QUOTE(MUM @ Mar 29 2019, 12:36 PM)

that nota penerangan is same as posted in the top page...thus there are some comment about it...

not an expert in this...but I think travelling expenses to work cannot be deducted from gross income for personal tax...i think YES for business tax

but about the license fees......

i know some other professioal fees can be claimed....

Q 17, page 4

http://lampiran1.hasil.gov.my/pdf/pdfam/FA..._01042011_1.pdfjust that I am not sure about yours.....

QUOTE(cherroy @ Mar 29 2019, 03:11 PM)

Only if you register a business and receive those income through the business entity.

Personal employment income whether full time or part time, it is the same.

If full time job cannot claim those expenses, then it is same for part time.

Those deductibles stated eg.

Your employer pay your an amount of travel allowances because you are need to travel to perform your job. Then specific amount of travel allowance is tax deductible.

Doing grab is a business, not employment.

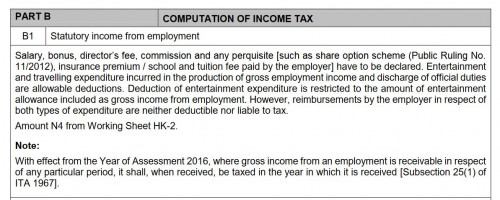

HK-2 : COMPUTATION OF STATUTORY INCOME FROM EMPLOYMENT

Below F. TOTAL GROSS EMPLOYMENT INCOME (A to E)

LESS:

G. Subscriptions to professional bodies

H. Entertainment expenditure

(restricted—section 38A)

J. Travelling expenditure

QUOTE

Subscriptions Compulsory membership subscriptions paid to professional - -

to professional bodies to ensure the continuance of a professional standing

bodies and practice such as those paid by those in the medical and

legal profession.

QUOTE

Travelling Travelling expenditure wholly and exclusively incurred in the - -

expenditure production of gross employment income is deductible.

1. The full amount of allowance must be included in the gross

employment income irrespective of whether this expenditure

is wholly or partly deductible.

2. Reimbursements received from the employer in respect

of travelling is neither liable to tax nor deductible.

3. Travelling expenditure is not deductible if incurred in

travelling to and from the house and place of work.

Example :

Annual salary RM30,000

Annual travelling allowance RM 6,000

Amount expended on travelling in the discharge of official

duties is RM5,000.

Amount of deduction allowed is RM5,000.

Mar 29 2019, 12:13 PM

Mar 29 2019, 12:13 PM

Quote

Quote

0.2539sec

0.2539sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled