QUOTE(jonchai @ Jun 3 2014, 12:32 PM)

revaluation of land.... hmm... if like that for me i won't hold it for long. but expect the counter to have strong support and possible to touch rm3Bursa Traders V5

Bursa Traders V5

|

|

Jun 3 2014, 12:39 PM Jun 3 2014, 12:39 PM

|

Senior Member

1,087 posts Joined: Apr 2013 |

|

|

|

|

|

|

Jun 3 2014, 02:44 PM Jun 3 2014, 02:44 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jun 3 2014, 03:10 PM Jun 3 2014, 03:10 PM

|

Senior Member

1,497 posts Joined: Dec 2005 |

|

|

|

Jun 3 2014, 03:15 PM Jun 3 2014, 03:15 PM

|

Senior Member

2,635 posts Joined: Jun 2011 From: bohtakchik |

Old man stock, old man stock...

Ding dong 2 months liao |

|

|

Jun 3 2014, 04:52 PM Jun 3 2014, 04:52 PM

|

Senior Member

1,087 posts Joined: Apr 2013 |

E&O... those who buy kena trap? or this is just beginning?

|

|

|

Jun 3 2014, 05:02 PM Jun 3 2014, 05:02 PM

|

Senior Member

1,021 posts Joined: Jun 2012 |

|

|

|

|

|

|

Jun 3 2014, 05:04 PM Jun 3 2014, 05:04 PM

|

Senior Member

1,087 posts Joined: Apr 2013 |

|

|

|

Jun 3 2014, 05:18 PM Jun 3 2014, 05:18 PM

|

Senior Member

1,087 posts Joined: Apr 2013 |

|

|

|

Jun 3 2014, 05:30 PM Jun 3 2014, 05:30 PM

|

Senior Member

4,715 posts Joined: Jan 2011 |

Y my latitude keep on dropping??Poor result??

|

|

|

Jun 3 2014, 07:25 PM Jun 3 2014, 07:25 PM

|

Senior Member

1,087 posts Joined: Apr 2013 |

|

|

|

Jun 4 2014, 07:57 AM Jun 4 2014, 07:57 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

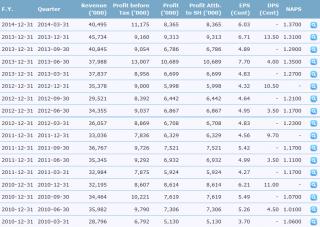

QUOTE(spring onion @ Jun 3 2014, 05:18 PM) btw, Well done! CCM DUOPHARMA BIOTECH BHD

dividend yield not bad, but wonder why this counter ain't not going up??? At least someone else here is willing to share and discus. hmmm..... interesting. Used to watch this for a while in my 555 but lost interest cos the earnings was in a general decline. Check the fiscal profits from 2009 to 2012. It showed a decline. BUT have to say, profits have recovered quite a fair bit if you look at the past 4 quarters. In regards to why the stock is not going up.... Actually in my opinion, the stock got move up a fair bit.... although I have to say perhaps the current 'correction'/'downtrend' looks overdone. Proof of the profits turnaround was first seen in the report announced on 28/8/13 Stock traded at 2.40 then. Since then the stock hit a high of 3.20. A gain of 80 sen or 33%. For some, maybe the stock still got room to jalan.... For some, they are not too sure how much of up room there is. For some, they might just see the current weakness as an opportunity to jump into this gravy train. |

|

|

Jun 4 2014, 08:16 AM Jun 4 2014, 08:16 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(spring onion @ Jun 2 2014, 12:02 PM) YTL Cannot trust too much what you read on the papers.http://www.thestar.com.my/Business/Busines...big-since-2008/ QUOTE As of March 31, 2014, YTL Corp had a total cash reserve of RM12.8bil. They forgot NICELY to mention their debts. Is like girl meets boy. Girl asks how much money you have in FD. But girl no ask how much loans (housing loans, car loans, credit cards loans) he has. Anyway as posted earlier... YTL's mountain of debts.....  total only 33 billion. |

|

|

Jun 4 2014, 11:06 AM Jun 4 2014, 11:06 AM

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Jun 4 2014, 07:57 AM) » Click to show Spoiler - click again to hide... « QUOTE(Boon3 @ Jun 4 2014, 08:16 AM) » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

Jun 4 2014, 11:28 AM Jun 4 2014, 11:28 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(spring onion @ Jun 4 2014, 11:06 AM) current price is below 3, might be tempting to some who wants high divvy yeild, growth prospect is there as long there is a increase quarter to quarter, Not a dividend player.haha. boon, i buy a few lots because i believe this quarter got nice figure, plan it for weeks trading. indeed it has nearly reach 1.80 but the shariah thingy made it went down the drain Mentioned that many times before. My thinking is simple, no profit = no dividends.. so profits is more important than dividends. LOL! I just wanted to point out the fact that it is very misleading everywhere. Newspaper is misleading many times. Research reports too. Forum postings cannot be trusted totally. You really need to dig your own info. On the shariah thingee. There's one interesting point. YTL Power was removed last Nov (or is Dec?). The removal thing from shariah list is based on debts issue. (does make sense a bit sense for me. you do not want to invest in companies saddled with huge debts) So if YTL Power was removed end last year, the baffling question was why wasn't YTL Corp? ;w I told you I don't trade daily.... which means, when I trade, I trade for stocks which has huge potential. I always shy away from those mickey mouse trades la.... I don't believe in making kfc trades. That's my mindset. |

|

|

Jun 4 2014, 11:39 AM Jun 4 2014, 11:39 AM

|

Senior Member

873 posts Joined: Dec 2009 |

QUOTE(Boon3 @ Jun 4 2014, 11:28 AM) Not a dividend player. well said mr Boon, must learn from you, the mindset once correct, do anything also correct, thank you for sharing Mentioned that many times before. My thinking is simple, no profit = no dividends.. so profits is more important than dividends. LOL! I just wanted to point out the fact that it is very misleading everywhere. Newspaper is misleading many times. Research reports too. Forum postings cannot be trusted totally. You really need to dig your own info. On the shariah thingee. There's one interesting point. YTL Power was removed last Nov (or is Dec?). The removal thing from shariah list is based on debts issue. (does make sense a bit sense for me. you do not want to invest in companies saddled with huge debts) So if YTL Power was removed end last year, the baffling question was why wasn't YTL Corp? ;w I told you I don't trade daily.... which means, when I trade, I trade for stocks which has huge potential. I always shy away from those mickey mouse trades la.... I don't believe in making kfc trades. That's my mindset. |

|

|

Jun 4 2014, 11:42 AM Jun 4 2014, 11:42 AM

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Jun 4 2014, 11:28 AM) » Click to show Spoiler - click again to hide... « So if YTL Power was removed end last year, the baffling question was why wasn't YTL Corp? ;w » Click to show Spoiler - click again to hide... « back to the CCMD counter, profit increases after decrease over last few years, which means that the upward trend is being expected. if CCMD profit does not interest you, so then what's the profit pattern that's worth investing? do you prefer A: 2010-25M 2011-35M 2012-40M 2013-43M or B: 2010-35M 2011-25M 2012-30M 2013-35M ???? teach us how to look at profit pattern for good potential stock This post has been edited by spring onion: Jun 4 2014, 11:44 AM |

|

|

Jun 4 2014, 12:02 PM Jun 4 2014, 12:02 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(spring onion @ Jun 4 2014, 11:42 AM) for YTL corp, i don't know, why not you tell me Yes, the point is the debt existed long ago but how come not many wanted to point this out? This is always my point about YTL. You surf around, and you only hear YTL is cash rich. How many times would you hear someone else talk about their debts? WHY I no tell me the profit is intact (in fact growing too. why? cos you already told me so. LOL! LOL! Kawan, you first posted it (and in your post, YOU highlighted the growth in profits) and I replied you in post #589 And what I say? I pointed out to you that the TTM already suggested that profits is much better. Must I repeat that again meh? LOL! QUOTE(spring onion @ Jun 4 2014, 11:42 AM) back to the CCMD counter, profit increases after decrease over last few years, which means that the upward trend is being expected. if CCMD profit does not interest you, so then what's the profit pattern that's worth investing? For your example, I would say A is much better.do you prefer A: 2010-25M 2011-35M 2012-40M 2013-43M or B: 2010-35M 2011-25M 2012-30M 2013-35M Errr... CCMD, I state it as it is wor.... the fact was fiscal profits from 2009 to 2012, showed a decline. and profits had turnaround since Aug last year. How else you want me to say it? This post has been edited by Boon3: Jun 4 2014, 12:05 PM |

|

|

Jun 4 2014, 12:16 PM Jun 4 2014, 12:16 PM

|

Senior Member

1,087 posts Joined: Apr 2013 |

for YTLC, i also can't comment much, i was just expecting a better quarter, that will eventually cause the price to move upwards, and it did. itu la, i found a nice guarantee KFC bucket of fried chicken... but shit happens. the rest is just history... quite sad to mention about it too

for CCMD, it's actually to ask you all about the profit outlook. whether it's an apple of your eye. cause you mentioned many times mar, got profit got divvy but what's the reason you choose A, profit seems to reach saturation point, whereelse B have good upside potential? |

|

|

Jun 4 2014, 12:26 PM Jun 4 2014, 12:26 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(spring onion @ Jun 4 2014, 12:16 PM) for YTLC, i also can't comment much, i was just expecting a better quarter, that will eventually cause the price to move upwards, and it did. itu la, i found a nice guarantee KFC bucket of fried chicken... but shit happens. the rest is just history... quite sad to mention about it too for profit outlook for CCMD, a more in-depth study will be needed.for CCMD, it's actually to ask you all about the profit outlook. whether it's an apple of your eye. cause you mentioned many times mar, got profit got divvy but what's the reason you choose A, profit seems to reach saturation point, whereelse B have good upside potential? I cannot say much until I understand its current business and its products. I will want to find out why the profits slumped from 2009. I know some wouldn't bother about this but I would. understanding what has happened before is always a plus for me. As it is, I really got nothing much to say since I do not know its products. ( Also, I might need to compare it to Pharmaniaga and Kotra and AHealth also) Yes, profit A might look to reach a saturation point but as it is, it has the better track record. And you are of course right, B could have its potential too. |

|

|

Jun 4 2014, 04:57 PM Jun 4 2014, 04:57 PM

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Jun 4 2014, 12:26 PM) » Click to show Spoiler - click again to hide... « the reason why the drop in profit in 2009 cash expenses increases, revenue remains intact the reason why the increase in profit in 2013 cash expenses remains, revenue increases This post has been edited by spring onion: Jun 4 2014, 04:57 PM |

|

Topic ClosedOptions

|

| Change to: |  0.0236sec 0.0236sec

0.44 0.44

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 01:43 AM |