QUOTE(Krv23490 @ Mar 29 2019, 04:14 PM)

As mentioned in post #1030, you will see IB's SG account number after you login to account management and initiate a deposit notification. IB might have different account number for different white labels.

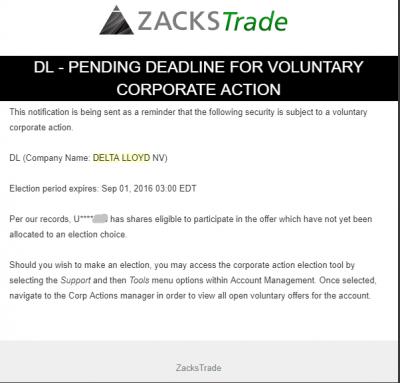

By comparing the deposit instruction of Captrader and my broker, Zackstrade (another IB white label), I notice that Captrader is affiliated IB UK while Zackstrade is affiliated with IB US.

All the deposit accounts are with Citibank in different regions. But the name/address registered to the Citibank account can be IB UK or IB US.

I think this does not make any difference.

This post has been edited by hyperzz: Mar 29 2019, 07:13 PM

Mar 29 2019, 05:16 PM

Mar 29 2019, 05:16 PM

Quote

Quote

0.3153sec

0.3153sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled