For my case, i choose FEDEX as the courier service, mainly because it's FAST. But what lies under was actually....

Here's the case, my package was declared as GIFT, so i was saved from the "TAXABLE ITEM" tax. That was until i found out this.

If you are buying from overseas and use a courier service (FEDEX,GDEX, watsoeverDEX...), Malaysia Custom actually charge a "KOS TAMBANG DAGANGAN" based on the weight of your parcel, and thus increase the original declared value of your parcel, and making it TAXABLE.

Based on the info from this guy HowToAvoidTax, item/parcel will only be taxed, if the total value is >RM500,

Penghantaran Melalui EMS[shipped through EMS]

Nilai Barang[Goods/Parcel Value] + Kos Pengeposan[Shipping Cost] = < RM 500 (Dikecualikan cukai)[non-taxable]

Nilai Barang + Kos Pengeposan = > Rm 500 (Dikenakan cukai sekiranya barang ditaksir bercukai)[taxable if goods declare as taxable items]

Nilai Barang + Kos Pengeposan = > RM 1000 (Jika Bercukai, akan dikenakan Borang Ikrar Kastam K1 dan dicukai)[if taxable item, required customs K1 form and taxable]

Nilai Barang + Kos Pengeposan = > RM 1000 (Tidak Bercukai, tidak dikenakan borang ikrar)[non-taxable item, not required customs declaration form]

Nilai Barang + Kos Pengeposan = > RM 2000 (Tidak Bercukai, Dikenakan Borang Ikrar Kastam K1)[non-taxable item, required customs K1 form]

Nilai Barang + Kos Pengeposan = > RM 10000 (Cukai atau tidak, Akan Kena borang K1A)[either taxable or non-taxable, required customs K1A form]

So for my parcel, the value declared was 10476YEN with conversion rate of 0.0328

Original Parcel Value: RM 343.61

Insurance: RM 3.44 (~1% of the original Parcel value i guess)

KOS TAMBANG DAGANGAN: RM 322.15

TOTAL PARCEL VALUE: RM 669.20

My parcel value become RM600++!!

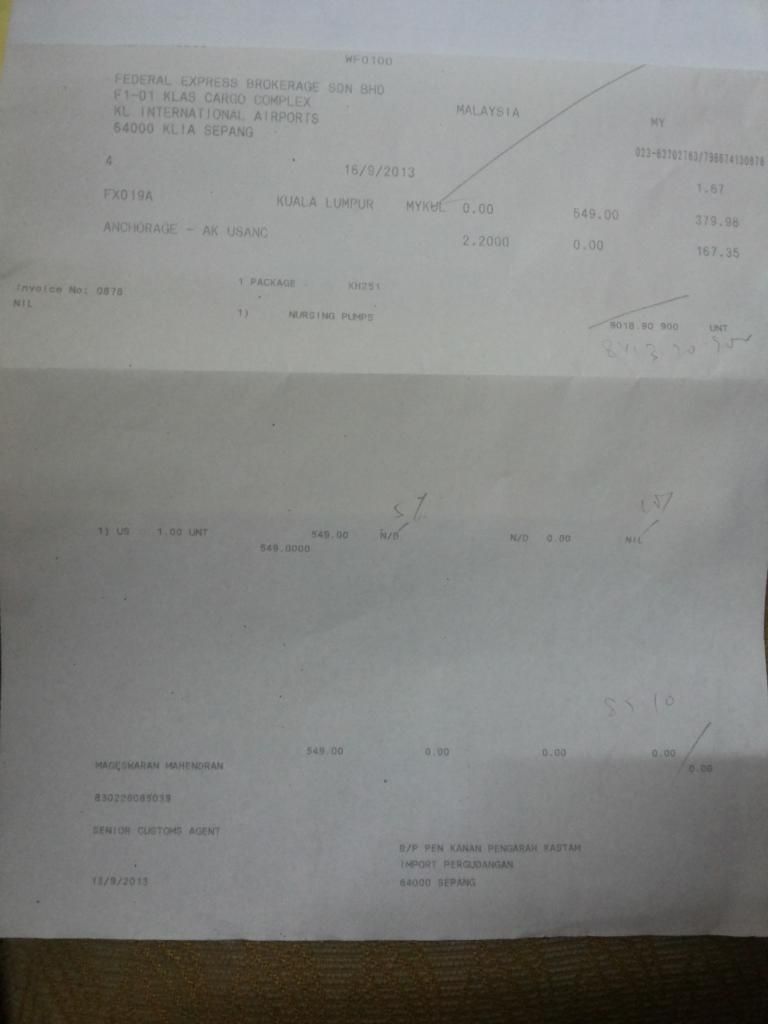

This is what stated at my Duty Tax Invoice

So how they calculate the KOS TAMBANG DAGANGAN? I was surprised when i receive this from FEDEX.

As my parcel was from Japan, and my parcel weight 1.8KG, based on the table they provided me below:

JAPAN

0 - 6.4KG -> RM322.15 (Caj Minimum)

> 6.4KG -> RM50.03

> 45KG -> RM42.45

> 100KG -> RM37.52

> 300KG -> RM32.22

> 500KG -> RM32.22

This makes me more

This post has been edited by PhantomLance: Jun 26 2013, 04:01 PM

Jun 26 2013, 02:01 PM, updated 11y ago

Jun 26 2013, 02:01 PM, updated 11y ago

Quote

Quote

0.0268sec

0.0268sec

0.62

0.62

6 queries

6 queries

GZIP Disabled

GZIP Disabled