QUOTE(degionz @ Mar 24 2018, 03:28 PM)

hi guys,

Did foreign worker have to fill out the borang E?

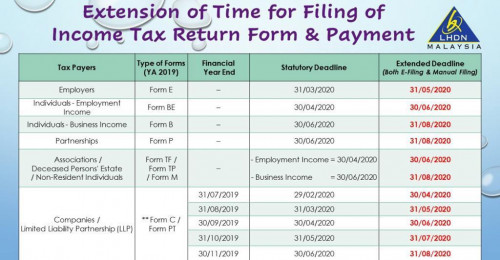

All employee should be included in the Form E.

As if foreign worker earned more than taxable threshold, they need to pay tax as well.

QUOTE(greenmacha @ Mar 24 2018, 11:47 PM)

Dear All,

Appreciate if anyone can clarify.

1. For new business (partnership) with no employee, how do we file in Form E if we have not registered with IRB to be "majikan"? Do the partners need to visit IRB to register as "majikan" first?

2. For dormant business (zero transaction from Day 1), I understand we do not need to register a tax file? Do we still need to file Form E for dormant company?

thank you very much.

Since 2014, even dormant company also need to furnish Form E.

http://lampiran2.hasil.gov.my/pdf/pdfam/Pr...NCP_2016_a2.pdf2.2 Dormant * Companies, Limited Liability Partnerships, Trust

Bodies And Co-operative Societies

2.2.1 Dormant * companies, limited liability partnerships, trust

bodies and co-operative societies are required to furnish the

ITRF (including Form E) with effect from Year of Assessment

2014.

Aug 7 2013, 07:24 PM, updated 13y ago

Aug 7 2013, 07:24 PM, updated 13y ago

Quote

Quote

0.0289sec

0.0289sec

0.44

0.44

6 queries

6 queries

GZIP Disabled

GZIP Disabled