QUOTE(babyphie @ Mar 19 2017, 11:45 AM)

Hi

Would like to ask for opinion here

I brought a laptop thru online but i made a mistake .

The tax invoice was printed in my bro name instead of mine ( the online account is under his name)

The purchases was paid by my credit card.

Can I include this deduction in my e-filling?

Haiz really regret why i made such mistake...

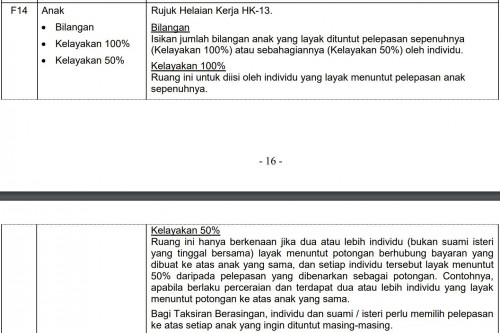

i read some where (as pic show) mention that credit card statement oso can become a prove of purchase, why don't u keep the statement in your record in case audit come......pls dont BOOM me if im wrong... Would like to ask for opinion here

I brought a laptop thru online but i made a mistake .

The tax invoice was printed in my bro name instead of mine ( the online account is under his name)

The purchases was paid by my credit card.

Can I include this deduction in my e-filling?

Haiz really regret why i made such mistake...

This post has been edited by ironman16: Mar 20 2017, 07:57 AM

Mar 20 2017, 07:56 AM

Mar 20 2017, 07:56 AM

Quote

Quote

0.0405sec

0.0405sec

1.36

1.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled