EPF dividends update:Annual Dividends:» Click to show Spoiler - click again to hide... «

2008 4.50%

2009 5.65%

2010 5.80%

2011 6.00%

2012 6.15%

2013 6.35%

2014 6.75%

2015 6.40%

2016 5.70%

2017 6.90%

2018 6.15%

2019 5.45%

2020 5.20%

10-yrs Annualised Returns:» Click to show Spoiler - click again to hide... «

2008 5.18%

2009 5.06%

2010 5.04%

2011 5.14%

2012 5.33%

2013 5.51%

2014 5.71%

2015 5.85%

2016 5.91%

2017 6.02%

2018 6.18%

2019 6.16%

2020 6.10%

(3-yr annualised: 5.60%)

(5-yr annualised: 5.88%)

============

https://www.thestar.com.my/news/nation/2021...c-stricken-2020PETALING JAYA: Despite the Covid-19 pandemic, the Employees Provident Fund (EPF) says it has delivered a solid performance in 2020 for both its operational and financial results with a total dividend payout of RM47.64bil.

The pension fund declared a dividend of 5.20% for Conventional Savings and 4.9% for Syariah Savings for 2020.

» Click to show Spoiler - click again to hide... «

It said the payout amounted to RM42.88bil and RM4.76bil respectively for both savings.

Last year, EPF declared dividends of 5.45% for Conventional Savings 2019 and 5% for Syariah Savings 2019.

In the past 10 years, EPF’s dividend payout for Conventional Savings was at 5.8% in 2010 followed by 6% (2011), 6.15% (2012), 6.35% (2013), 6.75% (2014), 6.4% (2015), 5.7% (2016), 6.9% (2017), and 6.15% (2018).

For Syariah Savings, it recorded dividends of 6.4% in 2017 and 5.9% in 2018.

EPF said its investment assets hit RM1 trillion on Dec 3 last year, having recorded a compounded annual growth rate (CAGR) growth of 11.2% since 1985, achieving a year-on-year growth of 7.9% for 2020.

EPF added that it had been successful in posting a strong performance in 2020 despite the once-in-a-lifetime event stemming from the pandemic and the unique circumstances the world found itself in, with the twin health and economic crises.

EPF chairman Tan Sri Ahmad Badri Mohd Zahir said they managed to safeguard their members’ retirement savings well, while meeting their immediate needs to deal with the current challenges.

“It was not easy at times as we had to walk a tightrope in ensuring that our members survive the difficult times while balancing their future needs.

“The quick spread of Covid-19 and its transmissibility made it a ‘black swan’ event that many found challenging to manage.

“However, we were proactive in managing the pandemic and that helped us to ride through the challenges. Our focus on digitalisation enabled us to assist our members more efficiently and seamlessly while ensuring that we remain relevant to members who are more technology-savvy, ” he said in a statement yesterday.

Ahmad Badri added that EPF’s speed of adaptability in its investment strategy and processes ensured that they were able to deliver optimum performance, and they further leveraged on the strength of about 250-strong investment professionals who diligently managed the portfolios and took proactive measures.

“Solid teamwork and digital infrastructure ensured that we could adapt seamlessly to the new work norms, ” he said.

He also noted that EPF also rebalanced its investment portfolios based on thorough consideration on how the Covid-19 pandemic and global uncertainties, such as the US presidential election in November 2020, the continuous US-China trade dispute, and the impact of the Brexit negotiations, had influenced capital markets worldwide.

On EPF’s investment portfolio, Ahmad Badri said following lower net contributions during the year, EPF’s ability to adapt to the current times ensured its investments were able to deliver long-term sustainable returns under the new normal, adding that the fund recorded its highest ever gross investment income of RM60.98bil, with RM6.15bil allocated to Syariah Savings.

“The strong performance was due to the prudent approach guided by the fund’s overall Strategic Asset Allocation (SAA), which has kept the EPF resilient despite the unanticipated crisis.

“By asset class, fixed income instruments made up 46% of investments, while equities comprised 42%. Real estate and infrastructure as well as money market instruments made up 5% and 7% respectively, ” he said.

Ahmad Badri added that EPF was a long-term investor and remained steadfast with its diversification programme across asset classes, strategies, managers, markets, countries and currencies.

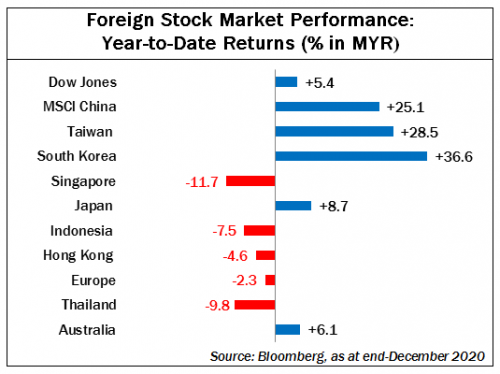

“The contribution from the overseas assets was also critical to our performance, ” he said.

As of December 2020, he said overall the EPF had 33% of its investment assets outside of Malaysia across all asset classes. Equities, particularly foreign equities, continued to be the driver of returns with a total income of RM28.71bil. The private equity portfolio also demonstrated strong performance with a consistent income distribution.

“While leading stock indices lost as much as 40% in the first quarter, the EPF took the opportunity to rebalance its portfolio by acquiring shares that were fundamentally strong at attractive prices.

“The recovery in the second half of the year on the back of improved global and domestic markets also contributed significantly to the EPF’s investment portfolios, providing for profit-taking opportunities, particularly in the fourth quarter, ” he said.

He noted that EPF, too, took prudent measures to write down RM7.71bil of its listed equity portfolio, to ensure that the fund’s long-term investment portfolios remained healthy.

With the i-Lestari and i-Sinar withdrawal facilities, Ahmad Badri said its money market portfolio grew significantly to cater for all the withdrawals, adding that the income from the money market portfolio came in at RM1.19bil.

To date, EPF noted that a total of RM18.1bil has been withdrawn by 5.16 million of its members under the i-Lestari facility.

Ahmad Badri said with almost half of the fund’s total asset allocation in fixed income instruments, comprising Malaysian government securities and equivalent, and loans and bonds, EPF was able to maintain stable returns and at the same time captured opportunities to realise profit as interest rates declined.

“Income from the portfolio came in at RM25.42bil, or 42% of the fund’s total gross income. The real estate and infrastructure portfolio’s income of RM5.66bil came with its own set of challenges, with lockdown measures and work-from-home resulting in lower income from certain segments of the real estate sector.

“However, the portfolio overall continued to play a role as a hedge against inflation with a spread of about 50 basis points above fixed income instruments, ” he said.

The EPF’s overall investment assets grew 7.9% to RM998bil, with the market value hitting RM1.02 trillion at the end of last year.

The fund’s membership base also grew by 2% to 14.89 million, while employers registered with the EPF stood at 534,398.

“It takes RM8.25bil to pay out every 1% dividend for Conventional Savings and RM972mil for every 1% dividend for Syariah Savings in 2020, ” he said.

Jan 12 2021, 03:54 PM

Jan 12 2021, 03:54 PM

Quote

Quote

0.0975sec

0.0975sec

0.25

0.25

7 queries

7 queries

GZIP Disabled

GZIP Disabled