QUOTE(jumping_jax @ Apr 26 2013, 04:26 PM)

From what you and others have been telling me, it seems to make sense for me to drop the medical component.

If I do that the premium becomes RM 800 per annum.

I do feel that 50K will not provide that much help, given our current standard of living and the impending pressure of inflation. That's why I'm looking to see if I can do better with a plan from another company.

I wouldn't mind paying slightly more for better coverage. Just wanted to know if I'm being taken for a ride here.

Which is why I said, drop the medical but maintain the life portion. You are now 25 year old and even though the premium increase is not significant due to you are still young, you should _not_ cancel the AIA

life plan and take up another.

Instead you should maintain the AIA RM50K and buy another to add on (if the plan is not able to be upgraded).

The reason is simple.

1. If you were to cancel the AIA RM 50K and buy another RM 100K with Insurer B, you are actually starting the premium allocation all over.

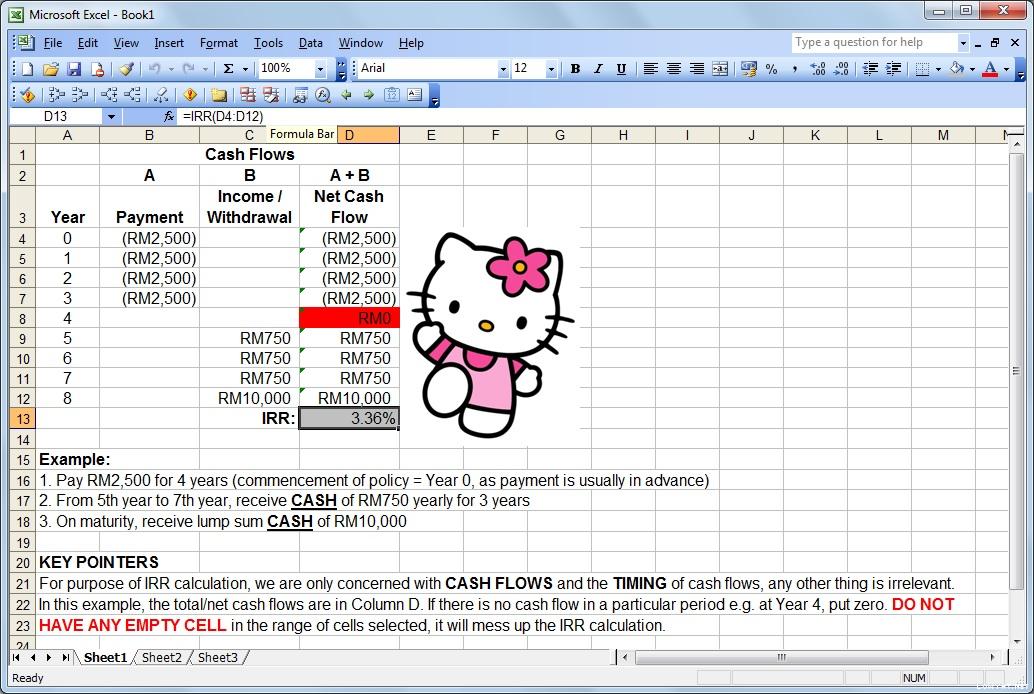

If you look at the insurance proposal, the first 6 years the 'cash value' will be slow in terms of accumulation. For example if you are paying RM 2000 per year, the first year premium allocation may only be 40%, and slowly goes up to 100% on the 7th year onwards.

This means for the first year RM 2K x 40% = RM 800 will be used into buying you units.

Your AIA plan already has RM8K inside and should you were to cancel and get a new plan, the premium allocation starts all over.

* The premium allocation table varies from product being selected.

2. All insurance product comes with waiting period - should you were to cancel the AIA Rm 50K and get a new one, should anything were to happen within the waiting period, for example cancer (choi!) before 60 days waiting period is not payable on the new plan.

--

For Life (death & total disability) & Critical Illness Cover it is recommended to have high cover when we are working (based on our affordability and income).

However, it is recommended that you reduce the cover over to medical once you are retired as the insurance charges is rather costly if you would like to maintain the high cover at older age.

Also our children may had also grown up and working, thus relieving us from being responsible to them.

At older age we are more prone to sickness and when we are retired, like any company benefits like car, petrol allowance, medical insurance, it ends there. Hence we will have to rely solely on our medical.

Apr 1 2013, 08:48 PM

Apr 1 2013, 08:48 PM

Quote

Quote

0.0544sec

0.0544sec

0.46

0.46

7 queries

7 queries

GZIP Disabled

GZIP Disabled