Topped up KAPTRF today.

FSM-FPX interface changed and looks cleaner.

Fundsupermart.com v11, Grexit or not, Europe will sail on...

Fundsupermart.com v11, Grexit or not, Europe will sail on...

|

|

Aug 3 2015, 10:33 AM Aug 3 2015, 10:33 AM

Return to original view | Post

#141

|

All Stars

52,874 posts Joined: Jan 2003 |

Topped up KAPTRF today.

FSM-FPX interface changed and looks cleaner. |

|

|

|

|

|

Aug 3 2015, 04:11 PM Aug 3 2015, 04:11 PM

Return to original view | Post

#142

|

All Stars

52,874 posts Joined: Jan 2003 |

Ringgit drops most in four weeks as factory PMI clouds outlook

(Aug 3): The ringgit weakened by the most in four weeks as data pointing to a contraction in Malaysia’s factory output dimmed the outlook for an economy reeling from falling oil prices and a political scandal. URL: http://www.theedgemarkets.com/my/article/r...-clouds-outlook [attachmentid=4686400] Mazlan CGPA! This post has been edited by David83: Aug 3 2015, 04:12 PM |

|

|

Aug 3 2015, 09:54 PM Aug 3 2015, 09:54 PM

Return to original view | Post

#143

|

||||||||||||||||||||||||

All Stars

52,874 posts Joined: Jan 2003 |

Portfolio update as of July 31st, 2015:

ROI: 6.8%, IRR: 2.6% |

||||||||||||||||||||||||

|

|

Aug 4 2015, 06:34 AM Aug 4 2015, 06:34 AM

Return to original view | Post

#144

|

All Stars

52,874 posts Joined: Jan 2003 |

WTI falls 3.8%, US market closed in RED:

Stocks close lower as energy, growth concerns weigh; Apple plunges U.S. stocks closed lower on Monday, the first day of trade for August, as investors weighed mostly lackluster economic data and a renewed decline in oil, amid overseas news. ( Tweet This ) "The growth picture right now is not all that encouraging," said John Caruso, senior market strategist at RJO Futures. "I think it's the data, that's the lion share of it." URL: http://finance.yahoo.com/news/nasdaq-tries...-134844727.html |

|

|

Aug 4 2015, 08:28 PM Aug 4 2015, 08:28 PM

Return to original view | Post

#145

|

All Stars

52,874 posts Joined: Jan 2003 |

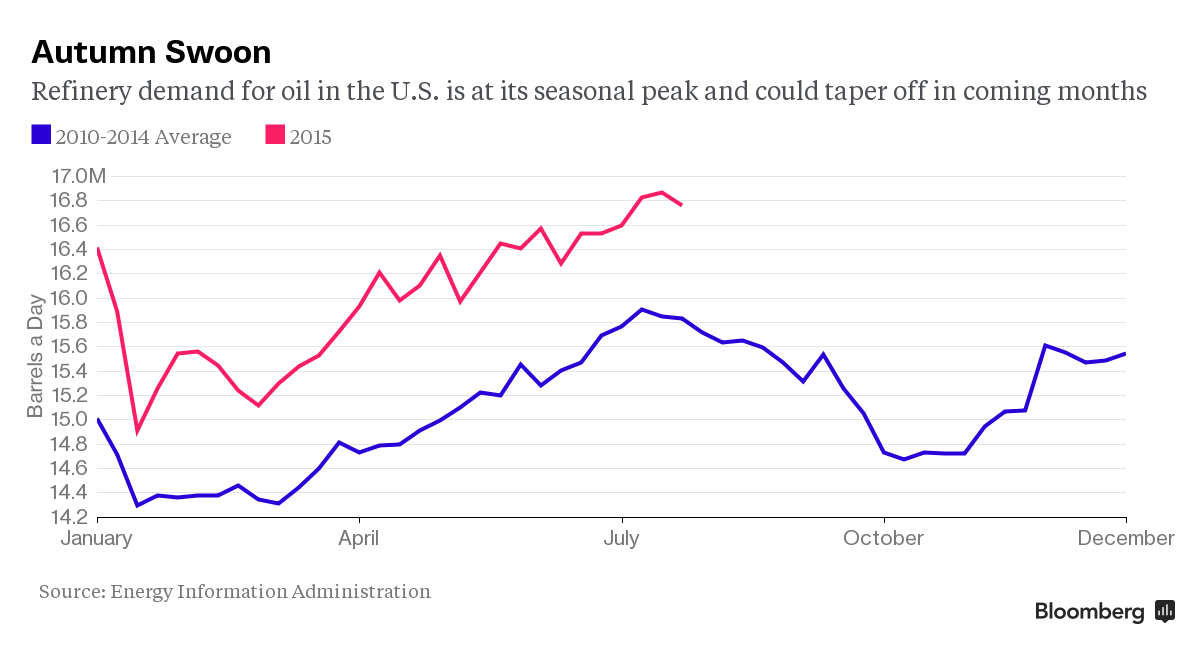

Oil’s Below $50 and About to Get Worse

Oil has fallen to a six-month low, and hopes of a quick rebound are fading as demand heads into an autumn swoon. Brent crude tumbled below $50 on Monday for the first time since January. Gasoline fell the most in almost three years. The slump may have further to go. U.S. refineries, which turned a record amount of crude into gasoline during July, typically slow down from August through October for maintenance.  URL: http://www.bloomberg.com/news/articles/201...s-demand-swoons |

|

|

Aug 4 2015, 08:28 PM Aug 4 2015, 08:28 PM

Return to original view | Post

#146

|

All Stars

52,874 posts Joined: Jan 2003 |

China Dethroned as World’s Most Liquid Stock Market After Curbs

China has lost its title as the world’s most liquid stock market as trading halts and regulatory efforts to curb bearish transactions drive away investors. Daily turnover on mainland exchanges has averaged the equivalent of $202 billion over the past 30 days, down from $288 billion at the start of July. After exceeding turnover on U.S. bourses for about a month through July 8, the value of shares traded in China is now $72 billion lower than in America. Volume in Shanghai on Tuesday was 36 percent below the 30-day average. URL: http://www.bloomberg.com/news/articles/201...ket-after-curbs |

|

|

|

|

|

Aug 5 2015, 02:17 PM Aug 5 2015, 02:17 PM

Return to original view | Post

#147

|

All Stars

52,874 posts Joined: Jan 2003 |

Weakest ringgit in 17 years unmoved by surprise exports rebound

The currency was down 0.6 percent at 3.8765 per dollar as of 1:12 p.m. in Kuala Lumpur, prices from local banks compiled by Bloomberg show. It fell to 3.8787 before the trade numbers, the lowest since September 1998 when it reached 3.9340. URL: http://www.theedgemarkets.com/my/article/w...exports-rebound |

|

|

Aug 5 2015, 08:10 PM Aug 5 2015, 08:10 PM

Return to original view | Post

#148

|

All Stars

52,874 posts Joined: Jan 2003 |

MACC said 2.6 billion is from Middle Easterner donour.

|

|

|

Aug 5 2015, 08:33 PM Aug 5 2015, 08:33 PM

Return to original view | Post

#149

|

All Stars

52,874 posts Joined: Jan 2003 |

Ringgit fighting a double edged sword

KUALA LUMPUR: Declining oil prices coupled with China's struggling economy have largely contributed to the depreciation of the ringgit, economists said. Malaysian Rating Corp Bhd chief economist Nor Zahidi Alias said the crude oil price, which dipped to US$50 per barrel recently, did not augur well for the Malaysian economy. URL: http://www.thestar.com.my/Business/Busines...word/?style=biz |

|

|

Aug 6 2015, 03:04 PM Aug 6 2015, 03:04 PM

Return to original view | Post

#150

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Aug 6 2015, 08:00 PM Aug 6 2015, 08:00 PM

Return to original view | Post

#151

|

All Stars

52,874 posts Joined: Jan 2003 |

Reserve below 100 billion

MYR at new 17-year low MYR loss 10.6% to date MGS yield climbs to 4.14% Ringgit leads Asia declines as reserves seen below $100 billion (Aug 6): The ringgit led losses in Asia on speculation Malaysia’s foreign-exchange reserves dropped below $100 billion in July for the first time since 2010. URL: http://www.theedgemarkets.com/my/article/r...low-100-billion |

|

|

Aug 6 2015, 08:34 PM Aug 6 2015, 08:34 PM

Return to original view | Post

#152

|

All Stars

52,874 posts Joined: Jan 2003 |

Lost Decade in Emerging Markets: Investors Already Halfway There

Just 14 years ago Wall Street fell in love with the BRICs, the tidy acronym for four major emerging economies that, to many, looked like sure winners. Today, after heady runs and abrupt reversals, most of the BRICs -- in fact, most developing nations-- look like big-time losers. The history of emerging markets is a history of booms and busts, but the immediate future may hold something more prosaic: malaise. Investors today confront what could turn out to be a lost decade of returns, with four or five more meager years ahead. “These are very much the lean years after the bonanza decade,” said Harvard Kennedy School economist Carmen Reinhart, one of the world’s top experts on financial crises and developing economies.  URL: http://www.bloomberg.com/news/articles/201...y-halfway-there |

|

|

Aug 7 2015, 07:36 AM Aug 7 2015, 07:36 AM

Return to original view | Post

#153

|

All Stars

52,874 posts Joined: Jan 2003 |

MYR will get 4 flat!

|

|

|

|

|

|

Aug 7 2015, 04:25 PM Aug 7 2015, 04:25 PM

Return to original view | Post

#154

|

All Stars

52,874 posts Joined: Jan 2003 |

CIMB GTF hit all time yesterday @ 0.8616

|

|

|

Aug 7 2015, 07:06 PM Aug 7 2015, 07:06 PM

Return to original view | Post

#155

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(nexona88 @ Aug 7 2015, 06:33 PM) Bank Negara's international reserves has shrunk to US$96.7 billion Expected and it'll be getting lower when MYR hits four flat!http://www.theedgemarkets.com/my/article/b...k-us967-billion |

|

|

Aug 7 2015, 07:12 PM Aug 7 2015, 07:12 PM

Return to original view | Post

#156

|

All Stars

52,874 posts Joined: Jan 2003 |

Gold faces longest weekly losing run since 1999, US data in focus

MANILA: Gold steadied near a 5-1/2-year low on Friday and was on track to show a loss for the seventh week in a row, its longest such slump since 1999, ahead of U.S. data that may determine how soon the Federal Reserve raises interest rates. A strong jobs number would fan speculation the Fed will raise rates next month, which is likely to pull non-interest-bearing gold to fresh lows. "If we get a strong jobs number tonight, I suspect that the market will shift expectations further in favour of September rather than December," said Ric Spooner, chief market analyst at CMC Markets in Sydney. Spot gold was flat at $1,089 an ounce at 0244 GMT. The metal has been trading below $1,100 since breaching that support in a July 20 rout, sinking as far as $1,077 on July 24, its weakest since February 2010. Bullion was down 0.6 percent on the week, with a seventh weekly loss in a row matching a similar losing streak in May-June 1999. U.S. gold for December delivery slipped 0.1 percent to $1,088.80 an ounce. URL: http://www.thestar.com.my/Business/Busines...1999/?style=biz |

|

|

Aug 8 2015, 09:28 AM Aug 8 2015, 09:28 AM

Return to original view | Post

#157

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Aug 8 2015, 09:35 AM Aug 8 2015, 09:35 AM

Return to original view | Post

#158

|

All Stars

52,874 posts Joined: Jan 2003 |

Wall St. drops as jobs report augurs for September rate hike

(Reuters) - U.S. stocks ended lower on Friday after solid job growth data for July pried the door open a little wider for a potential interest rate hike by the Federal Reserve in September. URL: http://finance.yahoo.com/news/stock-future...-111513773.html |

|

|

Aug 8 2015, 07:48 PM Aug 8 2015, 07:48 PM

Return to original view | Post

#159

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Aug 8 2015, 09:45 PM Aug 8 2015, 09:45 PM

Return to original view | Post

#160

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(MNet @ Aug 8 2015, 09:25 PM) Good job to the current administration as ringgit heading for four flat soon.All the efforts seem like useless: 1. Subsidies rationalization 2. Implementation of GST 3. Dodging a credit rating downgrade So, the question for now is what have we achieved for the the past 17 years while we have roughly 4.5 years to 2020? |

|

Topic ClosedOptions

|

| Change to: |  0.0451sec 0.0451sec

0.48 0.48

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 01:27 PM |