need help in explaining this:

ANY DISPOSAL OF SHARES IN A REAL PROPERTY COMPANY AND / OR REAL PROPERTY UNDER REAL PROPERTY GAINS TAX ACT 1976

it meants reits?

Income Tax Issues v4, Scope: e-BE and eB only

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Mar 7 2016, 12:13 PM Mar 7 2016, 12:13 PM

Return to original view | Post

#1

|

Senior Member

6,373 posts Joined: May 2007 |

need help in explaining this:

ANY DISPOSAL OF SHARES IN A REAL PROPERTY COMPANY AND / OR REAL PROPERTY UNDER REAL PROPERTY GAINS TAX ACT 1976 it meants reits? |

|

|

|

|

|

Mar 8 2016, 03:53 PM Mar 8 2016, 03:53 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

6,373 posts Joined: May 2007 |

|

|

|

Oct 25 2017, 01:42 PM Oct 25 2017, 01:42 PM

Return to original view | Post

#3

|

Senior Member

6,373 posts Joined: May 2007 |

for budget 2017, got 1k allocation for breast pumping equipment.

how about accessories? can claim? or those breast milk related like storage bag, can claim also? |

|

|

May 31 2020, 05:15 PM May 31 2020, 05:15 PM

Return to original view | Post

#4

|

Senior Member

6,373 posts Joined: May 2007 |

Hi, want to clarify, based on this link: http://www.hasil.gov.my/bt_goindex.php?bt_...nit=1&bt_sequ=1

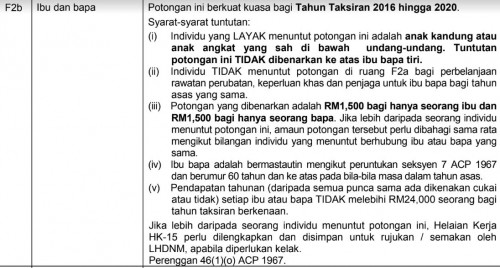

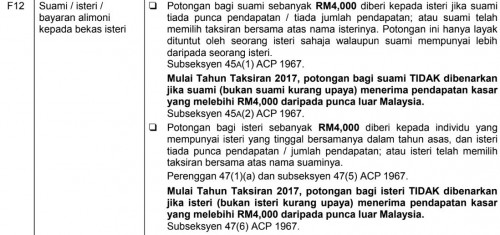

Under (2), means if i got parents, i can claim rm3k? Under (12), means if I'm married, i can claim rm4k? I'm claiming individual tax, not joint claim with wife. |

|

|

May 31 2020, 05:39 PM May 31 2020, 05:39 PM

Return to original view | Post

#5

|

Senior Member

6,373 posts Joined: May 2007 |

QUOTE(GrumpyNooby @ May 31 2020, 05:32 PM) Under (2), yes as long as your parents meet the eligibility criteria stated in the Nota Penerangan BE 2019. Thanks for your reply. Under (12), yes as long as your spouse is not working nor has income.  This post has been edited by fkinmeng: May 31 2020, 05:39 PM |

| Change to: |  0.0285sec 0.0285sec

0.53 0.53

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 12:25 PM |