QUOTE(nujikabane @ Oct 26 2015, 09:50 PM)

Hmm, they are both still generating income;

one of them income not fixed, but the other is a civil servants (earning monthly income).

The breadwinner of the family is the mom, and basically they rely on her income to make ends meet.

They still have 2 kids in college, and 1 still in school.

They are both fairly in good condition, but I am afraid that should they fall ill (hospitalized, and/or requiring surgery), it may make a huge dent in the financial of the family.

Any other advise ?

is giving you sound advice.

If one of your parent are civil servant, they might be having a good government hospitalization protection. I will make it simple for you by answer the question below.

1)Do your parent is having comprehensive medical coverage from government hospital?

2)Are you willing to fork out RM10,000/year for both of your parent medical insurance?

3)Do your parent leaving adequate of fund to you shall they pass away?

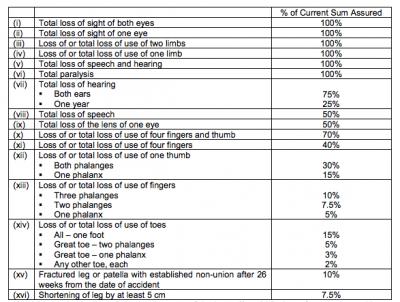

If the answer is Yes-No-No, then I'm advising you to get Critical Illness + Life coverage for your parent instead of medical protection as your parent can get medical protection in government hospital whereas if there is really some critical illness of pre-mature death happen, you will be compensated with some quick cash for better financial management. Critical Illness with Life protection plan are generally lower premium comparing to medical protection, which we called it income protection.

QUOTE(pobox @ Oct 28 2015, 11:00 AM)

ExpZero Dude. What's the difference between extender and extender-max?

It's similar but Smart Extender must be accompanied with a medical card(Example: Smart Premier Health, Smart Medic or Smart Medic Xtra) whereas Smart Extender Max can be bought individually.

QUOTE(dhanin @ Oct 28 2015, 02:06 PM)

Hi all,

How much the premium for 500k insurance coverage for the 1 year old baby?

Please share

Since the baby do not have any financial impact on the family, why would you need such high insurance coverage for 1 year old baby? Insurance company will only approve the application with special request from you.

Sep 17 2015, 09:14 PM

Sep 17 2015, 09:14 PM

Quote

Quote

0.0671sec

0.0671sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled