul 26 2019, 04:24 PM

Show posts by this member only | IPv6 | Post

#140

|

Junior Member

448 posts Joined: Aug 2005 |

Go for third party insurance. Every year same price. But if accident you're on your own. Then you wont complain insurance premium increased.

|

|

|

Jul 26 2019, 09:26 PM Jul 26 2019, 09:26 PM

|

Junior Member

810 posts Joined: Mar 2008 |

QUOTE(JIUHWEI @ Jul 26 2019, 03:46 PM) Maybe take your policy schedule for 2018, compare it with the current quotation, see what are the differences? I already compare both msig's 2018 and 2019 quotation… everything same just sum insured differ.Doesn't make sense to this insurance man. Then i quote another insurance from tokio marine and etiqa. Both also almost same price as the msig. I did not change job or claim ncd in past year. Wonder why sudden premium hike. Does that due to my IC address change ? (Is IC address / location matters? ) |

|

|

Jul 27 2019, 09:42 AM Jul 27 2019, 09:42 AM

|

All Stars

11,954 posts Joined: May 2007 |

QUOTE(alesi616 @ Jul 26 2019, 01:12 PM) hi all, Which company?I had compare my car year 2018 and 2019 insurance premium. Yr 2018 sum insured 54k, premium 1.49k Yr 2019 sum insured 49k, premium 1.7k Both are without NCD factor in. Notice that sum insured drop this year but the premium higher than last year. Is there a premium hike for car insurance also? I just notice there is price hike for medical insurance. CoronaV liked this post

|

|

|

Jul 28 2019, 12:46 PM Jul 28 2019, 12:46 PM

|

Junior Member

810 posts Joined: Mar 2008 |

|

|

|

Jul 29 2019, 09:23 AM Jul 29 2019, 09:23 AM

Show posts by this member only | IPv6 | Post

#144

|

Junior Member

448 posts Joined: Aug 2005 |

QUOTE(alesi616 @ Jul 28 2019, 12:46 PM) I had compare my car year 2018 and 2019 insurance premium. Yes it's true, premium have increased due to number of claims exceed premium collected.Yr 2018 sum insured 54k, premium 1.49k Yr 2019 sum insured 49k, premium 1.7k This is MSIG Alot of new cars getting into accidents.. and workshops like accidents more business for them to claim. |

|

|

Jul 29 2019, 04:47 PM Jul 29 2019, 04:47 PM

|

Junior Member

98 posts Joined: Jun 2019 |

What is the cheapest auto insurance?

|

|

|

Jul 29 2019, 07:46 PM Jul 29 2019, 07:46 PM

|

All Stars

11,954 posts Joined: May 2007 |

|

|

|

Jul 29 2019, 10:59 PM Jul 29 2019, 10:59 PM

|

Junior Member

810 posts Joined: Mar 2008 |

|

|

|

Jul 30 2019, 09:36 AM Jul 30 2019, 09:36 AM

Show posts by this member only | IPv6 | Post

#148

|

Junior Member

448 posts Joined: Aug 2005 |

|

|

|

Aug 28 2019, 10:47 AM Aug 28 2019, 10:47 AM

|

Junior Member

575 posts Joined: Jan 2011 |

|

|

|

Aug 28 2019, 09:43 PM Aug 28 2019, 09:43 PM

|

All Stars

11,954 posts Joined: May 2007 |

|

|

|

Dec 13 2019, 01:51 PM Dec 13 2019, 01:51 PM

|

Senior Member

1,327 posts Joined: Jun 2019 |

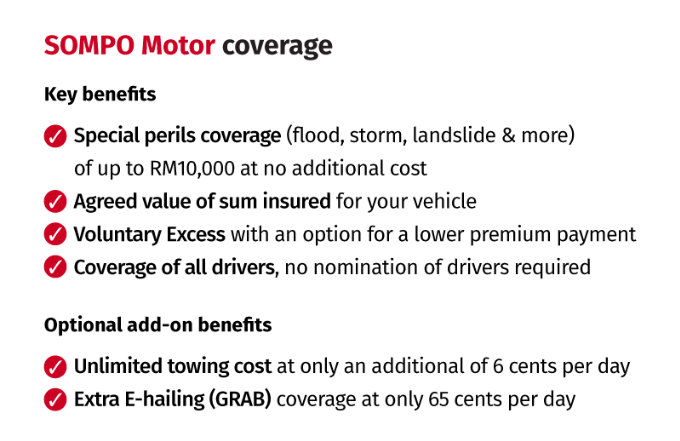

Anyone that purchase the berjaya sompo motor insurance recently? They include the special peril? (not add on)

|

|

|

May 4 2020, 08:16 PM May 4 2020, 08:16 PM

|

Senior Member

1,054 posts Joined: Jan 2003 |

QUOTE(viper707 @ May 4 2020, 03:31 PM) Hi There, What happened if some jokers tempered their odometer to claim savings ? My car insurance is due soon and I'm getting quotes from various companies and came across a product called Promilej from P&O Insurance. The premium is based on the kilometer driven and the discount is upfront not like another product by Tune insurance. Since this is my 2nd car, I used it less (below 6,000 km a year). Promilej offers 40% discount on the basic premium (before NCD and other rebates) if my mileage is less than 5,000. Thats a huge savings. They have 3 plans (5000, 10000 & 15000 KM) per year and discount varies accordingly. Anyone ever purchase this product, please advise. https://www.poi2u.com/car-insurance/policy/promilej They also have an app called POI2U to get online quotes as well. Thanks |

|

|

May 4 2020, 10:28 PM May 4 2020, 10:28 PM

|

All Stars

11,954 posts Joined: May 2007 |

Noticed that BJAK customer services is slow in responding to simple query

|

|

|

May 5 2020, 10:10 AM May 5 2020, 10:10 AM

|

Senior Member

1,054 posts Joined: Jan 2003 |

|

|

|

May 5 2020, 03:36 PM May 5 2020, 03:36 PM

|

Senior Member

1,103 posts Joined: Nov 2009 |

Want to ask, 3rd party insurance can use name other than the owner ?

|

|

|

May 7 2020, 11:50 AM May 7 2020, 11:50 AM

Show posts by this member only | IPv6 | Post

#156

|

Junior Member

448 posts Joined: Aug 2005 |

|

|

|

May 8 2020, 10:16 PM May 8 2020, 10:16 PM

|

All Stars

11,954 posts Joined: May 2007 |

axa car insurance can submit onlinw

|

|

|

Jul 3 2020, 04:03 PM Jul 3 2020, 04:03 PM

|

Newbie

9 posts Joined: Sep 2009 |

Wonder what happened at the end? Did you go for the coverage?

QUOTE(viper707 @ May 4 2020, 03:31 PM) Hi There, My car insurance is due soon and I'm getting quotes from various companies and came across a product called Promilej from P&O Insurance. The premium is based on the kilometer driven and the discount is upfront not like another product by Tune insurance. Since this is my 2nd car, I used it less (below 6,000 km a year). Promilej offers 40% discount on the basic premium (before NCD and other rebates) if my mileage is less than 5,000. Thats a huge savings. They have 3 plans (5000, 10000 & 15000 KM) per year and discount varies accordingly. Anyone ever purchase this product, please advise. https://www.poi2u.com/car-insurance/policy/promilej They also have an app called POI2U to get online quotes as well. Thanks |

|

|

Jul 3 2020, 10:44 PM Jul 3 2020, 10:44 PM

|

Junior Member

66 posts Joined: Jun 2020 |

I like etiqa coz can do online and can get discount 10%.

|

|

|

Jul 3 2020, 11:12 PM Jul 3 2020, 11:12 PM

|

Senior Member

4,726 posts Joined: Jul 2013 |

|

|

|

Jul 4 2020, 02:19 AM Jul 4 2020, 02:19 AM

Show posts by this member only | IPv6 | Post

#161

|

Senior Member

1,802 posts Joined: Oct 2015 |

QUOTE(adele123 @ Jul 3 2020, 11:12 PM) There are others who can do online and the 10% discount is also present (but not allianz) For etiqa, is it good in terms of calling for road assist and claiming damages??Kurnia, takaful malaysia, axa, tune, etc Etiqa does have an advantage. Can use amex to pay I have been using AIG seems okay but not sure if it is more expensive than others |

|

|

Jul 4 2020, 02:57 PM Jul 4 2020, 02:57 PM

|

All Stars

11,954 posts Joined: May 2007 |

|

|

|

Jul 4 2020, 11:00 PM Jul 4 2020, 11:00 PM

|

Senior Member

4,726 posts Joined: Jul 2013 |

QUOTE(BacktoBasics @ Jul 4 2020, 02:19 AM) For etiqa, is it good in terms of calling for road assist and claiming damages?? I am not sure honestly. Never had to use it. I have been using AIG seems okay but not sure if it is more expensive than others Since everything is online, price comparison can be done easily. Then you will know whether AIG or Etiqa is cheaper. This post has been edited by adele123: Jul 4 2020, 11:01 PM |

|

|

Jul 5 2020, 12:12 AM Jul 5 2020, 12:12 AM

Show posts by this member only | IPv6 | Post

#164

|

Senior Member