QUOTE(yklooi @ May 20 2022, 07:15 AM)

Since you are still waiting for feedback.

I kaypoh abit if for me,..... I would (which may not be 100% correct or effective)

Print out my previously submitted BE form,

Labelled it with "borang BE yang dahulunya telah Di hantar" at the top.

Highlight the area that was errorly submitted and remarks it as "infomasi tersalah lapurkan"

Print out a new BE form and fill in the correct data.

Label with pencil at the top page "matlumat terkini yang telah dikemaskini"

Fill in the required info (as per new submission),

Attach supporting documents

In the form can do summary of tax amount to be paid or no need to pay.

Sign the form.

Attach with a written letter addressing to them, describing & explaining the issue.

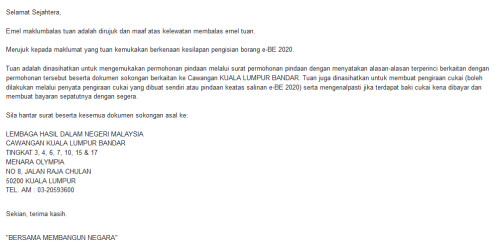

"Tuan adalah dinasihatkan untuk mengemukakan permohonan pindaan melalui surat permohonan pindaan dengan

menyatakan alasan-alasan terperinci berkaitan dengan permohonan tersebut beserta dokumen sokongan"

I have question when finalizing my amendment on the BE 2020,

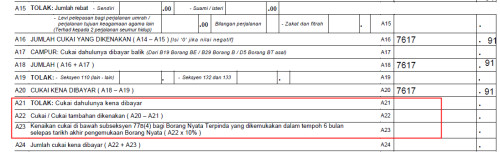

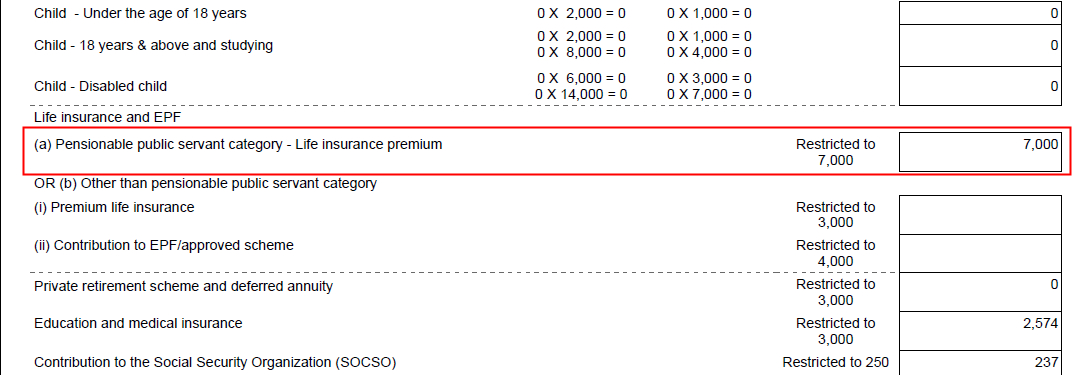

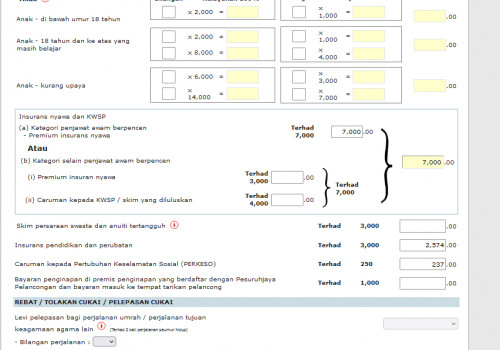

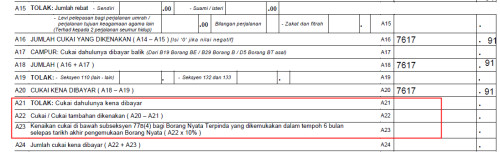

1) usually where to get/how to calculate for A21, does this A21 is the PCB in our EA Form 2020 ?

2) regarding to A23, since this amendment has been made after 6 months, I have to add 10% from A22 and total it up?

3) after calculation, I have over-paid the tax for let's say rm3000, usually how to calculate it for A23 portion ?

Apr 21 2022, 10:05 PM

Apr 21 2022, 10:05 PM

Quote

Quote

0.2797sec

0.2797sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled