Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

Ellizabeth

|

Dec 26 2017, 12:50 PM Dec 26 2017, 12:50 PM

|

New Member

|

Hi,

I want to ask the following scenario:

A receive extra income around RM2000-6000 every month by renting google and facebook account,There is no document to prove this and just can show bank transaction only. Do A need to declare in BE form for this extra income?

|

|

|

|

|

|

Ellizabeth

|

Dec 26 2017, 03:13 PM Dec 26 2017, 03:13 PM

|

New Member

|

QUOTE(cherroy @ Dec 26 2017, 01:07 PM) Yes. The bank transaction + Contact or agreement made through whatever be it email, FB etc, payment advice by the payor etc are the proof of source of income. Do you mind I inbox your for more details? |

|

|

|

|

|

Ellizabeth

|

Mar 2 2019, 01:05 PM Mar 2 2019, 01:05 PM

|

New Member

|

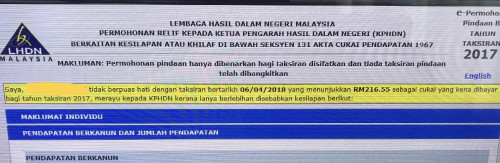

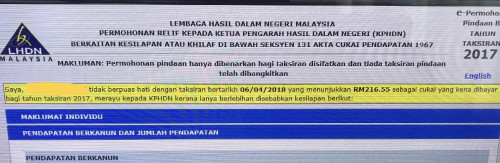

Anyone got this issue? I didn’t make any appeal and I agreed with the amount and even received the lehihan last year. it automatically show on my profile when I checked my account just now.. What should I do ? Is it normal? |

|

|

|

|

|

Ellizabeth

|

Mar 4 2019, 03:25 PM Mar 4 2019, 03:25 PM

|

New Member

|

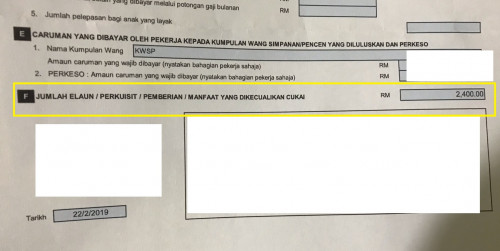

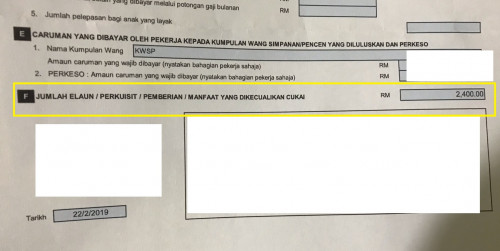

This is my EA form I got from my finance..I stucked at this section F. Do I need to insert this RM2400 in my efiling? Under which column where should I insert it OR not neccessary as this is entitled for tax exempt allowances ?  |

|

|

|

|

|

Ellizabeth

|

Mar 4 2019, 03:45 PM Mar 4 2019, 03:45 PM

|

New Member

|

QUOTE(David83 @ Mar 4 2019, 03:41 PM) No action required. It's tax exempted. Thanks for your information I heard frm my friend there is a limit for this right? |

|

|

|

|

|

Ellizabeth

|

Mar 31 2019, 10:12 PM Mar 31 2019, 10:12 PM

|

New Member

|

If I bought my phone in 2018 but I forgot to put in for tax reflief in income tax 2018

Can I save the receipt and put in under income tax 2019?

Or

phone buy in 2018 only allow to put in income tax 2018

|

|

|

|

|

|

Ellizabeth

|

Mar 31 2019, 10:18 PM Mar 31 2019, 10:18 PM

|

New Member

|

QUOTE(David83 @ Mar 31 2019, 10:13 PM) I guess laptop same right? But laptop only every three years |

|

|

|

|

|

Ellizabeth

|

Mar 31 2019, 10:26 PM Mar 31 2019, 10:26 PM

|

New Member

|

QUOTE(David83 @ Mar 31 2019, 10:19 PM) Same goes to laptop or tablet (iPad category). The 3 years ruling has long gone. The Lifestyle Tax Relief has replaced the laptop tax relief. Ah I see, Which mean we can claim it every year if I buy laptop every year. Thanks for the info! |

|

|

|

|

Dec 26 2017, 12:50 PM

Dec 26 2017, 12:50 PM

Quote

Quote

0.0287sec

0.0287sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled