Ok, please check the facts below:

1. TIN is NOT the same as US Income Tax No.

2. You need a TIN when filling up the W-8BENN form, which is used to avoid paying CGT to the US since we are NRAs. (This is the form required for all of us to fill up when we decide to trade directly on the US market.)

3. You need a US Income Tax no. when filling up the 1040NR form to claim back the 30% WHT which is NOT possible for Malaysians since there is no tax treaty with the US. (So, basically the first post of the thread is wrong, for Malaysian investors, that is. It is not possible to claim back ANY portion of the 30% WHT for us NRAs without tax treaty of any kind with the US, correct?)

Please check the above 3 facts.

And so there is NO issue trading directly on NYSE, the TIN is NOT an issue at all. I just keep paying the 30% WHT to the US government while trading with my broker on TD Ameritrade. There is no worries about FATCA even though I trade with TD, as long as I don't mess up with the US gov by claiming ANY portion of the 30% WHT back.

The only concern here is claiming back ANY portion of the 30% WHT. If I do so, I mess up with the US gov because I will have a US income tax no by then and have to deal with FATCA.

If however, I choose to keep paying the 30% WHT (which means I only fill up the W-8BEN form), I will have no issues messing up with FATC/US gov etc., even though I will be required to have a TIN.

In short, no worries about trading NYSE on TD Ameritrade TOS platform,

as long as I don't claim back ANY portion of the 30% WHT.

Correct?

As for brokers' choice (if I choose not to trade with US brokers):

I am a long-term trader who wants to save on commission and looking for platforms without ongoing charges of any kind, including custody fees, inactivity fees etc.

One single trade would be 7000-10000 USD for me (of course if the commission is low enough to account for less than 1% of the trade amt, then I will go for a lower trade amount, maybe 3-5k USD)

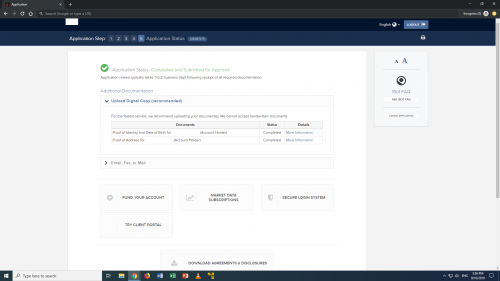

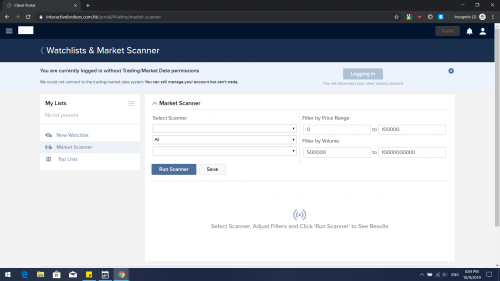

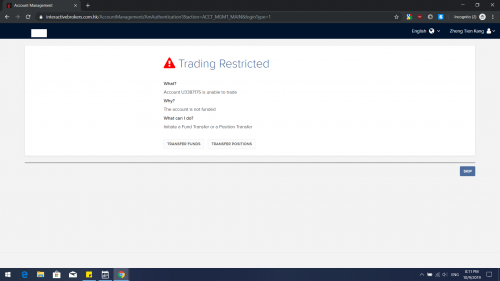

I know IB is a stupid choice for me, and I am aware of the whitelabels. But I don't know which is good?

I am looking for investing in

USD-denominated accumulating class (so no dividend handling charges) UK/Swiss ETF (Vanguard S&P 500 UCITS or iShares S&P 500 UCITS)I know about Captrader and TradeStation. But Captrader only trades in Euro (I prefer USD shares, so that currency is my own liability) and I can't tell if Tradestation trades in LSE/SIX (can't find the market info on their official page. I only know they trade in the "US and worldwide"

https://www.tradestation.com/about/)I also looked up eToro, but they don't have accumulating class UCITS, only a distributing one. Moreoever, it is traded in GBP, not USD

https://www.etoro.com/markets/iusa.lAny good suggestion? Or I have to relax my requirement?

Thanks for the help everyone.

Aug 17 2019, 02:15 PM

Aug 17 2019, 02:15 PM

Quote

Quote

0.1041sec

0.1041sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled