I have a question..basically the reinvestment from divident or income distrbution not subject to sales charge right

Fundsupermart.com v4, Manage your own unit trust portfolio

Fundsupermart.com v4, Manage your own unit trust portfolio

|

|

Oct 6 2013, 06:38 PM Oct 6 2013, 06:38 PM

Return to original view | Post

#81

|

Senior Member

2,526 posts Joined: Sep 2013 |

I have a question..basically the reinvestment from divident or income distrbution not subject to sales charge right

|

|

|

|

|

|

Oct 7 2013, 11:09 PM Oct 7 2013, 11:09 PM

Return to original view | Post

#82

|

Senior Member

2,526 posts Joined: Sep 2013 |

Hey wanna ask how do we get tax exemption ah for fsm...do we get tax examption by investing in unit trust?

|

|

|

Oct 11 2013, 04:00 PM Oct 11 2013, 04:00 PM

Return to original view | Post

#83

|

Senior Member

2,526 posts Joined: Sep 2013 |

QUOTE(yklooi @ Oct 11 2013, 11:08 AM) An Insight Into The Investor Sentiment Cycle Lota of people know this is the best way but sometimes its difficult to read the market dunno which phase it is in currently right..except there is a convinient way of knowing?By James Yeo - October 11, 2013 Stock market goes through cycles just like the 4 seasons: spring, summer, autumn and winter. However, if you were to compare the market cycle and investors’ sentiment, you realise that human emotions often get into the way of investing. http://www.fool.sg/2013/10/11/an-insight-i...s76yhocs0070001 (click "refresh" when prompted to login in) |

|

|

Oct 15 2013, 11:26 PM Oct 15 2013, 11:26 PM

Return to original view | Post

#84

|

Senior Member

2,526 posts Joined: Sep 2013 |

|

|

|

Oct 17 2013, 09:29 PM Oct 17 2013, 09:29 PM

Return to original view | Post

#85

|

Senior Member

2,526 posts Joined: Sep 2013 |

QUOTE(maldiniho @ Oct 17 2013, 11:02 AM) for me , i just top up regularly - regardless the momentary market jerk. money cost averaging, this should be a slow and steady long term investment. Does this method work? Meaning in long term all the funds will have positive return regardless of short term movement |

|

|

Oct 17 2013, 10:17 PM Oct 17 2013, 10:17 PM

Return to original view | Post

#86

|

Senior Member

2,526 posts Joined: Sep 2013 |

QUOTE(gark @ Oct 17 2013, 10:10 PM) No guarantee that dca will result in profit over the long term. It depends highly on the fund, all dca does is smooth out the ups and down of the performance..... Fsm recomended funds lo...hahaha..buy all the recomended ones safer bet?Attempt to dca in a lousy fund will result in lousy results, but then again past performance does not indicate future performance.... Any agent who tell you otherwise should be shot... |

|

|

|

|

|

Oct 18 2013, 11:46 PM Oct 18 2013, 11:46 PM

Return to original view | Post

#87

|

Senior Member

2,526 posts Joined: Sep 2013 |

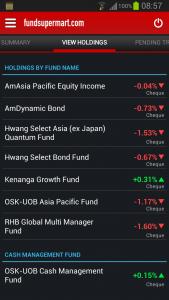

My allocation is as attached...is that healthy?

Most of the time red red..but looking long term hopefully will turn green haha All almost same distribution compared to I have a colleague who just focus on reit only...I'm using fsm.whereas he is using some osk platform he said no sales charge? This post has been edited by kkk8787: Oct 18 2013, 11:48 PM Attached thumbnail(s)

|

|

|

Oct 19 2013, 10:30 AM Oct 19 2013, 10:30 AM

Return to original view | Post

#88

|

Senior Member

2,526 posts Joined: Sep 2013 |

QUOTE(gark @ Oct 19 2013, 10:01 AM) Correct buying REIT got no sales charge ..... I think he said full reits...apparently safer bet he said...whereas mine higher risk.. red more than green avday. .. hopefully in long term can turn green....amdynamic not doing well Huhbut... have to pay brokerage fee, clearing fee and stamp duty. Your friend is misleading or delusional..and IF he solely concentrate on REIT, I cannot imagine he is doing well lately. BTW Most REIT in Malaysia HAVE management fee like UT... about 0.5%-1.0% p.a. |

|

|

Oct 19 2013, 11:53 PM Oct 19 2013, 11:53 PM

Return to original view | Post

#89

|

Senior Member

2,526 posts Joined: Sep 2013 |

Why cant I buy amdynamic using regular saving plan?

This post has been edited by kkk8787: Oct 20 2013, 12:27 AM |

|

|

Oct 20 2013, 09:02 AM Oct 20 2013, 09:02 AM

Return to original view | Post

#90

|

Senior Member

2,526 posts Joined: Sep 2013 |

|

|

|

Oct 20 2013, 12:36 PM Oct 20 2013, 12:36 PM

Return to original view | Post

#91

|

Senior Member

2,526 posts Joined: Sep 2013 |

QUOTE(yklooi @ Oct 20 2013, 12:29 PM) RSP Special List It is not required to have an initial investment for funds stated in the RSP Special List before starting the RSP. For the funds that are not included in the RSP Special List, you are required to invest at the minimum initial investment amount first before starting the RSP. for list of RSP Special list in FSM https://www.fundsupermart.com.my/main/buyse...pecialList.svdo? |

|

|

Oct 20 2013, 01:19 PM Oct 20 2013, 01:19 PM

Return to original view | Post

#92

|

Senior Member

2,526 posts Joined: Sep 2013 |

QUOTE(yklooi @ Oct 20 2013, 12:45 PM) Hey thx yk...will do when tmr working day...I was thinking why am have 2 similar funds ambond and amdynamic both a lot similarities but amdynamiv got removed as recommended fund d |

|

|

Oct 20 2013, 01:22 PM Oct 20 2013, 01:22 PM

Return to original view | Post

#93

|

Senior Member

2,526 posts Joined: Sep 2013 |

QUOTE(Pink Spider @ Oct 20 2013, 12:44 PM) U mean u already holding AmDynamic Bond? Hey pink kor...yupe memang have it d....holding....ya cannot rsp d... bought it last time coz fsm consultant recommend to balance up my otherwise all equity funds...but amdynamic after I bought red red nia...rsp I can do ambond nia...I rsp ambond now tot wanna rsp amdynamic to average down since price low nowRegular Savings Plan tab > Apply Oops, just checked, it's indeed not available for RSP. Most likely FSM expect it to be closed for subscription again in a not-too-distant future, thus did not bother to allow it for RSP. Just buy in manually every month lor... |

|

|

|

|

|

Oct 20 2013, 05:28 PM Oct 20 2013, 05:28 PM

Return to original view | Post

#94

|

Senior Member

2,526 posts Joined: Sep 2013 |

QUOTE(yklooi @ Oct 20 2013, 03:19 PM) a lot similarity? as of Sept 13 Ambond holds 30.21% AAA grade bonds 44.65% AA grade bonds 3.93% A grade bonds Amdynamic holds 1.97% AAA grade bonds 60.96% AA grade bonds 20.84% A grade bonds |

|

|

Oct 20 2013, 06:51 PM Oct 20 2013, 06:51 PM

Return to original view | Post

#95

|

Senior Member

2,526 posts Joined: Sep 2013 |

QUOTE(yklooi @ Oct 20 2013, 05:37 PM) I like a little risk....I go for dynamic. Yupe got it...ya I was thinking also....2 per cent exit charge...with that all my earning habis...but a full equity portfolio the cis told me not recommended... thus bond...will ask the frenly cis tomorrowI suggest you ask CIS at FSM CIS = Client Investment Specialist. previously a forummer posted a question that is worth giving a thought..... if a bond fund is giving a return almost similar to FD...why go bond? |

|

|

Oct 21 2013, 06:59 PM Oct 21 2013, 06:59 PM

Return to original view | Post

#96

|

Senior Member

2,526 posts Joined: Sep 2013 |

All funds ah...hwang ex japan quantum fund if calculate from 2 months back still -1.3 Le...

Anyway just to inform I asked fsm d...amdynamic memang cannot rsp as they gonna close anytime once target size achieved |

|

|

Oct 21 2013, 10:07 PM Oct 21 2013, 10:07 PM

Return to original view | Post

#97

|

Senior Member

2,526 posts Joined: Sep 2013 |

something unrelated..hmm

This post has been edited by kkk8787: Oct 21 2013, 10:13 PM |

|

|

Oct 22 2013, 07:36 PM Oct 22 2013, 07:36 PM

Return to original view | Post

#98

|

Senior Member

2,526 posts Joined: Sep 2013 |

QUOTE(Pink Spider @ Oct 22 2013, 09:23 AM) Nothing much to talk about, it's a fairly stable and well-managed global fund IMHO Only problem is u transcact twiceGood idea. Every month dump all excess cash in CMF. Then when ur FD matures, sell CMF and transfer to ur bank, then top up FD Once from saving to cmf...another cmf back to account...so transaction fees x 2 |

|

|

Oct 22 2013, 09:08 PM Oct 22 2013, 09:08 PM

Return to original view | Post

#99

|

Senior Member

2,526 posts Joined: Sep 2013 |

|

|

|

Oct 22 2013, 09:13 PM Oct 22 2013, 09:13 PM

Return to original view | Post

#100

|

Senior Member

2,526 posts Joined: Sep 2013 |

wah all green!!!! I hope it stays that way

|

|

Topic ClosedOptions

|

| Change to: |  0.0539sec 0.0539sec

0.65 0.65

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 01:13 PM |