Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

zmt

|

Mar 17 2016, 01:46 PM Mar 17 2016, 01:46 PM

|

New Member

|

Is this deductable?

4. Bil bulanan yang dibayar oleh majikan bagi telefon talian tetap, telefon bimbit, alat kelui, PDA atau langganan jalur lebar termasuk kos pendaftaran dan kos pemasangan yang didaftar atas nama pekerja atau majikan.

|

|

|

|

|

|

zmt

|

Mar 18 2016, 09:54 AM Mar 18 2016, 09:54 AM

|

New Member

|

QUOTE(David83 @ Mar 17 2016, 01:57 PM) This is BIK aka Elaun / perkuisit / pemberian / manfaat (yang diterima oleh pekerja daripada majikan/bagi pihak majikan) yang dikecualikan cukai Your HR should put that under Section G. No need to declare/deduct. Seems like my HR did not put this under section G. Will check with them. What about this? 3. Kad petrol, elaun petrol atau elaun perjalanan atau kad tol atau gabungannya atas urusan rasmi. Sekiranya amaun yang diterima melebihi RM6,000 setahun, pekerja boleh membuat potongan selanjutnya bagi amaun yang dibelanjakan untuk tugas rasmi. Rekod berkaitan dengan potongan selanjutnya dan amaun yang dikecualikan hendaklah disimpan untuk tempoh

tujuh tahun bagi tujuan audit.I get transport allowance, fix amount every month, the same as my phone allowance. Is this supposed to be under section G? |

|

|

|

|

|

zmt

|

Mar 2 2021, 02:07 PM Mar 2 2021, 02:07 PM

|

New Member

|

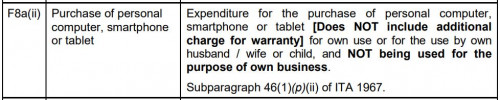

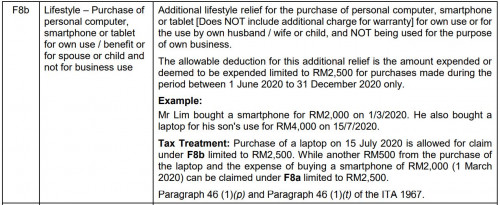

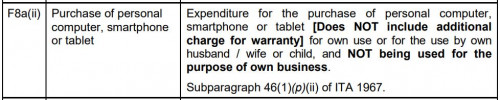

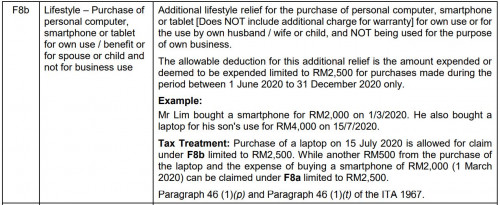

QUOTE(GrumpyNooby @ Mar 1 2021, 10:26 PM) Graphic cards only is not qualified for tax relief under both sections.   F8a(ii) - must be fully functioning computer system (desktop), laptop, smartphone and tablet F8b - must be either laptop, smartphone or tablet Can I claim max 2.5K for F8a for books, internet and claim max 2.5K for F8b (rm500 smartphone, rm1500 laptop, rm500 laptop)? |

|

|

|

|

|

zmt

|

Mar 2 2021, 02:14 PM Mar 2 2021, 02:14 PM

|

New Member

|

QUOTE(GrumpyNooby @ Mar 2 2021, 02:11 PM) As long as you have receipt to support all your claims. Yes, all the receipts under my name, hope this pass LHDN. |

|

|

|

|

Mar 17 2016, 01:46 PM

Mar 17 2016, 01:46 PM

Quote

Quote

0.2246sec

0.2246sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled