QUOTE(zenwell @ Sep 25 2015, 09:39 PM)

Went to CIMB Uptown and placed 2k OTC

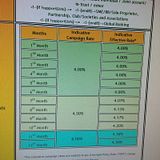

1month FD: 3.70%

3 months FD: 3.90%

Just a quick opinion of mine.1month FD: 3.70%

3 months FD: 3.90%

RM2k x 3.15% pa /12 = RM5.25 per month (eFD from your current bank account)

RM2k x 3.9% pa /12 = RM6.50 per month (over counter)

Personally, the difference in actual amount is too little to trouble yourself over the counter. Your time alone is worth more than the RM1.25 cents a month (or RM3.75 over 3 months). While I understand it varies individually, only go to counters when the difference in amount is more valuable than the time spent, or/and petrol and parking spent.

Example

RM10k x 3.15% pa/12 = RM26.25 pm

RM10k x 3.90% pa/12 = RM32.50 pm

Over 3 months, RM18.75 ... at least this covers your time (to some, RM19 isn't even worth the trouble), assuming you just need to walk there. Remember, it's not just once that you need to go over. You need to go to counter as well to uplift. That will be 2 visits just to make that difference is amount compared to eFD. Maybank 3 months eFD is 3.20%. The difference will be even lesser since I'm only using 3.15% for calculation.

Remember, we're all in this thread to make sure our money works for us, with as minimal effort as possible. If cost>interest gained = no good ROI. Unless the bank is just within walking distance of your office, then I think it wasn't a good idea to go OTC.

Sep 27 2015, 06:15 PM

Sep 27 2015, 06:15 PM

Quote

Quote

0.0447sec

0.0447sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled