QUOTE(chiahau @ Nov 23 2015, 07:58 AM)

just wanted to share, it's actually worth to pledge. i came across Gen-X 's blog January this year, got to know about how this premier card works, and before this i was so proud to be M2Card Gold card holder because every year i earn RM600 cash rebate + earning RM1000++ jusco voucher from my spending.

after reading Gen-X 's blog, then i realized what i have wasted so far. so without hesitation i find my way to do whatever necessary to get the premier card.

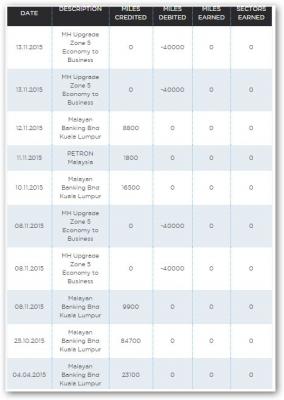

I successfully got my card by mid of Feb, and with the points i earned so far, managed to redeem 4 business class upgrade for long haul flight to europe.

Nov 23 2015, 09:16 AM

Nov 23 2015, 09:16 AM

Quote

Quote 0.0462sec

0.0462sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled