QUOTE(zeronuker @ Feb 21 2019, 07:31 AM)

Thanks for all your reply.

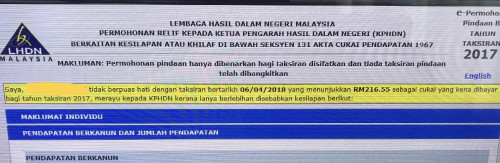

I'll probably print all the documents I have regarding this issue and head over to LHDN counter to enquire.

However, in the mean time, should I include the CP38 monthly deduction in my tax filling under MTD? The CP38 deductions is on my EA Form.

perhaps a phone call would suffice for them to have a check.I'll probably print all the documents I have regarding this issue and head over to LHDN counter to enquire.

However, in the mean time, should I include the CP38 monthly deduction in my tax filling under MTD? The CP38 deductions is on my EA Form.

if i understand this correctly, ur -ve balance (total amount view and not the current year view only) is showing for the payment u've made. when tax amount is calculated (usually when u submit efiling) then it will offset the -ve amount. u can click on the year assessment to see the description of the payment u've made or being deducted.

Feb 21 2019, 08:38 AM

Feb 21 2019, 08:38 AM

Quote

Quote

0.0289sec

0.0289sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled