Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

dragonteoh

|

Mar 22 2020, 12:32 PM Mar 22 2020, 12:32 PM

|

|

Hi Guys,

I got a question regarding BE form Section F6

"Perbelanjaan perubatan bagi penyakit serius ke atas diri sendiri, suami / isteri atau anak"

Wife facing Hypertension & Diabetes issue since last year and go for medication (government and private hospital)

Can she claim under this section ?

|

|

|

|

|

|

dragonteoh

|

Mar 22 2020, 01:42 PM Mar 22 2020, 01:42 PM

|

|

QUOTE(MUM @ Mar 22 2020, 12:46 PM) What disease is considered a serious disease and where can I find the list in the Tax Guide Book? The tax relief for medical expenses expended on self, spouse or child of up to a maximum of RM5,000 revised to RM6,000 is available in respect of treatment of serious diseases which is defined to include AIDS, Parkinson’s, cancer, renal failure, leukaemia and other similar diseases such as heart attack, pulmonary hypertension, chronic liver disease, fulminant viral hepatitis, head trauma with neurological deficit, brain tumour or vascular malformation, major burns, major organ transplant and major amputation of limbs. https://www.thestar.com.my/opinion/letters/...edical-expensesnota penerangan BE 2019 http://lampiran1.hasil.gov.my/pdf/pdfam/No...an_BE2019_1.pdfLooks like not applicable for hypertension. As i search the info, pulmonary hypertension is totally different than Hypertension while Diabetes i think should be applicable as list got mention Diabetes Mellitus  This post has been edited by dragonteoh: Mar 22 2020, 01:48 PM This post has been edited by dragonteoh: Mar 22 2020, 01:48 PM |

|

|

|

|

|

dragonteoh

|

Apr 4 2020, 11:40 PM Apr 4 2020, 11:40 PM

|

|

QUOTE(cybpsych @ Mar 25 2020, 08:24 AM) MCO: IRB to shut Hasil Care Line call centre from March 26https://www.theedgemarkets.com/article/mco-...centre-march-26KUALA LUMPUR (March 24): The Inland Revenue Board (IRB) announced that its Hasil Care Line (HCL) call centre will be closed from March 26, until the end of the Movement Control Order (MCO) on March 31. The IRB in a statement on Tuesday said the services offered by the board are also limited to online services such as the filing of the Income Tax Return Form (BNCP) and tax payments through the ezHASiL platform. Any enquiries can be directed to the board via HASiL Live Chat or by filling up feedback form, available on the website at https://maklumbalaspelanggan.hasil.gov.my/MaklumBalas/ms-my/, Facebook and Twitter. For further information, taxpayers can access IRB’s official website at http://www.hasil.gov.my By the way, their live chat is not stable. keep on DC non stop , maybe too much people checking for BPN. |

|

|

|

|

|

dragonteoh

|

May 17 2020, 10:07 AM May 17 2020, 10:07 AM

|

|

Hi not sure is it correct place to post this question.

I always hear people say make donation can claim income tax.

However, from BE Form E1 till E7, i din saw any row that mention if donate to let say old folks house or orphanage can claim.

All 7 rows info is donation for those library , government and sports.

Am i correct?

If i am wrong, then which row should i fill in , if donate to Pertubuhan Kebajikan Anak-Anak Yatim & OKU Mesra ?

|

|

|

|

|

|

dragonteoh

|

May 17 2020, 10:23 AM May 17 2020, 10:23 AM

|

|

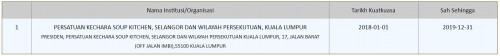

QUOTE(GrumpyNooby @ May 17 2020, 10:19 AM) Hadiah wang kepada institusi / organisasi / tabung yang diluluskanHadiah wang kepada institusi / organisasi / tabung yang diluluskan oleh Ketua Pengarah Hasil Dalam Negeri. Subseksyen 44(6) dan proviso, ACP 1967 http://www.hasil.gov.my/bt_goindex.php?bt_...nit=8&bt_sequ=1from the list , i think many organization did not register their name. |

|

|

|

|

|

dragonteoh

|

May 17 2020, 10:38 AM May 17 2020, 10:38 AM

|

|

QUOTE(GrumpyNooby @ May 17 2020, 10:33 AM) If not listed, then not eligible for taxable income reduction. Normally because I do a donation, I check the background of the respective non-profit or charity organization. Those registered and eligible usually carry a registration number starts with PPM: For example: Malaysian Medical Relief Society (Reg. No: PPM-020-14-16091999) Ooo, is that mean, if their institution registration no come with the word PPM , then is eligible ? Then is consider eligible, however, not sure why LHDN site can't find their name in the list. This post has been edited by dragonteoh: May 17 2020, 10:41 AM |

|

|

|

|

|

dragonteoh

|

May 17 2020, 10:53 AM May 17 2020, 10:53 AM

|

|

QUOTE(GrumpyNooby @ May 17 2020, 10:42 AM) Usually not eligible. Best to counter check with list in the LHDN database, some may have expired.  Too bad, the name is totally not appear in the list, even they have PPM in their registration. |

|

|

|

|

|

dragonteoh

|

May 24 2020, 10:29 AM May 24 2020, 10:29 AM

|

|

QUOTE(StarPrimo @ May 17 2020, 01:51 PM) If the organisation is not registered, then it’s not eligible for deduction. Perhaps check with LHDN for eligibility. well , checked with the organisation. They din register. Lucky we ask, else later submit deduction and LHDN come check, then will be trouble. |

|

|

|

|

|

dragonteoh

|

Apr 30 2025, 10:05 AM Apr 30 2025, 10:05 AM

|

|

Hi Guys,

Got 2 question about house rental.

Scenario : House rent to 2nd Tenant via Agent start on July 2024.

Tenant paid the 1st Rent (July) to Agent as commission.

Owner top up the SST fee.

Q1 : July Rent income declare as RM0 or July rental RMxxxx ?

Q2 : Agent commission deduction is inclusive SST or exclude SST ?

Thanks for help.

This post has been edited by dragonteoh: Apr 30 2025, 10:06 AM

|

|

|

|

|

Mar 22 2020, 12:32 PM

Mar 22 2020, 12:32 PM

Quote

Quote

0.2105sec

0.2105sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled