QUOTE(Masdank @ Oct 16 2022, 03:24 PM)

Hi all, need some advises here.

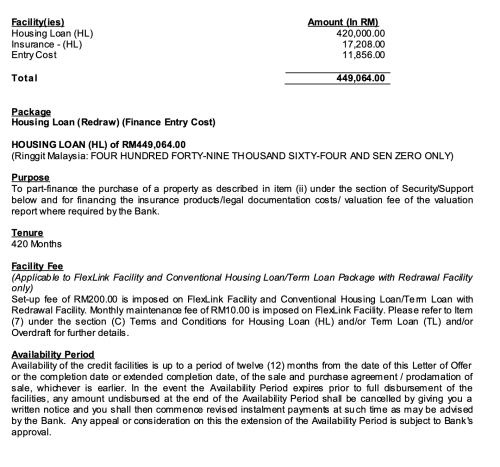

Got my letter offer from PBB before 1 August 2022:

BR 3.02% + SR 0.58 = 3.6%

Signed the LO on 1 August 2022 (Monday)

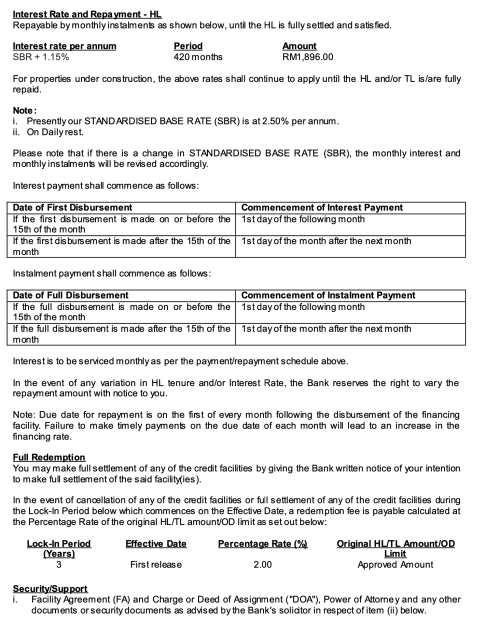

Last week, the bank asked to sign a revised letter offer due the BR to SBR revision.

SBR 2.50 + SR 1.10 = 3.6%

Is there a difference between SR 0.58 and SR 1.10 @ ELR 3.6%?

Pretty confirm no but do you all think possible to ask the bank to maintain SR 0.58% + SBR 2.50% = 3.08%

There won't be a difference.

QUOTE(Vizcana @ Oct 16 2022, 06:25 PM)

Hi, glad to find this forum discussion.

I am a foreigner which has been living in a rented unit for 5 years. I am planning to get my own property. Wanted to ask few questions

1. How is the approval rate for foreigner nowadays? Especially after Covid time.

2. Any idea what is the best % of MOF which i could expect? I saw from few articles (copy and pasted among them), that foreigner w/o mm2h can only get 70%, is that true?

3. Any extra loan/admin fee which applicable for my case that i should be aware of?

1. Depends on overall profile

2. Margin can be 70 - 90%

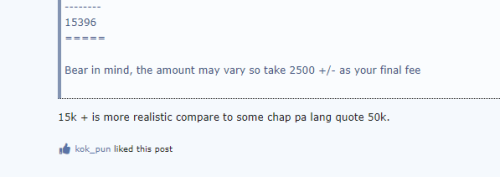

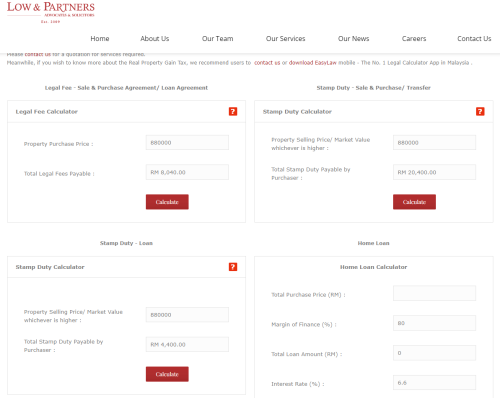

3. Stamp duties, Legal fees, etc.

Sep 26 2022, 01:57 PM

Sep 26 2022, 01:57 PM

Quote

Quote

0.5744sec

0.5744sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled