I think that the 4th telco issue is overblown..

This post has been edited by gark: Feb 29 2016, 05:00 PM

SGX Counters, Discussion on Counters in the SGX

|

|

Feb 29 2016, 04:59 PM Feb 29 2016, 04:59 PM

Return to original view | Post

#1

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

Looking at M1.. ~6% yield..

I think that the 4th telco issue is overblown.. This post has been edited by gark: Feb 29 2016, 05:00 PM |

|

|

|

|

|

Mar 1 2016, 10:40 AM Mar 1 2016, 10:40 AM

Return to original view | Post

#2

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Hansel @ Feb 29 2016, 10:05 PM) Saizen is going dormant, going through with its plans to selloff its entire portfolio of income-generating properties... Saizen is not delisting yet because they have performance guarantee ( 5% in escrow account) to the buyer for six months after the property is sold.And in actual fact,... I am watching Saizen NOT because I have Saizen in my portfolio,... but it's because I want to learn how a REIT can selloff all its assets and turn itself into a cash company. The points that I am interesting to watch would be how the REIT reimburses the unitholders after it disposes off its entire portfolio, what valuation used, why a REIT would want to selloff its assets, how long it takes to complete the whole process, etc,... To me, what Saizen is doing is something very unique. It's not delisting, and neither is it continuing to create value for its unitholders. It just sold off its income-generating assets, and does not intend to continue operating. How about the unitholders ? Saizen will return the bulk of the money to shareholders (95% of selling price) as capital return, pay off the remaining accrued rentals as final dividend and then six months later IF there are no claims or repair cost exceeding the 5%, they will pay out the final remaining money after all expenses and will promptly close shop by delisting. Saizen have no intention to become a cash company. The thing is that saizen sold to new buyer exactly at NAV, so it is important to hold properties at below NAV value. This post has been edited by gark: Mar 1 2016, 10:43 AM |

|

|

Mar 1 2016, 11:20 AM Mar 1 2016, 11:20 AM

Return to original view | Post

#3

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Hansel @ Mar 1 2016, 10:50 AM) Tq Gark,... actually, Saizen does not really have to take this route of giving performance guarantee first after disposing to another party. right ? They could just sell-off lock, stock and barrel to another party, and then proceed to delist the REIT. But of course, if the assets are not at 'good, rentable' conditions, then the buyer would want to buy at prices below NAV. I see a pattern of delisting here by a REIT. It depends on the contract... some sales have no performance guarantee, some sale is LSB type..The problem is that they are selling of a whole bunch of buildings (in good rentable condition), and the buyer is a hedge fund, so they are not going to inspect each building one by one. The performance guarantee to the buyer is just a formality, i think there is high chance to recover the amount unless there is major maintenance. Total payment proposed as follows Special distribution: $1.056 (Mar 16) Normal distribution: $0.031 (Mar 16 - Rent accrued Jun-Dec 2015) Escrow account: $0.0895 (5% performance bond - July 16) ----------------------------------- Sub total: $1.1765 Post completion expenses: $0.0118 Cost paid to manager: $0.0042 ----------------------------------- Sub total: $0.016 ----------------------------------- Total: $1.1605 Post completion distribution: Rent from Jan-Mar 16 ~ $0,014 Based on current price there is still some arbitrage value, depending on the normal distribution and escrow account. This post has been edited by gark: Mar 1 2016, 11:23 AM |

|

|

Mar 1 2016, 12:16 PM Mar 1 2016, 12:16 PM

Return to original view | Post

#4

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Hansel @ Mar 1 2016, 12:12 PM) Many thanks agan fro the workings, Gark,... it's very helpful... Very likely will be approved.. you must consider that the share was trading at around 0.85 when the deal is announced. Who does not want that kind of windfall? Were you at the meeting this morning,... have all the three resolutions been approved ? Saizen REIT is halted now... possibly pending further updates from the mtg this morning,... |

|

|

Mar 1 2016, 01:58 PM Mar 1 2016, 01:58 PM

Return to original view | Post

#5

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Hansel @ Mar 1 2016, 12:24 PM) Right,... that 0.85 has inched-up to 1.090 yesterday, if my memory serves me correctly,.. I think many would now be queueing at,..1.110,...? ...taking into account that Triangle would claim for ONLY half of the escrow amount before the next 6 months is up ? No one knows how much of the escrow accounts are available once all the claims is completed.The guaranteed payment and dividend = 1.07. Any extra after that will just be a bonus. |

|

|

Mar 1 2016, 02:20 PM Mar 1 2016, 02:20 PM

Return to original view | Post

#6

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(prince_mk @ Mar 1 2016, 02:01 PM) Lol.. the calculation is all there for everyone to see. You have to consider to take risk or not only.Current price is 1.10 If escrow account is not used AND 1/4 of 2016 dividend is paid you will earn 7.45 cents If escrow account is 50% used and 1/4 of 2016 dividend is paid you will earn ~3 cents If escrow account is empty and 1/4 dividend is NOT paid you will LOSE 3 cents So consider the above.. and waiting time is about 6 months to completion This post has been edited by gark: Mar 1 2016, 02:21 PM |

|

|

|

|

|

Mar 2 2016, 12:05 PM Mar 2 2016, 12:05 PM

Return to original view | Post

#7

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Hansel @ Mar 2 2016, 11:16 AM) Looks like my TA is not accurate. I revised my short term TP for OCBC from $7.50 to $8.00 a few days ago,... and THEORETICALLY, OCBC will hover around 8.00 to 8.150 for these two weeks. Today,.. it has jumped to 8.34 now,.... Better to lose opportunity rather than lose money.. I have not bought enough !!!!!!!!!!!!!!!!!!!! I want to throw away my model !!!!!!!!! Margin of safety is important.. There will more opportunities in the future, market is roller coaster right now. This post has been edited by gark: Mar 2 2016, 12:05 PM |

|

|

Mar 2 2016, 12:18 PM Mar 2 2016, 12:18 PM

Return to original view | Post

#8

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

Anyone got trade SGX CFD here? 10:1 leverage..

|

|

|

Mar 2 2016, 01:09 PM Mar 2 2016, 01:09 PM

Return to original view | Post

#9

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Hansel @ Mar 2 2016, 12:57 PM) Yield is not everything, yield can change if the underlying business factor change. If the earning is increasing, you can more or less bet that your yield will increase, but if the earning is suffering, you can bet the yield will be less in the future. If a company cannot earn enough money or having a loss, how to maintan the dividend? It is more important for you to analyze the underlying business and deduct if there is sufficient margin of safety. Margin of safety is not just as simple as PE, PB, DY, EV/EBITDA, FCF etc... as these are all moving target and the business change. True margin of safety is that IF i buy this business now, AND if things go south, how far south it can possibly go, what is my safety factor? Just my 2 sen.. This post has been edited by gark: Mar 2 2016, 01:11 PM |

|

|

Mar 2 2016, 01:21 PM Mar 2 2016, 01:21 PM

Return to original view | Post

#10

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

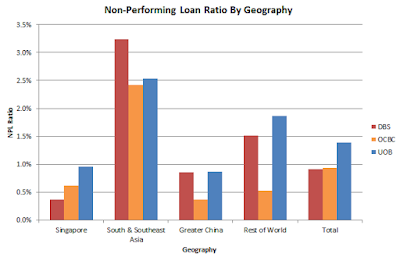

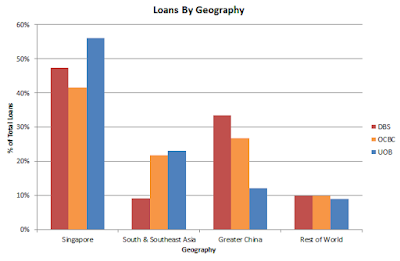

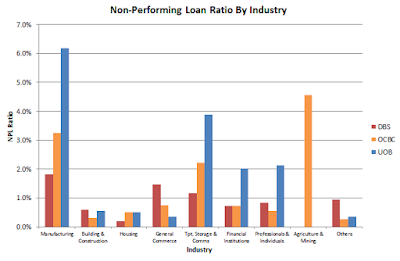

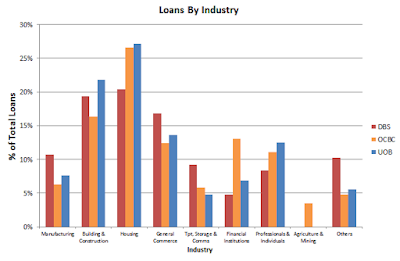

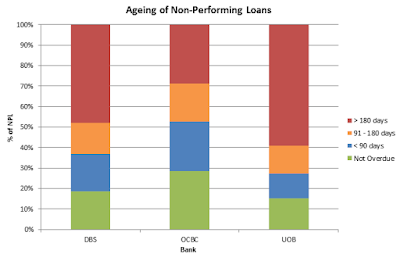

Seems like a lot of SG bank fans here.. here I give you all some data to make your own conclusion..

Source |

|

|

Mar 3 2016, 02:55 PM Mar 3 2016, 02:55 PM

Return to original view | Post

#11

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(elea88 @ Mar 3 2016, 02:47 PM) i dunno.. Feb div all in.. Since Nov div collected till now, i hv not buy anything. If you need to hold cash longer term, but want some return can try to hold in ABF SG Bond ETF (A35). Current yield is 2.32%.Sitting in SG... earning nothing!!!!!! But if buy , takut Buy wrong.. now suddenly very EMO. My Objective.. Buy for long term yield.. but looks like still need EMO STAMINA.... But short term, be mindful of trading cost. |

|

|

Mar 3 2016, 03:29 PM Mar 3 2016, 03:29 PM

Return to original view | Post

#12

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(elea88 @ Mar 3 2016, 03:06 PM) Got bad experience holding too much cash during 2014-2015. Being too liquid can be painful if exceed 6 months.. especially in SG, as the FD is pretty poor. As least MY FD is more palatable. Been there done that, so 2016 strategy is to try to get nearly fully invested, with opportunity fund in more stable instruments. These instruments will be sold off if need cash to invest. See if it works out. This post has been edited by gark: Mar 3 2016, 03:30 PM |

|

|

Mar 3 2016, 04:13 PM Mar 3 2016, 04:13 PM

Return to original view | Post

#13

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(yck1987 @ Mar 3 2016, 04:09 PM) Bro Gark, you intend to invested more to Reits or other counters as in the opportunity fund? Will you build a diversified portfolio into different sector like financial, telco, healthcare, transport, real estate, consumer utility etc.? I am investing in a few countries, with 4 different brokerage. For Sg I am going for passive income investing. It will be roughly 60-70% REIT and 30-40% yield stocks, my target blended yield to be 8% with 90-95% invested (5-10% generated from dividend to subscribe future rights What's your strategy? This is still a plan tho.. most of my holding is still in cash This post has been edited by gark: Mar 3 2016, 04:17 PM |

|

|

|

|

|

Mar 3 2016, 04:20 PM Mar 3 2016, 04:20 PM

Return to original view | Post

#14

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(elea88 @ Mar 3 2016, 04:17 PM) same for my strategy for SG. More of Yield collection. SG is my safe haven.. IF anything happen to Malaysia (touch wood).. can still run there and live off my investments. Anyway, Thank you to "Gark". if not because of him.... i will not be motivated to take a trip to SG and open my DBS ac. TQ.... That is why it is important for me the brokerage is in SG. Anyway no need to thank me, its my pleasure to help. This post has been edited by gark: Mar 3 2016, 04:22 PM |

|

|

Mar 4 2016, 10:05 AM Mar 4 2016, 10:05 AM

Return to original view | Post

#15

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(prince_mk98 @ Mar 3 2016, 08:40 PM) seldom see people comment abt overseas reits like in HK or China or Korea. China dont have much REITs, HK have quite some reits but lower yield. So is japan and USA low yield too.any insights on these countries? currently all mine are S Reits and some Sg shares. |

|

|

Mar 4 2016, 10:06 AM Mar 4 2016, 10:06 AM

Return to original view | Post

#16

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(AVFAN @ Mar 3 2016, 08:53 PM) i also treat SG like that - just safe reits, strong currency, somewhere near to go if necessary. US - for more aggressive punts - both capital and currency. local... not going near bursa, but some FD. |

|

|

Mar 4 2016, 10:39 AM Mar 4 2016, 10:39 AM

Return to original view | Post

#17

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(elea88 @ Mar 4 2016, 10:29 AM) HAHA.. I HV A BIT of a lot of counters... Diversification is good to reduce the overall risk of your portfolio, but if you hold too much, it can diworsesify instead. Holding too much stocks, will tend to cancel each other gains out.Yes i know to stick to 5.. but i dunno. end up one long list. in my 2 yrs journey with SGX. For me.. i reduce my RISK with DIVERSIFICATION. So, i try to hv stocks from few industries.. but favour towards reits coz the 4 yr dividend thing.. With Reits, I know that over time, I will get DIV YIELD, but the Capital appreciaton will be slow. So, I added some NON REITS but good div too... However my TOTAL PORTFOLIO is still a + for Capital Appreciation... Not sure my style is correct or not.. But after I buy did not sell. Only hv sold off some FIRST REIT so far... Some stocks can like -30% and some can hv +20% or +30% too... Even when I added TELCO in my list.. i ended with SUNTEC & M1... and my friend says.. haiya may as well buy across the board, include STARHUB. Afterall keeping for long long term ma..... Who knows which Co in 5 yrs time can be better than the another.. ? There is only so much a CHART can tell us.... My Investments... My Rules.. haha I stick to 10-20 stock max for all my portfolios. If your portfolio is growing like a wild bush... time to trim some. But then again, like you said, your stocks, your rule. This post has been edited by gark: Mar 4 2016, 10:43 AM |

|

|

Mar 4 2016, 11:01 AM Mar 4 2016, 11:01 AM

Return to original view | Post

#18

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(elea88 @ Mar 4 2016, 10:53 AM) If you want to trim look at your portfolio, are there like 2-3 items which performs similarly ie. same industry, same business etc? Study carefully and then choose one. If you want diversification within industry then choose 2 max.Example if you are holding like 4 OnG related stocks, study carefully and choose 1-2, sell what you think is not going to perform and consolidate to the new positions. otherwise your portfolio will move like the STI. Anyway just 2 cent, you do what is comfortable to you. Not necessary you have to follow one. This post has been edited by gark: Mar 4 2016, 11:04 AM |

|

|

Mar 4 2016, 11:03 AM Mar 4 2016, 11:03 AM

Return to original view | Post

#19

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(MCPlz @ Mar 4 2016, 10:51 AM) just want to ask... normally when do you guys take profit? do you take it when it reaches a certain percentage point? like 10% of your average price or more... or do you do TA and set target price.. or keep forever... No hard and fast method.. if the counter reach overvalue, then sell, if undervalue then buy.. metrics like PE, DY, EV/Ebitda is useful but just part of the consideration.Uncle Koon KY has an even simpler method, if the stock can make more money next year then buy, if not then sell. This post has been edited by gark: Mar 4 2016, 11:03 AM |

|

|

Mar 4 2016, 04:17 PM Mar 4 2016, 04:17 PM

Return to original view | Post

#20

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

| Change to: |  0.1722sec 0.1722sec

0.76 0.76

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 08:47 AM |