Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

voonmingloo

|

May 22 2020, 01:11 AM May 22 2020, 01:11 AM

|

|

yes, LHDN can ask to audit more than 7 years back even 15 years if they felt something not correct. We can only Re submit (wrong calculation being taxed) and ask back any extra credit from LHDN up till 5 years back only.

|

|

|

|

|

|

voonmingloo

|

May 25 2020, 08:53 PM May 25 2020, 08:53 PM

|

|

QUOTE(Salary @ May 25 2020, 07:54 PM) Really? Have you experienced this before and will they penalise you if you do not keep receipts older than 7 years? I have helped to re-submit for my parent's tax whom my dad have submitted tax as single filling (husband and wife together, at that time was form J) instead of able to separately filling for theirs incomes. So I have met the seniors officer to discussed and they gave me all the answers I asked. If you do not keep receipts older that 7 years if fine, they can calculate for you. They will only ask more than 7 years IF they found highly suspicious receipts exemptions that you have filled. This post has been edited by voonmingloo: May 25 2020, 08:56 PM |

|

|

|

|

|

voonmingloo

|

May 25 2020, 08:59 PM May 25 2020, 08:59 PM

|

|

QUOTE(cybpsych @ May 25 2020, 08:53 PM) thye dont penalize you for "storage", but inability to present the original receipt and non-substantiated claims. http://www.hasil.gov.my/bt_goindex.php?bt_...t_sequ=7&cariw=11.1 Retention Of Records

11.1.1 Taxpayers are required to keep sufficient records for a period of seven years from the end of the year to which income from the business relates, as provided under paragraph 82(1)(a) of the Act, to enable the DGIR to ascertain income or loss from the business. Subsection 82(8) further provides that all records relating to any business in Malaysia must be kept and retained in Malaysia. 'Records' under subsection 82(9) include books of accounts, invoices, vouchers, receipts and other documents necessary to verify entries in any books of accounts.http://www.hasil.gov.my/bt_goindex.php?bt_...sequ=1&bt_lgv=2Record Keeping

Taxpayer is required to keep the following documents for 7 years:

EA/EC Form

Original dividend vouchers

Insurance premium receipts

Books purchase receipts

Medical receipts

Donation receipts

Zakat receipts

Children`s birth certificates

Marriage certificate

Other supporting documents

Working sheets (if any)

The calculation of the 7 year period begins from the end of the year in which the ITRF is filed.Thanks. |

|

|

|

|

|

voonmingloo

|

Oct 7 2021, 12:56 AM Oct 7 2021, 12:56 AM

|

|

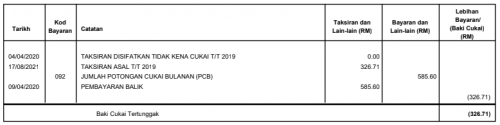

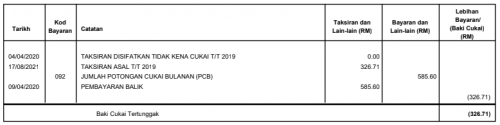

QUOTE(optimus9333 @ Oct 2 2021, 05:46 PM) Hi guys I suddenly got slap with 'Baki Cukai Tertunggak' for my 2019 income. Seems legit even got hardcopy letter The thing is i made all tax filing on time last year and even got full tax refund suddenly only charge me this year for tertunggak How is this possible? If i pay this can i get refund when filing tax next year?  The amount in bracket means u hv credit... |

|

|

|

|

May 22 2020, 01:11 AM

May 22 2020, 01:11 AM

Quote

Quote

0.2174sec

0.2174sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled