QUOTE(djhenry91 @ Nov 7 2016, 06:20 PM)

Hehe... I actually cannot brain hor...Why the need to keep boasting about weekend meals?

And all the transactions simply simply hantem out one.... LOL!

Can afford tens of thousands to bet on a stock and what... no money to belanja ownself eat weekend meal?

Need to go thru all this meh.

And you know my biasness against KFC traders.

Cos in the long run, KFC traders will lose...

It's common mathematics.

You can win 20 small bets, 20 KFC meals....

but all it takes is...

one lousy trade to muntah out all the profits.

Yea... some will fast hand fast leg say...

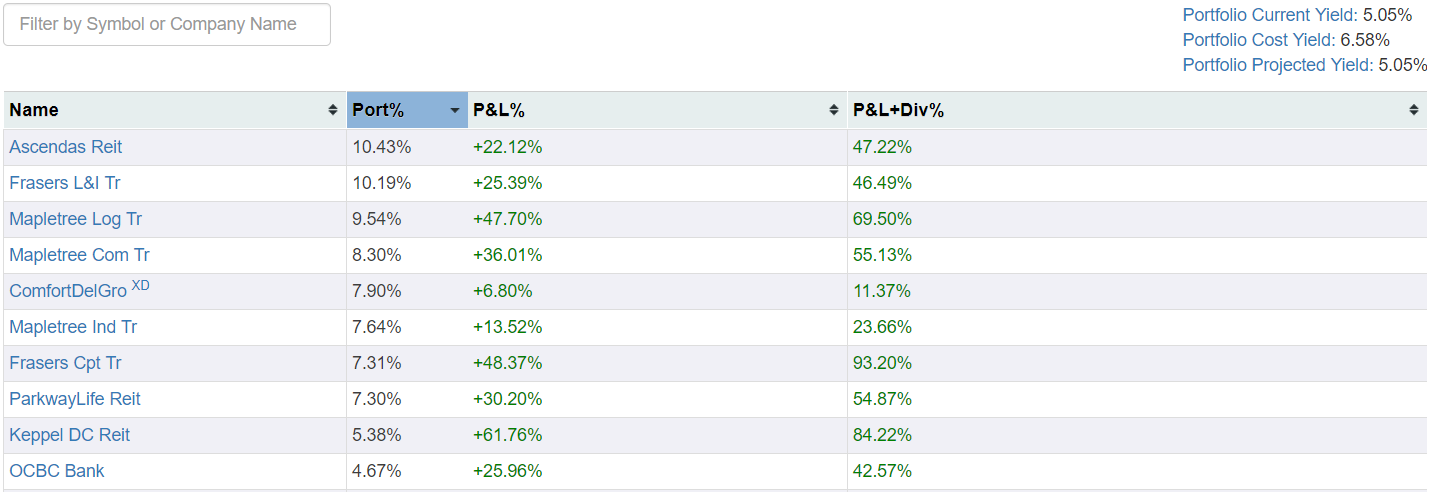

REITS la....

where got fall so much one....

REITS stock(s) won't die one....

here's one simple example... (hehe I don't simply take out my fingers and press here press there one....

4.6.2013 ..... not too long ago...... this stock traded at 1.65

2 months later ..... this REITS stock closed at 1.26

If one had been play play the stock like masak masak......

hoping to win weekend meals.....

imagine how much money one would have lost during that period?

all it takes is one lousy trade to muntah out all the profits... and maybe even more.....

REITS trading? LOL! LOL! LOL! LOL!

This post has been edited by Boon3: Nov 8 2016, 09:06 AM

Nov 8 2016, 09:03 AM

Nov 8 2016, 09:03 AM

Quote

Quote

0.0245sec

0.0245sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled