by john loh | The StarBiz | Monday March 17, 2014 MYT 9:54:42 AM

http://www.thestar.com.my/Business/Busines...ty-development/

KUALA LUMPUR: Armed with an RM170mil war chest from the sale of its Segambut land to IJM Land Bhd, Tan Sri Robert Tan Hua Choon’s FCW Holdings Bhd is on the prowl to beef up its landbank in Malaysia.

Shareholders approved its maiden property development venture at an EGM last Friday.

FCW, a contract manufacturer of toiletry products and cables, had proposed in September a 50:50 joint-venture (JV) with IJM Land, the property arm of conglomerate IJM Corp Bhd, to develop 6.23ha of freehold land in Segambut.

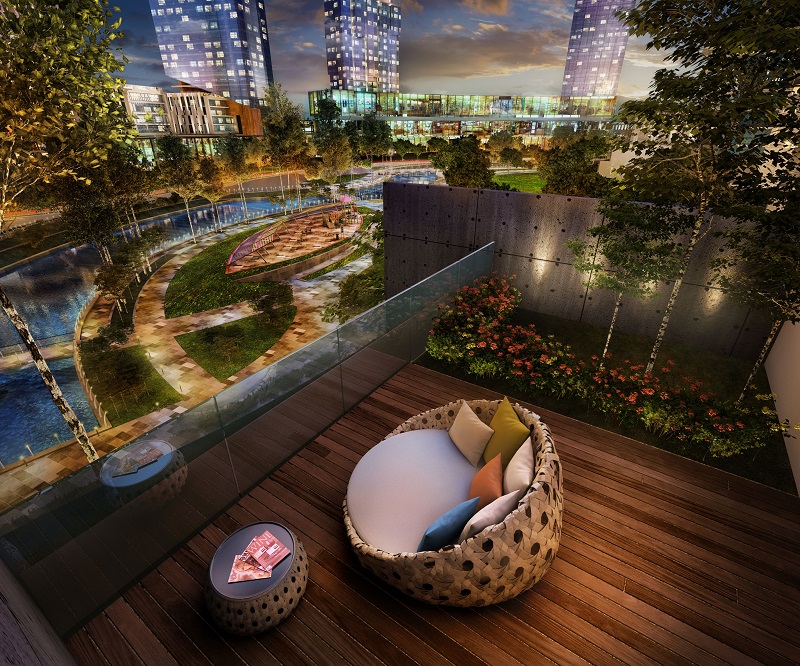

The mixed-use, RM1.3bil gross development value (GDV) project, called 368 Residences, is to be launched in 2016 at the earliest, FCW director Thor Poh Seng told reporters after the EGM.

Sited diagonally opposite the Segambut KTM station and close to Mont’Kiara, Jalan Kuching and Jalan Ipoh, it is slated to take some six years to develop over four or five phases.

FCW and IJM Land have yet to obtain the development order and other approvals for 368 Residences, but it will likely have a plot ratio of 4.5 times, Thor said.

“We haven’t finalised the number of blocks – it could be six, seven or eight. The total apartment units will also depend on market demand closer to the launch,” he added.

Asked where FCW was looking to add to its landbank, Thor said: “We don’t limit ourselves by location.”

However, he dismissed speculation that a merger was brewing between the 73-year-old Tan’s FCW and Goh Ban Huat Bhd (GBH).

Shares of FCW had raced to a peak of RM1.28, its best since early 2004, around the time that it had announced the deal with IJM Land.

The counter last settled down 4.5 sen at 94 sen, up 15% for the year.

Under the JV, FCW is to sell four parcels of contiguous land off Jalan Segambut to 368 Segambut Sdn Bhd, a jointly-owned entity of FCW and IJM Land, for RM187.97mil.

This works out to an effective land cost of 14% of GDV and RM280 per sq ft.

The transaction is expected to be wrapped up in September. The land is currently zoned as industrial and would need to be converted into a commercial title.

An extension for the DUKE Expressway has also been planned nearby.

Depending on whether the JV requires corporate guarantees, FCW stands to pocket RM48.95mil or RM97.64mil in disposal gains from the exercise, according to FCW’s circular to shareholders.

Of the total RM187.97mil in sale proceeds, FCW will plough RM18.8mil back into the JV company and RM168.98mil into its own coffers for working capital.

Besides that cash hoard, it had cash and near cash of RM37.11mil versus long and short-term debts of RM2.62mil as at Dec 31, 2013, putting it in a net cash position of RM34.49mil.

FCW’s finances showed that it had raked in a net profit of RM3.07mil for the six months to December, down 27.2% from the same period a year ago.

Revenue also fell to RM13.02mil versus RM15.52mil, which it attributed to weak sales in its contract manufacturing division and lower selling prices.

FCW had acquired the Segambut land from its sister-firm GBH in 2007 for RM86mil cash and later leased it back to GBH for the latter’s warehousing.

Low-key businessman Tan, who controls 25.35% of FCW and 74.35% of GBH, is said to be a close associate of former finance minister Tun Daim Zainuddin. GBH owns another 6.07ha of land in Segambut next to FCW, which was what had sparked talk of a merger between the two companies.

Tan, whose brother-in-law is Malton Bhd boss Datuk Desmond Lim Siew Choon, also has stakes in Jasa Kita Bhd, Marco Holdings Bhd, GPA Holdings Bhd, PDZ Holdings Bhd and Keladi Maju Bhd.

Mar 17 2014, 10:32 AM

Mar 17 2014, 10:32 AM

Quote

Quote

0.0357sec

0.0357sec

0.54

0.54

6 queries

6 queries

GZIP Disabled

GZIP Disabled