for this relief i can relief for 2 years? after i relief on YA 2020 , i can still relief it on 2021?

This post has been edited by swrong: Sep 27 2021, 02:02 AM

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Sep 27 2021, 02:02 AM Sep 27 2021, 02:02 AM

Return to original view | Post

#1

|

Junior Member

29 posts Joined: Nov 2006 |

|

|

|

Sep 27 2021, 11:24 AM Sep 27 2021, 11:24 AM

Return to original view | IPv6 | Post

#2

|

Junior Member

29 posts Joined: Nov 2006 |

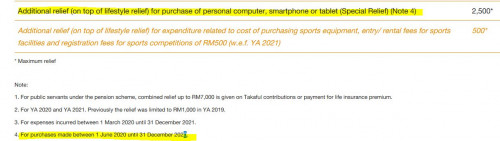

QUOTE(MUM @ Sep 27 2021, 08:09 AM) In the new Permai stimulus package announced today, the government has extended the special tax relief of RM2,500 on purchases of phones, computers, and tablets to 31 December 2021. thank you very much The special tax relief was introduced in the middle of last year as a way to boost work-from-home arrangements. Individual taxpayers could claim tax relief of up to RM2,500 for purchases of these particular electronic devices between 1 June and 31 December 2020. This was on top of the existing tax relief that allowed taxpayers to claim up to RM2,500 under the lifestyle category, which includes expenditure on sports equipment, reading materials, Internet bills, and the same personal electronic devices. https://ringgitplus.com/en/blog/income-tax/...tax-relief.html Permai package: RM2.5k tax relief for phone, computer purchases extended another year By Arfa Yunus, Mohamed Basyir - January 18, 2021 https://www.nst.com.my/news/government-publ...-phone-computer count by calendar year,...many had said, you can claim for 2 years |

| Change to: |  0.3452sec 0.3452sec

0.76 0.76

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 02:06 PM |