QUOTE(kl98 @ Nov 20 2015, 07:26 PM)

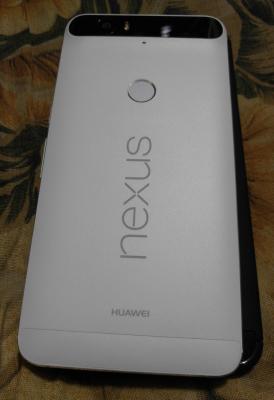

Seeking advice of someone who has experience purchasing the Nexus 6p from outside Malaysia.

1. Was it subject to GST? I believe cell phones are taxable to 6% now. Just wanna confirm

2. How did you deal with SIRIM application? Did you head straight in person to the branch, or apply online? Still RM100?

Any other incidental costs (apart from Fedex shipping) that I need to take in to account?

Thanks.

This is applicable to all phone imports

If your phone is held by custom

1. You need to apply Sirim permit on your own : RM 106 can cover up to 3 units of phone. It is now very convenient to pay Sirim online and apply permit online. At worse you will get the Sirim permit the next working day. I had detailed in Nexus 6 official thread page 1 how to do this. OR you can personally go to nearest Sirim center to do it . You need to submit your IC details, courier notice, airway bill and tech specs of phone ( any info from the web is good enough)

Just email the permit over to courier company. If courier is DHL, the Sirim center will auto email them directly

2. You need to pay the courier company 6% GST on phone invoice value plus its courier charges - you can do this payment online too

This post has been edited by benny888: Nov 20 2015, 07:39 PM

Nov 20 2015, 02:47 PM

Nov 20 2015, 02:47 PM

Quote

Quote

0.0527sec

0.0527sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled