Rm420k for 30 years, premium will be RM18,765.00

Rm480k for 30 years, premium will be RM21,446.40

i still hav option to take like 10 years / 15 years ? then when reaching the expiry can renew ?

what is the disadvantages and advantages of taking half duration and renew later ?

is it in future after 15 years, i go another 15 years the price will be different since cost goes high... ?

is it like if i take 15 years... RM18,765.00 becomes RM9382.50...

then after 15 years, renew base on the outstanding balance...

so in this case, i believe can save more.. incase if i able to reduce more principal on first 15 years. The next 15 years would be cheaper right.

example now im 33 if i take straight 30 years for 480k cost RM21,446.40

if i take just 1st 15 years for 480k, mayb it cost half of above price

then after 15 years, in age 48 lets say my principal balance is RM319524, and i take MRTA for next 15 years..

how the price looks like ?

-straight 30 years 480k cost RM21,446.40

-1st 15 years (age 33) RM480000 cost ?

-2nd 15 years (age 48) RM319524 cost ?

-add up both sum doest it lower / higher than straight 30 years purchasing ?

need ur advice since i feel RM18,765.00 / RM21,446.40... straight 30 years eating up cash

ok the MLTA quotation of yours, is it mixed up with any riders ? can i have just surrender value purpose.

i already have personal insurances with medical card and critical illness...

QUOTE(onnying88 @ May 16 2014, 02:02 AM)

Hi, As for you quotation for MRTA and MLTA,

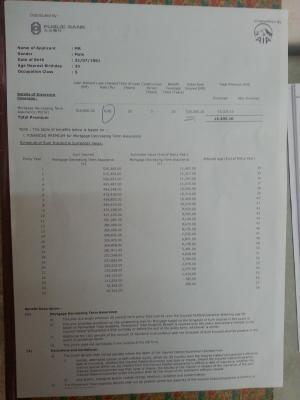

Quotation for MRTA

Age: 33 (1981)

Male / Non-smoker

MRTA cover for Death & TPD (Total Permanent Disability)

MRTA coverage of Rm420k for 30 years, premium will be RM18,765.00

MRTA coverage of Rm480k for 30 years, premium will be RM21,446.40

-----------------------------------------------------------------------------------------------------------------------

Quotation for MLTA

For MLTA type 1 with NO Surrender Value (but will have some value only if you surrender this policy earlier)

Age: 33 (1981)

Male / Non-smoker

MLTA type 1 , Cover Death & TPD (Total Permanent Disability)

MLTA type 1 coverage of Rm420k for 30 years,

Monthly premium = RM209.10

Yearly premium = RM2389.80

MLTA type 1 coverage of Rm480k for 30 years,

Monthly premium = RM238.98

Yearly premium = RM2731.20

--------------------------------------------------------------

For MLTA type 2 with Guaranteed Surrender Value

Age: 33 (1981)

Male / Non-smoker

MLTA Tenure: There is NO term for this MLTA type 2 so it can be use up to age 100, just surrender this policy at any year you want to terminate or when the loan fully paid.

MLTA coverage type 2 coverage of RM420k, Cover Death & TPD only

Monthly premium = RM450.92

Yearly premium = RM5153.40

GUARANTEED

Surrender value at 40years = RM277,242.00 (total paid only RM206,136.00)

Surrender value at 35years = RM240,656.00 (total paid only RM180,369.00)

Surrender value at 30years = RM200,659.00 (total paid only RM154,602.00)

Surrender value at 25years = RM158,806.00 (total paid only RM128,835.00)

Surrender value at 20years = RM118,730.00 (total paid only RM103,068.00)

Surrender value at 14years = RM72,688.00 (total paid only RM72,147.60) <----- RM5153.40 x 14years = RM72,147.60

MLTA coverage type 2 coverage of RM480k, Cover Death & TPD only

Monthly premium = RM515.32

Yearly premium = RM5889.60

GUARANTEED

Surrender value at 40years = RM316,848.00 (total paid only RM235,584.00)

Surrender value at 35years = RM275,035.00 (total paid only RM206,136.00)

Surrender value at 30years = RM229,325.00 (total paid only RM176,688.00)

Surrender value at 25years = RM181,493.00 (total paid only RM147,240.00)

Surrender value at 20years = RM135,691.00 (total paid only RM117,792.00)

Surrender value at 14years = RM83,050.00 (total paid only RM82,454.40) <----- RM5889.60 x 14years = RM82,454.40

---------------------------------------------------------------------------------------

For MLTA type 3 with non guaranteed surrender value

(This is an investment link plan which the surrender value will base on investment fund performance thus the surrender value is not guaranteed)

Age: 33 (1981)

Male / Non-smoker

MLTA Tenure: There is NO term for this MLTA type 3 also, so it can be use up to age 100, just surrender this policy at any year you want to terminate or when the loan fully paid.

MLTA type 3, Cover Death & TPD and OAD (old age disability)

MLTA coverage type 2 coverage of RM420k, Cover Death & TPD only

Monthly premium = RM200.00

Yearly premium = RM2400.00

Projected Surrender value

At 14 years, High = Rm31,051.00, Low = Rm22,708.00

At 20 years, High = Rm52,067.00, Low = Rm31,036.00

At 25 years, High = Rm64,009.00, Low = Rm33,655.00

At 30 years, High = Rm73,261.00, Low = Rm30,687.00

MLTA coverage type 2 coverage of RM480k, Cover Death & TPD only

Monthly premium = RM220.00

Yearly premium = RM2640.00

Projected Surrender value

At 14 years, High = Rm33,816.00, Low = Rm24,710.00

At 20 years, High = Rm56,373.00, Low = Rm33,478.00

At 25 years, High = Rm68,724.00, Low = Rm35,746.00

At 30 years, High = Rm77,601.00, Low = Rm31,500.00

------------------------------------------------------------------------------

The best MLTA plan for you would be the MLTA type 3 as the premium is the lowest among all MLTA option with the bonus of non guaranteed surrender value.

If the commitment is ok for you, then MLTA type 2 will be a good choice as you guaranteed can get back all your premium paid as early at 14th years. So you will not lose your money to get the protection of Rm480k right after 14 years.

Do let me know if you have any question regarding the quotation above.

Regards,

Onn

This post has been edited by GHOSTVIC: May 20 2014, 04:20 AMQuotation for MRTA

Age: 33 (1981)

Male / Non-smoker

MRTA cover for Death & TPD (Total Permanent Disability)

MRTA coverage of Rm420k for 30 years, premium will be RM18,765.00

MRTA coverage of Rm480k for 30 years, premium will be RM21,446.40

-----------------------------------------------------------------------------------------------------------------------

Quotation for MLTA

For MLTA type 1 with NO Surrender Value (but will have some value only if you surrender this policy earlier)

Age: 33 (1981)

Male / Non-smoker

MLTA type 1 , Cover Death & TPD (Total Permanent Disability)

MLTA type 1 coverage of Rm420k for 30 years,

Monthly premium = RM209.10

Yearly premium = RM2389.80

MLTA type 1 coverage of Rm480k for 30 years,

Monthly premium = RM238.98

Yearly premium = RM2731.20

--------------------------------------------------------------

For MLTA type 2 with Guaranteed Surrender Value

Age: 33 (1981)

Male / Non-smoker

MLTA Tenure: There is NO term for this MLTA type 2 so it can be use up to age 100, just surrender this policy at any year you want to terminate or when the loan fully paid.

MLTA coverage type 2 coverage of RM420k, Cover Death & TPD only

Monthly premium = RM450.92

Yearly premium = RM5153.40

GUARANTEED

Surrender value at 40years = RM277,242.00 (total paid only RM206,136.00)

Surrender value at 35years = RM240,656.00 (total paid only RM180,369.00)

Surrender value at 30years = RM200,659.00 (total paid only RM154,602.00)

Surrender value at 25years = RM158,806.00 (total paid only RM128,835.00)

Surrender value at 20years = RM118,730.00 (total paid only RM103,068.00)

Surrender value at 14years = RM72,688.00 (total paid only RM72,147.60) <----- RM5153.40 x 14years = RM72,147.60

MLTA coverage type 2 coverage of RM480k, Cover Death & TPD only

Monthly premium = RM515.32

Yearly premium = RM5889.60

GUARANTEED

Surrender value at 40years = RM316,848.00 (total paid only RM235,584.00)

Surrender value at 35years = RM275,035.00 (total paid only RM206,136.00)

Surrender value at 30years = RM229,325.00 (total paid only RM176,688.00)

Surrender value at 25years = RM181,493.00 (total paid only RM147,240.00)

Surrender value at 20years = RM135,691.00 (total paid only RM117,792.00)

Surrender value at 14years = RM83,050.00 (total paid only RM82,454.40) <----- RM5889.60 x 14years = RM82,454.40

---------------------------------------------------------------------------------------

For MLTA type 3 with non guaranteed surrender value

(This is an investment link plan which the surrender value will base on investment fund performance thus the surrender value is not guaranteed)

Age: 33 (1981)

Male / Non-smoker

MLTA Tenure: There is NO term for this MLTA type 3 also, so it can be use up to age 100, just surrender this policy at any year you want to terminate or when the loan fully paid.

MLTA type 3, Cover Death & TPD and OAD (old age disability)

MLTA coverage type 2 coverage of RM420k, Cover Death & TPD only

Monthly premium = RM200.00

Yearly premium = RM2400.00

Projected Surrender value

At 14 years, High = Rm31,051.00, Low = Rm22,708.00

At 20 years, High = Rm52,067.00, Low = Rm31,036.00

At 25 years, High = Rm64,009.00, Low = Rm33,655.00

At 30 years, High = Rm73,261.00, Low = Rm30,687.00

MLTA coverage type 2 coverage of RM480k, Cover Death & TPD only

Monthly premium = RM220.00

Yearly premium = RM2640.00

Projected Surrender value

At 14 years, High = Rm33,816.00, Low = Rm24,710.00

At 20 years, High = Rm56,373.00, Low = Rm33,478.00

At 25 years, High = Rm68,724.00, Low = Rm35,746.00

At 30 years, High = Rm77,601.00, Low = Rm31,500.00

------------------------------------------------------------------------------

The best MLTA plan for you would be the MLTA type 3 as the premium is the lowest among all MLTA option with the bonus of non guaranteed surrender value.

If the commitment is ok for you, then MLTA type 2 will be a good choice as you guaranteed can get back all your premium paid as early at 14th years. So you will not lose your money to get the protection of Rm480k right after 14 years.

Do let me know if you have any question regarding the quotation above.

Regards,

Onn

May 18 2014, 07:45 PM

May 18 2014, 07:45 PM

Quote

Quote

0.0327sec

0.0327sec

0.50

0.50

6 queries

6 queries

GZIP Disabled

GZIP Disabled