QUOTE(chongaik82 @ Apr 21 2015, 02:02 PM)

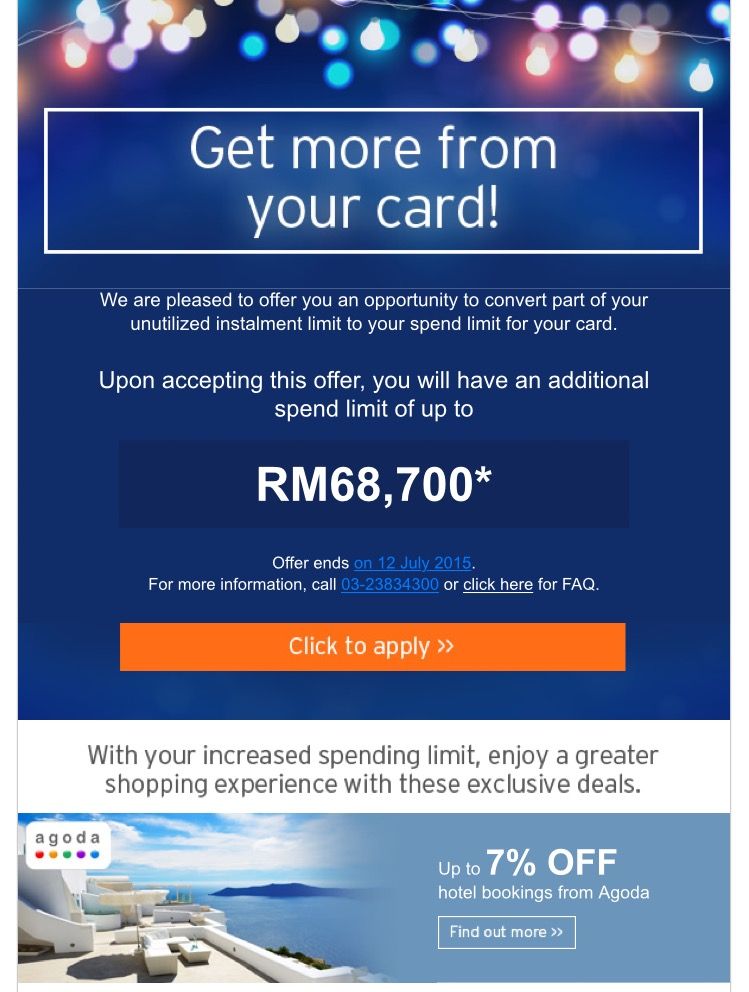

FYI. Citibank just call back and confirm the Cash Limit[color=blue] is for Cash Advance or balance transfer. It is not for Dial for Cash[COLOR=red] purpose (loan equivalent purpose)

This limit will not increase your credit limit in CCRIS.

That's Wired... This limit will not increase your credit limit in CCRIS.

How come they told me I can Use Cash Limit (Y) for Dial for Cash + NO CL Deduction from Spending Limit (X)...

Plus, the Total Amount CL of My Citibank CCs also Shown (X+Y) at CCRIS

As maybe I got Special Treats from Citibank as one of their Preferred Customer....

This post has been edited by fly126: Apr 21 2015, 08:02 PM

Apr 21 2015, 07:29 PM

Apr 21 2015, 07:29 PM

Quote

Quote

0.0615sec

0.0615sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled