QUOTE(zack.gap @ May 24 2020, 01:28 AM)

1) Boustead paid

zero dividends for FY19 -

https://www.theedgemarkets.com/article/bous...clean-its-books2) Fire sale for parts of Jalan Cochrane asset -https://www.theedgemarkets.com/article/boustead-puts-jalan-cochrane-land-sale

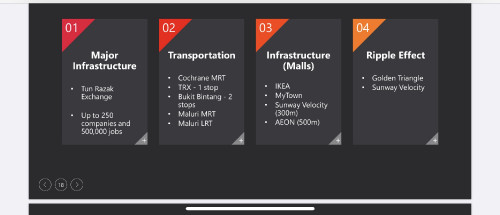

3) MRT is most definitely not a '3 minute' walk away. The residential area for One Cochrane is recessed into the plot of land, behind the huge car park area. So is the MRT entrance. I'd say a 'healthy' 10 minutes brisk walk, rain or shine, is closer to the mark.

4) People don't own properties for only 2 years. And you'd be naive to think developer hasn't priced in this additional cost. Additional 'rebates' are usually priced in as well (otherwise first buyers would be disgruntled). Lowest nett price was around 830k (type A) when I surveyed late last year. Has this changed?

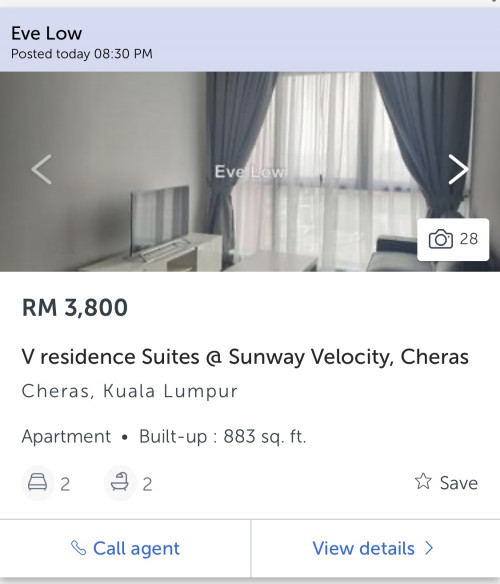

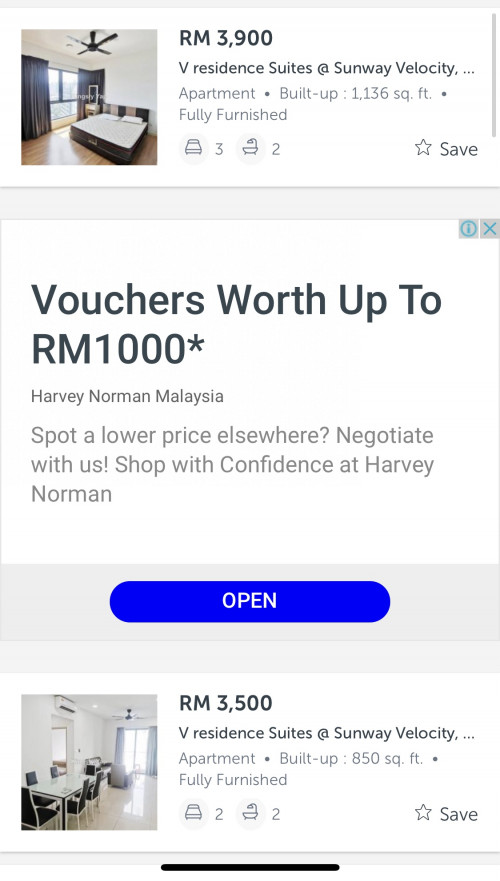

I'm curious on how you do your analysis. Mine basically says One Cochrane is a white elephant. Not close enough to walk to TRX so have to drive or take MRT. But if driving better take Continew since cheaper. If purely MRT better take Maluri area since got refurbished AEON and Sunway group facilities within walking distance. Unless you think having Ikea across the road is a heavy premium worth paying ?

First of all, I have to admit that I haven’t studied much of boustead financial numbers in detail. However last I can recall is that dividend is not the only way to gauge the financial health of a company especially a huge conglomerate like boustead.U can see a lot of growth companies don’t pay dividend and that doesn’t mean that they are good or bad. It’s just their decision to reinvest back. Also at times like this i can’t say it’s unwise not to fix their cashflow and operation health first. Beside the news that u posted, there are several good news like growing revenue, reduced operational cost that should be take note of too. For a property company to make money they have to spend money to develop and only see revenue starts coming in from the sales of property. You can see that they are more good news coming up especially on Palm oil since it’s coming back up again that would benefit the company compared to previous year. Again all these are fluid factors and shouldn’t be valued from one angle only.

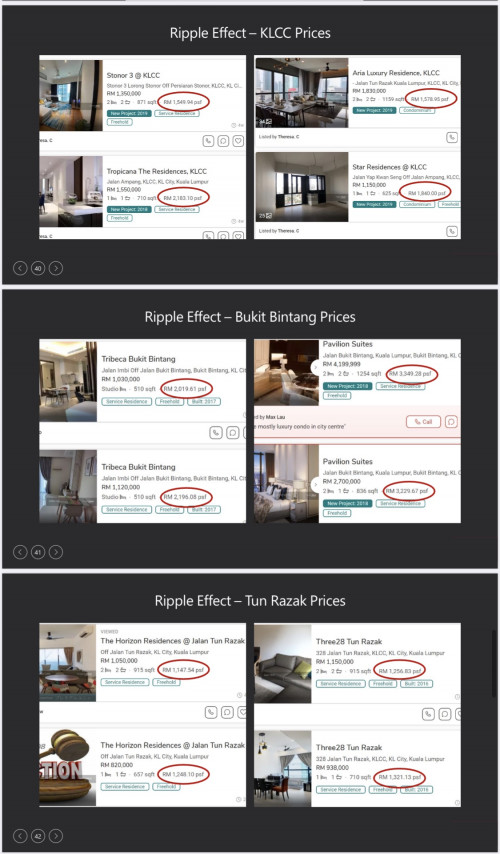

Also, on the maintanence cost, it’s wiser to look at it at a wider perspective instead of ringgit and cents to other projects. In this instance, Maintenance fee is a function of density/facility and potential capital growth. I'm ready to bet the additional RM1k/year in maintenance fee for possible 0.5% better capital appreciation (eg RM45k/year). Again, this is highly subjective to what do you want from purchasing this property. If want cheap maybe this is not the one. If want value per ringgit invested, its worth thinking. I would rather choose higher potential return than cheap investment. Just like picking stocks. Of course everyone has their preference. But if I know I’m getting a good growth stock at under market value that has high potential to grow/ appreciate further, I would get it.

Also FYI, OC development has garnered an award for Best Transit Oriented Development (Future) from iproperty.com mainly contributed by its features of superior connectivity and proximity to conveniences and kL city centre. (This can be looked up and checked).

May 15 2020, 10:13 AM

May 15 2020, 10:13 AM

Quote

Quote

0.3781sec

0.3781sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled