Fundsupermart.com v6, Manage your own unit trust portfolio

|

|

Apr 16 2014, 11:30 AM Apr 16 2014, 11:30 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

Aiseh.. my EPF can invest again already. Seems "timing" not so right.. though I know this EPF thingy is long term..

|

|

|

|

|

|

Apr 17 2014, 06:43 AM Apr 17 2014, 06:43 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

Europe and US has been up alot yesterday..

|

|

|

Apr 17 2014, 09:05 AM Apr 17 2014, 09:05 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Apr 17 2014, 09:41 AM Apr 17 2014, 09:41 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

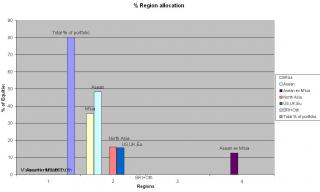

maybe it was JUST too early to see the bigger pictures or results portfolio allocation fixed since early January.... the results....i think is quite resilient....see the MOM and the happenings in the mkts advise please Attached thumbnail(s)

|

|

|

Apr 17 2014, 09:56 AM Apr 17 2014, 09:56 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(yklooi @ Apr 17 2014, 09:41 AM) maybe it was JUST too early to see the bigger pictures or results portfolio allocation fixed since early January.... the results....i think is quite resilient....see the MOM and the happenings in the mkts advise please |

|

|

Apr 17 2014, 12:19 PM Apr 17 2014, 12:19 PM

|

Junior Member

343 posts Joined: Jun 2008 |

Funds currently in my portfolio

1. KAF Global Equities 2. OSK-UOB KidSave 3. Hwang Select Income 4. Hwang Select Asia Ex Japan Quantum I'm thinking to sell KAF Global, then buy in another fund during market crash. Looking at RGEY. What do you guys think? |

|

|

|

|

|

Apr 17 2014, 12:22 PM Apr 17 2014, 12:22 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(@secret@ @ Apr 17 2014, 12:19 PM) Funds currently in my portfolio 1. KAF Global Equities 2. OSK-UOB KidSave 3. Hwang Select Income 4. Hwang Select Asia Ex Japan Quantum I'm thinking to sell KAF Global, then buy in another fund during market crash. Looking at RGEY. What do you guys think? just curious? mind to share? |

|

|

Apr 17 2014, 12:37 PM Apr 17 2014, 12:37 PM

|

Junior Member

343 posts Joined: Jun 2008 |

QUOTE(yklooi @ Apr 17 2014, 12:22 PM) uncle looi, me rookie lehdont know what to say. I just tot KAF global not performing so well as compared to other Global fund. im open to any type of fund though, current armors dont allow me to have complete exposure to every market This post has been edited by @secret@: Apr 17 2014, 12:39 PM |

|

|

Apr 17 2014, 12:43 PM Apr 17 2014, 12:43 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(@secret@ @ Apr 17 2014, 12:37 PM) uncle looi, me rookie leh http://www.marketwatch.com/story/stop-sabo...ents-2014-04-14dont know what to say. I just tot KAF global not performing so well as compared to other Global fund. im open to any type of fund though, current armors dont allow me to have complete exposure to every market Be prepared to live with some bad returns — for a time QUOTE The tale is hardly new. Investors buy a fund after a period of good performance, waiting for the fund to prove something before adding it to their portfolio. But when the market turns and the fund’s asset category cools — or when today’s hot manager regresses toward the average after a period of oversized results — investors bail out, and look for another fund to buy, typically choosing again something that’s been hot lately. It’s more that investors should assume that whenever they decide to buy a fund, they will have lousy timing on it, at least for the short term, and they should be prepared to live with that. |

|

|

Apr 17 2014, 12:50 PM Apr 17 2014, 12:50 PM

|

Junior Member

343 posts Joined: Jun 2008 |

QUOTE(Pink Spider @ Apr 17 2014, 12:43 PM) http://www.marketwatch.com/story/stop-sabo...ents-2014-04-14 well yeah. just on considering stageBe prepared to live with some bad returns — for a time good read. thanks drunk accountant. haha |

|

|

Apr 17 2014, 12:52 PM Apr 17 2014, 12:52 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(@secret@ @ Apr 17 2014, 12:50 PM) Ask those of us who invested in Pacific Global Stars Fund.Before most of us invested in it, it used to be a star (that was downturn time, PGSF did well bcos the Fund Manager raised cash position at the right timing). Then we jump in...boom time esp for Developed Markets. PGSF lagged severely because it underweighted Developed Markets ("DM"). Then there was a period when we all cursed and swore at it. Now I believe most of us made (small) money with it and glad that we held on, if we had switched to the performing DM-overweight funds when PGSF lagged, we could have ended up worse. DM has been solid lately, while Asia ex Japan kept see sawing sideways. When Asia picks up pace, PGSF will be a star again. P.S. - I'm most clear-headed when I'm drunk. LOL This post has been edited by Pink Spider: Apr 17 2014, 12:54 PM |

|

|

Apr 17 2014, 01:02 PM Apr 17 2014, 01:02 PM

|

Junior Member

343 posts Joined: Jun 2008 |

QUOTE(Pink Spider @ Apr 17 2014, 12:52 PM) Ask those of us who invested in Pacific Global Stars Fund. occasionally silent reader Before most of us invested in it, it used to be a star (that was downturn time, PGSF did well bcos the Fund Manager raised cash position at the right timing). Then we jump in...boom time esp for Developed Markets. PGSF lagged severely because it underweighted Developed Markets ("DM"). Then there was a period when we all cursed and swore at it. Now I believe most of us made (small) money with it and glad that we held on, if we had switched to the performing DM-overweight funds when PGSF lagged, we could have ended up worse. DM has been solid lately, while Asia ex Japan kept see sawing sideways. When Asia picks up pace, PGSF will be a star again. from cursing to topping up PGSF. I saw them. human greedy nature. AND i don't know how its like for this coming market crash. Totally new to investment,never experience any. I only remembered *2002 was terrible that my parents took my pocket money savings to pay off the losses. This post has been edited by @secret@: Apr 17 2014, 01:14 PM |

|

|

Apr 17 2014, 01:12 PM Apr 17 2014, 01:12 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(@secret@ @ Apr 17 2014, 01:02 PM) occasionally silent reader Must be investing with margin account.from cursing to topping up PGSF. I saw them. human greedy nature. AND i don't know how its like for this coming market crash. Totally new to investment,never experience any. I only remembered 1997 was terrible that my parents took my pocket money savings to pay off the losses. NEVER invest with borrowed money, my opinion. |

|

|

|

|

|

Apr 17 2014, 01:21 PM Apr 17 2014, 01:21 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Pink Spider @ Apr 17 2014, 01:12 PM) Quantitative expert-san Pinky - NEVER ever ar?What if i can get 4.99%pa loan 3 years tenure (Citibank cash on call heheh), AND my flexi mortgage is 4.4%pa (thus while waiting to use loan $ / opportunity, i don't lose much) AND my trading /investing vehicle can near guarantee hit >= 8%pa when i execute (may have to hold >1yr though) AND my debt/equity ratio is less than 20% including the new loan (and including all debts/mortgages) AND most importantly, my emergency buffer can more than cover the monthly payments IF any "black swan" happens... Safe enough, right? heheh - just checking another opinion for my er.. bright idea / stupidity done This post has been edited by wongmunkeong: Apr 17 2014, 01:22 PM |

|

|

Apr 17 2014, 01:24 PM Apr 17 2014, 01:24 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(wongmunkeong @ Apr 17 2014, 01:21 PM) Quantitative expert-san Pinky - NEVER ever ar? Oops, here comes Mr Direct Access What if i can get 4.99%pa loan 3 years tenure (Citibank cash on call heheh), AND my flexi mortgage is 4.4%pa (thus while waiting to use loan $ / opportunity, i don't lose much) AND my trading /investing vehicle can near guarantee hit >= 8%pa when i execute (may have to hold >1yr though) AND my debt/equity ratio is less than 20% including the new loan (and including all debts/mortgages) AND most importantly, my emergency buffer can more than cover the monthly payments IF any "black swan" happens... Safe enough, right? heheh - just checking another opinion for my er.. bright idea / stupidity done Yeah if you're quite sure and/or your investment is quite secure, by all means go leveraged. E.g. housing loan 4% EFFECTIVE RATE, REIT dividend yield 6% But if leverage to |

|

|

Apr 17 2014, 02:32 PM Apr 17 2014, 02:32 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Pink Spider @ Apr 17 2014, 01:24 PM) Oops, here comes Mr Direct Access Trading options (selling options to get premiums) leh? Yeah if you're quite sure and/or your investment is quite secure, by all means go leveraged. E.g. housing loan 4% EFFECTIVE RATE, REIT dividend yield 6% But if leverage to eg. speculative option selling based on standard deviation / probabilities of strike price sold being hit within a specific timeline + out of 3 possible movements (no move much, move kakaload against me, move kakaload for me), can win 2 (no move much, move as planned) eh - direct access best lar, dance like snake then try try no fun. yoda says do, or do not. there is no try |

|

|

Apr 17 2014, 02:34 PM Apr 17 2014, 02:34 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(wongmunkeong @ Apr 17 2014, 02:32 PM) Trading options (selling options to get premiums) leh? OMGeg. speculative option selling based on standard deviation / probabilities of strike price sold being hit within a specific timeline + out of 3 possible movements (no move much, move kakaload against me, move kakaload for me), can win 2 (no move much, move as planned) eh - direct access best lar, dance like snake then try try no fun. yoda says do, or do not. there is no try I totally cannot brain a word being written there |

|

|

Apr 17 2014, 04:02 PM Apr 17 2014, 04:02 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(laith @ Apr 17 2014, 03:18 PM) I was being introduced Pacific Dana Aman & Hwang Aiiman Growth by my banker. According to banker, the return at least is higher than the last year EPF dividend per annum. Any thoughts on this, sifus? just be warned...past performance may not means future performance Most Consistent EPF-Approved Funds...February 19, 2014 http://www.fundsupermart.com.my/main/resea...?articleNo=4331 |

|

|

Apr 17 2014, 04:51 PM Apr 17 2014, 04:51 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Apr 17 2014, 07:39 PM Apr 17 2014, 07:39 PM

|

Senior Member

5,613 posts Joined: Jun 2006 From: Cyberjaya, Shah Alam, Ipoh |

QUOTE(@secret@ @ Apr 17 2014, 02:02 PM) occasionally silent reader 2001-2002 is the period WHR the dot.com company bu bble crash in the US right?from cursing to topping up PGSF. I saw them. human greedy nature. AND i don't know how its like for this coming market crash. Totally new to investment,never experience any. I only remembered *2002 was terrible that my parents took my pocket money savings to pay off the losses. |

|

Topic ClosedOptions

|

| Change to: |  0.0221sec 0.0221sec

0.42 0.42

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 11:10 AM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote