Photo from google. Dated May 2020

This post has been edited by stephdreamcloud: Jun 3 2020, 06:52 PM

Investment ONE COCHRANE RESIDENCES [MRT PROPERTY], Next to IKEA and Ikano Megamall + Hotel

|

|

Jun 3 2020, 06:51 PM Jun 3 2020, 06:51 PM

Return to original view | IPv6 | Post

#21

|

Junior Member

97 posts Joined: May 2020 |

|

|

|

|

|

|

Jun 3 2020, 07:15 PM Jun 3 2020, 07:15 PM

Return to original view | IPv6 | Post

#22

|

Junior Member

97 posts Joined: May 2020 |

Ok I see where ure coming from 👌 Just from experience ya, some it won’t be so fast one to be reflected esp in land and survey that’s why I believe the lag in the data of this, I’m not doubting the credibility or efficiency. Also, again speaking from experience, oc now waiting list open. If sales not good, why need open waiting list le.

|

|

|

Jun 4 2020, 04:49 PM Jun 4 2020, 04:49 PM

Return to original view | IPv6 | Post

#23

|

Junior Member

97 posts Joined: May 2020 |

|

|

|

Jun 4 2020, 08:46 PM Jun 4 2020, 08:46 PM

Return to original view | Post

#24

|

Junior Member

97 posts Joined: May 2020 |

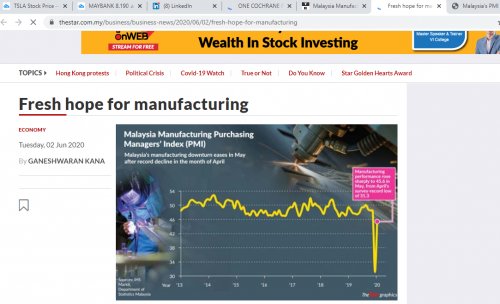

actually it doesn't matter ... what matters is data speaks for itself... and investment should be like that too, not based on emotion, but data, research. source: https://www.thestar.com.my/business/busines...r-manufacturing https://tradingeconomics.com/malaysia/manuf...month%20earlier. |

|

|

Jun 5 2020, 10:10 AM Jun 5 2020, 10:10 AM

Return to original view | IPv6 | Post

#25

|

Junior Member

97 posts Joined: May 2020 |

QUOTE(zack.gap @ Jun 4 2020, 10:18 PM) LOL the data definitely speaks but my question is do you even understand what you're seeing? of course, common sense is that it definitely won't be so fast to come back up, but isn't it a good sign? hahaPMI below 50 means perceived contraction, period. Think of it in terms of acceleration and velocity. Below 0 acceleration is deceleration, 0 means constant velocity and more than 0 is acceleration. Just because deceleration is closer to 0, it doesn't mean your velocity is any greater. Similarly just because PMI is nearer to 50 (constant velocity) doesn't mean economy is getting better. If Malaysia manufacturing output is 30% in March, a PMI of 48 just means it slowed down a bit slower, in this case maybe to 29% of total output. Tl;dr Anything below 50 PMI is bad news in this kind of economy, period. |

|

|

Jun 9 2020, 04:57 PM Jun 9 2020, 04:57 PM

Return to original view | IPv6 | Post

#26

|

Junior Member

97 posts Joined: May 2020 |

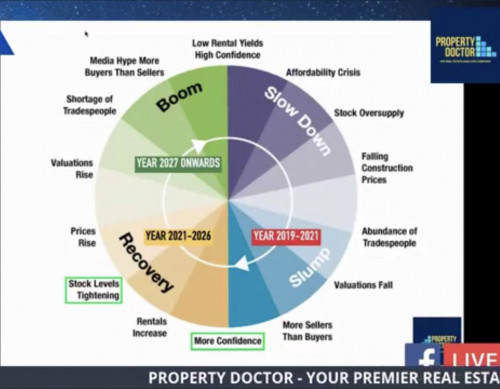

Can read more about property cycle: https://www.starproperty.my/news/investment...ty-cycle/114518

Also important to consider the property market cycle.. Of course we are not yet at the recovery / stabilisation part yet but as seen very recently government initiatives to stimulate economy (whether want to be taken positively or not, no convincing here, just sharing what I know because I’m not here to convince anyone, just providing another POV ) it seems like we r getting there. Bottom won’t be forever. N those who knows how to make good use of opportunity will make use of this time and the initiatives to their benefits.  |

|

|

|

|

|

Jun 10 2020, 05:42 PM Jun 10 2020, 05:42 PM

Return to original view | IPv6 | Post

#27

|

Junior Member

97 posts Joined: May 2020 |

No need like that. I’m not here to convince anyone as said. Share facts and data only. Also if you guys have good investment deals, do share too. Speculator or not only time will tell.

This post has been edited by stephdreamcloud: Jun 10 2020, 05:42 PM |

|

|

Jun 11 2020, 04:29 PM Jun 11 2020, 04:29 PM

Return to original view | IPv6 | Post

#28

|

Junior Member

97 posts Joined: May 2020 |

3 bedrooms sold out already. Left 2 bedrooms. 600+k onwards.

|

|

|

Jun 18 2020, 11:34 AM Jun 18 2020, 11:34 AM

Return to original view | Post

#29

|

Junior Member

97 posts Joined: May 2020 |

was informed developer left 40+ units.

|

|

|

Jun 22 2020, 08:34 PM Jun 22 2020, 08:34 PM

Return to original view | IPv6 | Post

#30

|

Junior Member

97 posts Joined: May 2020 |

|

|

|

Jun 28 2020, 10:04 PM Jun 28 2020, 10:04 PM

Return to original view | IPv6 | Post

#31

|

Junior Member

97 posts Joined: May 2020 |

|

|

|

Jun 29 2020, 06:37 PM Jun 29 2020, 06:37 PM

Return to original view | IPv6 | Post

#32

|

Junior Member

97 posts Joined: May 2020 |

Depending on goals. Different people invest for different expected return or goals. Most importantly u know what ure buying la ya. Do own judgement based on studies and facts.

Based on my calculation, cheapest unit is 660+ K onwards. lower than projects in the area. |

|

|

Jul 1 2020, 12:18 PM Jul 1 2020, 12:18 PM

Return to original view | IPv6 | Post

#33

|

Junior Member

97 posts Joined: May 2020 |

Yes only closed door deals can get that good price

|

|

|

|

|

|

Jul 1 2020, 10:37 PM Jul 1 2020, 10:37 PM

Return to original view | IPv6 | Post

#34

|

Junior Member

97 posts Joined: May 2020 |

|

|

|

Jul 2 2020, 01:35 PM Jul 2 2020, 01:35 PM

Return to original view | IPv6 | Post

#35

|

Junior Member

97 posts Joined: May 2020 |

QUOTE(flight @ Jul 2 2020, 08:16 AM) Should just directly join faizul ridzuan group. If im not wrong he was the one who negotiated this deal with the deve. Got pros n cons tho... u get the deal but then u r gona pay him few ks to get the deal also. Better to look for group buy. Same rebateUnless ure in to learn some stuff from him la 👍 This post has been edited by stephdreamcloud: Jul 2 2020, 01:37 PM |

|

|

Jul 2 2020, 01:36 PM Jul 2 2020, 01:36 PM

Return to original view | IPv6 | Post

#36

|

Junior Member

97 posts Joined: May 2020 |

QUOTE(SongChiang @ Jul 2 2020, 10:07 AM) Nope. Group dealwould like add on, previously got a forumer mentioned for group buy got 650 psft, it's correct if it's for bumi. after calculating: if bumi, it's about 646 psft - 671 psft (most expensive unit) non-bumi, it's about 692-719 psft This post has been edited by stephdreamcloud: Jul 3 2020, 10:33 AM |

|

|

Jul 4 2020, 02:24 PM Jul 4 2020, 02:24 PM

Return to original view | IPv6 | Post

#37

|

Junior Member

97 posts Joined: May 2020 |

QUOTE(DesRed @ Jul 4 2020, 09:24 AM) If let's say if I do a group buy with my friends and relatives, am I entitled to that discount or that is only for registered groups? Like what Boonie mentioned ya.The amount is not small tho and the amount of units that u need to take also not small 😆 This post has been edited by stephdreamcloud: Jul 4 2020, 02:24 PM |

|

|

Jul 13 2020, 11:02 AM Jul 13 2020, 11:02 AM

Return to original view | Post

#38

|

Junior Member

97 posts Joined: May 2020 |

QUOTE(BoonieTan @ Jul 11 2020, 02:21 PM) For benefits of non-mandarin speakers, the key points by Tony Guru about bulk purchase are as follows: thanks for sharing. i totally agree with these points. even being given a good deal on hand, i would think through this also and really look at the benefits of the project if i were to buy into it, instead of looking at "how nice" the project is.... i came across quite some not very good/relevant questions when it comes to investors approaching me before deciding to buy a property - mostly too focused on aesthetic instead of the strength , developer reputation and track record, the package (discount vs rebate ) , potential returns, growth triggers in the area ( the more the better, this is important especially when comparing between projects ) , supply and demand, and of course loan eligibility.1. Make sure the bulk purchase deal you entering is in line with or lower than market value of surrounding properties. 2. Perform your diligence on the developer reputation and their track record. 3. Check the profile of your fellow bulk purchasers profile - avoid speculators who won't hesitate to go highly gearing entering such deals - this may lead to future foreclosures and causing a sharp drop in your property value 4. Measure your own head before buying your cap. Don't buy properties which you cannot afford the monthly installment and maintenance. And lastly, caveat emptors - if the developers offering reasonable deals to the market in the first place, why do they have to resort to bulk purchase to clear their inventories? Not sure if I agree with all his points (as he darn sure has his own vested interests making such claims - if not mistaken, he's a leader of property agency himself) but some are best kept for own's consideration before going into bulk purchase deal. SongChiang liked this post

|

|

|

Jul 29 2020, 12:43 PM Jul 29 2020, 12:43 PM

Return to original view | IPv6 | Post

#39

|

Junior Member

97 posts Joined: May 2020 |

|

|

|

Jul 29 2020, 12:57 PM Jul 29 2020, 12:57 PM

Return to original view | IPv6 | Post

#40

|

Junior Member

97 posts Joined: May 2020 |

Found some infos which have been summarised/listed out nicely...

Main benefits:

Source: https://newlaunch-my.ippstatic.com/live/MY/...%20Brochure.pdf again as always, if got lower entry price (which enable u to invest lower price than other surrounding projects, it is worth considering, provided u have ur exit strategy in place, adi compared/done due dilligence, check dsr, income ok - i think it's better i state these so that ppl don't just PM this that without doing due dilligence first. i find there's quite a few of impulsive purchase due to many rebates and incentives thrown into property market lately ). Attached thumbnail(s)

|

| Change to: |  0.0581sec 0.0581sec

1.06 1.06

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 12:08 PM |