QUOTE(awangbok @ Oct 14 2020, 11:19 AM)

if i may ask

can we determine the portfolio turnover ratio in public mutual unit trust.

how do we calculate it

thanks in advance

I am not well versed in financial terms, so not really sure what it really means by “portfolio turnover”. And to be sure, I google it…

"What does a mutual fund's Portfolio Turnover Ratio indicate?"» Click to show Spoiler - click again to hide... «

1. Port folio Turnover Ratio represents the churn of the fund portfolio or the percentage of the portfolio holdings that have changed over a time period.

2. Portfolio turnover is calculated by dividing either the total purchases or total sales, whichever is lower, by the average of the net assets. The measurement is usually reported for a 12-month time period.

3. If a portfolio has a low turnover, it could mean that could mean that the fund follows a buy and hold strategy and that the fund manager has high conviction in his picks.

4. High portfolio turnover indicates high transaction or trading costs, and therefore impacts the return for the investor.

5. A high turnover with high returns can be expected. However, a high turnover with lower returns is a indicator for review

https://economictimes.indiatimes.com/wealth...ow/63556068.cmsOn the financial manager side (running the unit trust fund), I guess it will be in the yearly financial report.

On our own portfolio of funds, we have to keep track of it in an excel spreadsheet.

In my excel file, there are 3 main tabs.

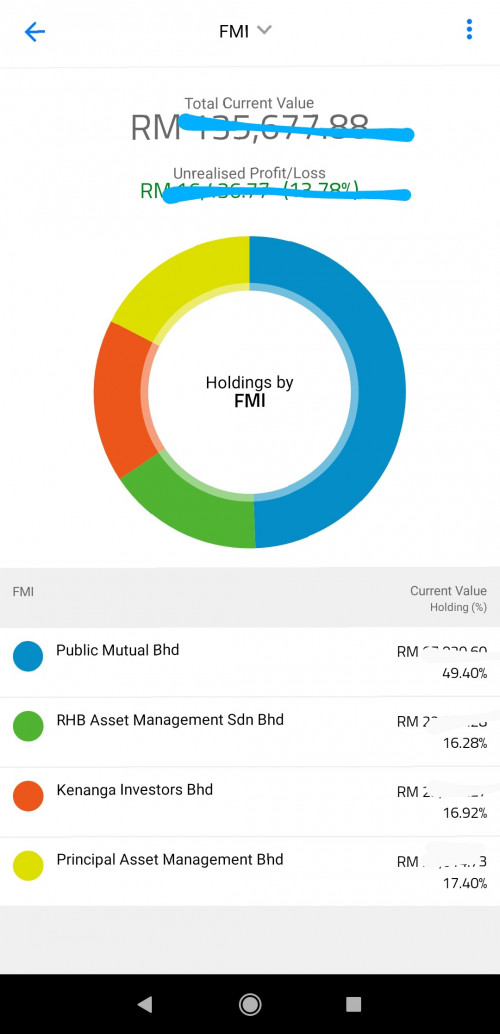

In the 1st tab, it is showing the portfolio of funds I am having… similar to what PMO is showing in the Accounts page.

In the 2nd tab, it shows all the switches out.

I kept track of the money I invested separately in a 3rd tab. And any withdrawal is also tracked in this 3rd tab.

Portfolio Turnover ratio = Total amount in Tab 2 / Total amount in Tab 3.

-------------

Since I have recorded the date of each purchases, and also the dates of each switch out, the 2nd tab has switch in and out dates, and the number of days in between the dates; I have also the following summaries for each year:

- Total Amount turnover or switch out, in each year.

- Average number of days holding the purchase before switching out, in each year.

- Average amount of the switches, in each year.

Hence, after many years, I can review back how I much 'trading' I done over the years, getting more chronic or more laissez-faire...

Jul 24 2020, 03:30 PM

Jul 24 2020, 03:30 PM

Quote

Quote

0.1107sec

0.1107sec

0.46

0.46

7 queries

7 queries

GZIP Disabled

GZIP Disabled