Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.9, Please Read Post#1 and #3

|

Plutoman

|

Aug 4 2015, 11:23 PM Aug 4 2015, 11:23 PM

|

Getting Started

|

QUOTE(jonathanchee315 @ Aug 4 2015, 02:36 PM) The CASA account got term and condition apply ? Like need to deposit a certain minimum amount into the account ? Or just need to open a CASA account that's all to eligible for the 4.21% 15 month step out FD? RHB 4.21% FD not for 12 months placement? Got 15 months placement? |

|

|

|

|

|

Plutoman

|

Aug 4 2015, 11:40 PM Aug 4 2015, 11:40 PM

|

Getting Started

|

QUOTE(cklimm @ Aug 4 2015, 11:43 AM) the only one doing Forex promotion is OCBC, 3 months, board rate+4%p.a http://www.ocbc.com.my/assets/pdf/FCY_TD_TC.pdfDo you know what it means by board rate + 4%? The board rate is normal FD rate? For example 3.20% for 3 months normal FD rate? |

|

|

|

|

|

Plutoman

|

Aug 4 2015, 11:46 PM Aug 4 2015, 11:46 PM

|

Getting Started

|

QUOTE(aeiou228 @ Aug 4 2015, 11:29 PM) You are right, 12 months FD. Last year RHB had 15 months FD promo for 4.10% or 4.20% cant remember, thought its back again. Thanks for the info.. |

|

|

|

|

|

Plutoman

|

Aug 5 2015, 05:08 PM Aug 5 2015, 05:08 PM

|

Getting Started

|

QUOTE(cklimm @ Aug 5 2015, 09:37 AM) for example, SGD 3 months board rate is 0.06%pa, during promotion you can have 4.06% pa, but for 3 months only. Thanks for the info, Mr. Kim  Sounds attractive, but the risk is on the forex loss. Have to study a bit first.. |

|

|

|

|

|

Plutoman

|

Sep 23 2015, 02:50 PM Sep 23 2015, 02:50 PM

|

Getting Started

|

QUOTE(Konohamaru @ Sep 23 2015, 01:48 PM) why OCBC, UOB, PBB,Maybank,Hongleong,RHB all got FD promotion 3.95%~4.x%, only CIMB no promotion???? I think CIMB also has, but promo over the counter. I asked one of CIMB bank before, the cashier said they have promo depend on FD amount. Didn't ask further because no FD to put that time, haha.. |

|

|

|

|

|

Plutoman

|

Sep 23 2015, 09:24 PM Sep 23 2015, 09:24 PM

|

Getting Started

|

QUOTE(Vincent9696 @ Sep 23 2015, 06:59 PM) 12 months any idea what is the rate? can get 4.25%?? since 3 months alr 3.95%  |

|

|

|

|

|

Plutoman

|

Sep 23 2015, 10:49 PM Sep 23 2015, 10:49 PM

|

Getting Started

|

QUOTE(wil-i-am @ Sep 23 2015, 09:26 PM) Y goes thru d pain when AmBank n Uob offer 4.20%? Ambank & UOB not convenient for me. Do not have these 2 banks near where i stay. So always look for RHB, CIMB, Maybank or PB only. Easy for me. Really miss the RHB 4.21%.. dont know when wanna come back again  |

|

|

|

|

|

Plutoman

|

Sep 23 2015, 11:04 PM Sep 23 2015, 11:04 PM

|

Getting Started

|

QUOTE(msa9696 @ Sep 23 2015, 10:21 PM) Can't remember but definitely lower than 4.15%. I concur on the 3.95% which I asked about 2 weeks ago. I asked in Wisma Genting, beside CIMB is just Maybank. I told them Maybank give 4.15% effective rate for 10 months, the lady then asked me go to Maybank as really impossible for them to offer such good rate. She gave me a look like how come so competitive now Banks' FD war good for us  CIMB used to give 12 months 4.2% unfixed deposit promo. Maybe now focus on shorter term deposit, since giving such good rate for 3 months FD. |

|

|

|

|

|

Plutoman

|

Sep 30 2015, 11:10 AM Sep 30 2015, 11:10 AM

|

Getting Started

|

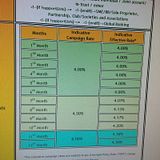

QUOTE(McFD2R @ Sep 30 2015, 10:45 AM) Maybank  The T&C below mentioned that campaign rate subject to OPR change. bbgoat bro mentioned about monthly interest credit, is that mean the interest rate can change anytime if OPR changes. Still, if this promo is true for all customer, damn good deal weyyy... Happened that I got some matured FD too  |

|

|

|

|

|

Plutoman

|

Sep 30 2015, 11:37 AM Sep 30 2015, 11:37 AM

|

Getting Started

|

QUOTE(Ramjade @ Sep 30 2015, 11:14 AM) What it meant is if opr decrease today, they can decrease the 4.5% or maintain. If increase, that 4.5% can increase to maintain. Since this is step up FD, I am wondering if it is monthly step up since bbgoat bro mentioned about monthly interest. For example public bank step up is 6 + 6, which mean if the OPR changes during 7th month, it will not affect the 12month effective interest rate at all. If OPR changes during 5th month, then the second step up rate will be affected. |

|

|

|

|

|

Plutoman

|

Oct 1 2015, 07:30 AM Oct 1 2015, 07:30 AM

|

Getting Started

|

QUOTE(wil-i-am @ Oct 1 2015, 07:20 AM) Returns is gud but no PIDM coverage Plus capital not guaranteed. Sound a bit like mutual fund with guaranteed return. |

|

|

|

|

|

Plutoman

|

Oct 2 2015, 09:53 PM Oct 2 2015, 09:53 PM

|

Getting Started

|

Guys, is it true that HLB is not issuing saving passbook anymore for new saving account opening?? Tried to open saving account for fd placement but was told now they only give debit card and we have to use their internet banking to check our account.

Super weird to me. First time hearing bank not issuing saving passbook anymore.

|

|

|

|

|

|

Plutoman

|

Oct 2 2015, 11:18 PM Oct 2 2015, 11:18 PM

|

Getting Started

|

QUOTE(cappuccino vs latte @ Oct 2 2015, 10:25 PM) I believe is quite common now a days most of the bank don't have pass book anymore. We are forced to get a debit card and be charged min RM8 per annum. As far as I know Public Bank still able to issue a pass book. Thanks for the info, its new to me tho. All this while been getting pass book from other banks (rhb, cimb, pb, maybank). |

|

|

|

|

Aug 4 2015, 11:23 PM

Aug 4 2015, 11:23 PM

Quote

Quote

0.0414sec

0.0414sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled