QUOTE(GrumpyNooby @ Nov 11 2020, 04:04 PM)

Income Tax Issues v4, Scope: e-BE and eB only

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Nov 15 2020, 11:12 PM Nov 15 2020, 11:12 PM

Return to original view | Post

#21

|

Senior Member

1,397 posts Joined: Feb 2012 From: sOuL SoCiETY.. iSKaNDaRPuTeRi.. JB.. JDT |

|

|

|

|

|

|

Nov 20 2020, 01:53 PM Nov 20 2020, 01:53 PM

Return to original view | Post

#22

|

Senior Member

1,397 posts Joined: Feb 2012 From: sOuL SoCiETY.. iSKaNDaRPuTeRi.. JB.. JDT |

QUOTE(MUM @ Nov 16 2020, 12:04 AM) it i more like this.... nice so my understanding so far good if you contributed 3k into PRS in 2017, you can claim 3k tax relief during tax submission in April 2018, then contributed 3k into PRS in 2018, you can claim 3k tax relief during tax submission in April 2019 again, but if you contribute 0 into PRS in 2018, you cannot claim any tax relief during tax submission in April 2019, then if contributed 3k into PRS in 2019, you can claim 3k tax relief during tax submission in April 2020 again but if you contribute 2k into PRS in 2020, you can claim 2k tax relief during tax submission in April 2021 |

|

|

Nov 20 2020, 05:04 PM Nov 20 2020, 05:04 PM

Return to original view | Post

#23

|

Senior Member

1,397 posts Joined: Feb 2012 From: sOuL SoCiETY.. iSKaNDaRPuTeRi.. JB.. JDT |

QUOTE(yklooi @ Nov 20 2020, 01:59 PM) no lah... you can claim deposited amount only yklooi liked this post

|

|

|

Dec 31 2020, 07:42 AM Dec 31 2020, 07:42 AM

Return to original view | Post

#24

|

Senior Member

1,397 posts Joined: Feb 2012 From: sOuL SoCiETY.. iSKaNDaRPuTeRi.. JB.. JDT |

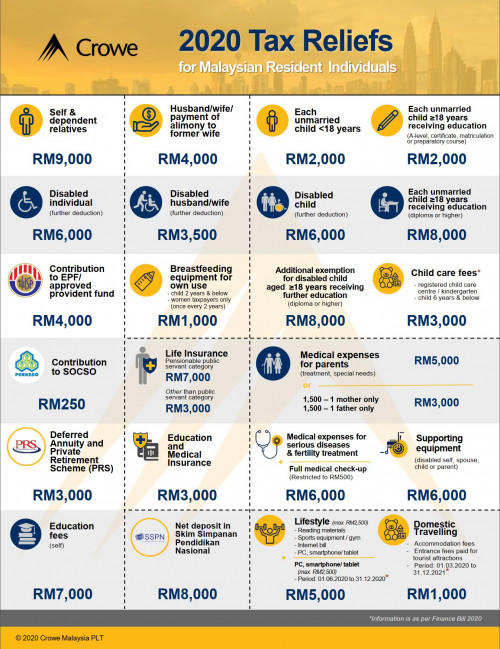

QUOTE(un.deux.trois @ Dec 29 2020, 11:41 PM) Hi. Does anyone know any app or website that can estimate the personal income tax for 2020 assessment that take into account all the incentives announced this year? Thanks. For head's up on the incentives officially will always from LHDN... (2020 not out yet) but saw this Crowe 2020 below.. still not sure for real or not  This post has been edited by WaNaWe900: Dec 31 2020, 07:44 AM |

|

|

Jan 16 2021, 09:40 PM Jan 16 2021, 09:40 PM

Return to original view | Post

#25

|

Senior Member

1,397 posts Joined: Feb 2012 From: sOuL SoCiETY.. iSKaNDaRPuTeRi.. JB.. JDT |

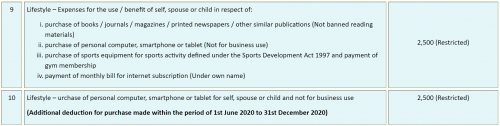

QUOTE(GrumpyNooby @ Jan 15 2021, 01:18 PM) Personal tax relieves for YA2020 is updated at LHDN portal: Indeed additional 2.5k tax relief Tahun Taksiran 2020: http://www.hasil.gov.my/bt_goindex.php?bt_...nit=1&bt_sequ=1  |

|

|

Jan 18 2021, 06:13 PM Jan 18 2021, 06:13 PM

Return to original view | Post

#26

|

Senior Member

1,397 posts Joined: Feb 2012 From: sOuL SoCiETY.. iSKaNDaRPuTeRi.. JB.. JDT |

|

|

|

|

|

|

Jan 29 2021, 02:21 PM Jan 29 2021, 02:21 PM

Return to original view | Post

#27

|

Senior Member

1,397 posts Joined: Feb 2012 From: sOuL SoCiETY.. iSKaNDaRPuTeRi.. JB.. JDT |

|

|

|

Mar 3 2021, 11:08 PM Mar 3 2021, 11:08 PM

Return to original view | Post

#28

|

Senior Member

1,397 posts Joined: Feb 2012 From: sOuL SoCiETY.. iSKaNDaRPuTeRi.. JB.. JDT |

QUOTE(Xenopher @ Mar 1 2021, 12:02 PM) During login I was prompted an error 'Your Digital Certificate has expired'. And I can't renew it as well (tried 3 times today).  Anyone facing this issue? QUOTE(mypagan_26 @ Mar 1 2021, 12:11 PM) QUOTE(vincentxiang @ Mar 1 2021, 11:00 PM) try using different browser with pop-up enable and do clear cache or history QUOTE(whirlwind @ Mar 1 2021, 04:35 PM) Based on my EA form my total pay I should key into the “pendapatan berkanun penggajian “ right? But then when I click next this error appeared “jumlah pendapatan Yang dipindahkan mesti ada nilai, sila masukkan pendapatan pasangan dari HK6 atau selain HK6” . Tried key in 0 also same error pop up. Can anyone advise? below the wages need to key-in 1 if the whole salary from 1 company or 2 & more if the amount from multiple companies you've been working... put 0 will not do whirlwind liked this post

|

|

|

Jul 25 2021, 12:30 PM Jul 25 2021, 12:30 PM

Return to original view | Post

#29

|

Senior Member

1,397 posts Joined: Feb 2012 From: sOuL SoCiETY.. iSKaNDaRPuTeRi.. JB.. JDT |

QUOTE(starry-starry @ Jul 14 2021, 09:43 PM) Oppppsss.. seems like I read and interpreted TS question wrongly... I already claimed RM2500 in YR 2020 income tax for this lifestyle thingy... bought a laptop... I wonder if I can get another laptop or hp for YR 2021 income tax deduction. QUOTE(MUM @ Jul 14 2021, 09:46 PM) i am not in the position to confirm it 100%, The "lifestyle thingy" meant to be yearly... and yes I'd claimed it last year buying new tablet and this year getting another notebook again but i think i am "sure" can get one EACH year as the claim are for calendar year like internet subscription or gym membership for if they were to limit it to only one time for this 2 years pandemic package,...they would have stated it in like previously for the computer thing like as per image.. |

|

|

Mar 1 2022, 12:55 AM Mar 1 2022, 12:55 AM

Return to original view | IPv6 | Post

#30

|

Senior Member

1,397 posts Joined: Feb 2012 From: sOuL SoCiETY.. iSKaNDaRPuTeRi.. JB.. JDT |

|

|

|

Mar 10 2022, 12:54 AM Mar 10 2022, 12:54 AM

Return to original view | IPv6 | Post

#31

|

Senior Member

1,397 posts Joined: Feb 2012 From: sOuL SoCiETY.. iSKaNDaRPuTeRi.. JB.. JDT |

|

| Change to: |  0.3458sec 0.3458sec

1.33 1.33

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 11:33 AM |