QUOTE(audy @ Aug 19 2016, 03:25 PM)

How do I inform PM of change of my correspondence address and is the process complicated? Can any PM agent or anyone who has done it advise me?

I asked my agent to do it and he said he has (true or not I dunno) but I am still getting mails delivered to my old address. It has been 8 mths and I am getting frustrated. He tells me he will check with PM but each time when I asked for status, he said he forgot to check.

if you cannot wait for answer.......or if there is no response....try thisI asked my agent to do it and he said he has (true or not I dunno) but I am still getting mails delivered to my old address. It has been 8 mths and I am getting frustrated. He tells me he will check with PM but each time when I asked for status, he said he forgot to check.

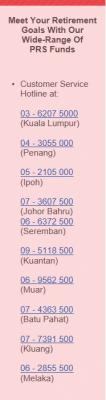

http://www.publicmutual.com.my/contactus.aspx

Aug 19 2016, 04:28 PM

Aug 19 2016, 04:28 PM

Quote

Quote

0.1160sec

0.1160sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled