QUOTE(Yggdrasil @ Apr 17 2020, 10:40 AM)

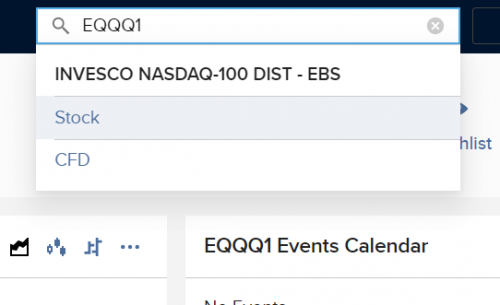

Have you found the answer? I can't seem to find the ETF using another account. Weird.

Edit: Whoops I forgot that EQQQ.MI is EQQQ INVESCO NASDAQ-100 DIST BVME.ETF

BVME is Milan Exchange.

Some info i can get online

Page 23

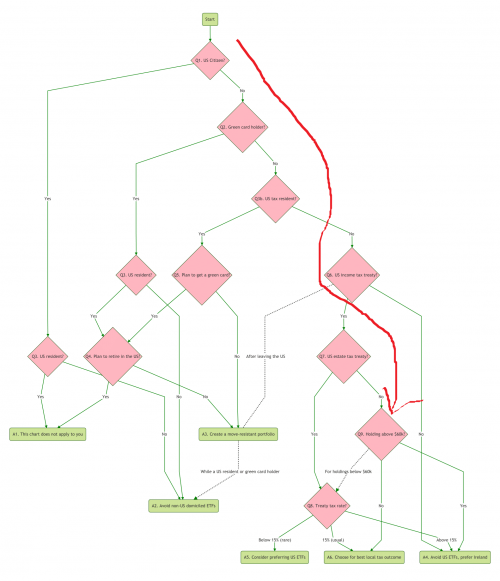

I think the leveling is at such that

LEVEL1: EQQQ underlying US-based company pays dividend, US treaty with ireland-domiciled fund e.g. EQQQ -> Charge 15%

LEVEL2: EQQQ listed in Italy BVME, for the remaining 15% of the dividend, does Italy Exchange charges witholdings tax?

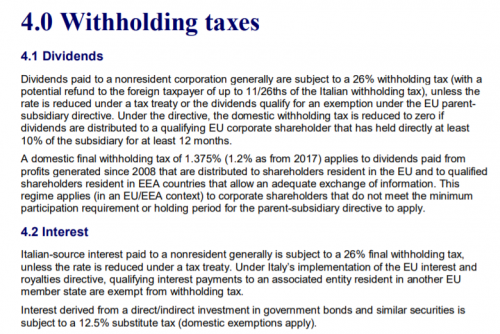

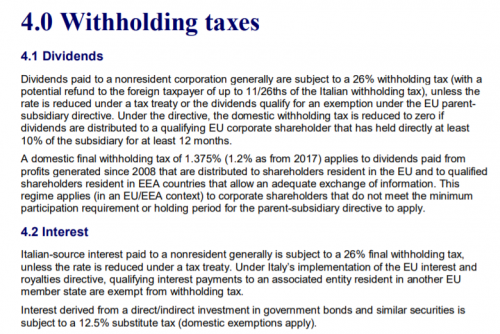

Italy’s New Capital Gains Tax Regime for Nonresident CompaniesQUOTE

As of January 1, 2019, the effective tax rate for capital gains — applicable to the sale of “qualified” Italian shareholdings held by nonresidents without a permanent establishment in Italy — will increase from 13.95 percent to 26 percent. These taxes can be avoided under double tax treaty (DTT) provisions generally stating that, for (non- real-estate) companies, capital gains on disposal of shares are taxable only in the seller’s country of residence. There are, however, DTTs between Italy and other countries (including Brazil, China, France, India, Israel, Saudi Arabia, and South Korea) that derogate from this general rule and do not grant treaty protection under specified circumstances.

Italian regulations on capital gain taxesQUOTE

Italian tax laws impose the withholding at source on ETFs that are collective investment schemes (UCITS). This designation is applicable to the ETFs currently listed on the Italian Stock Exchange Market ETFPlus.

Withholding rate of 26% for ETFs listed on the Italian Stock exchange market (IBKR market symbol: BVME.ETF) is taxed at source.

So in the end, after reading all these, i just felt it is getting more and more complicated for us to confirm on how Italy define "qualified" for witholdings tax on BVME listed Irish-domiciled ETF.

Personally feel Italy tax system is as on par with US's ones which is foreign investment unfriendly.

This post has been edited by tadashi987: Apr 17 2020, 11:49 AM

This post has been edited by tadashi987: Apr 17 2020, 11:49 AM

Nov 20 2019, 01:57 PM

Nov 20 2019, 01:57 PM

Quote

Quote

0.1043sec

0.1043sec

0.18

0.18

7 queries

7 queries

GZIP Disabled

GZIP Disabled