Hi bro thanks for your brief explanation. . Really appreciate it..

Hi, As for you quotation for MRTA and MLTA,

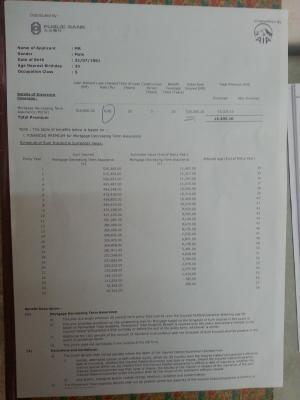

Quotation for MRTA

Age: 33 (1981)

Male / Non-smoker

Loan: RM275k

MRTA coverage of RM275k for 15 years, Cover Death & TPD (Total Permanent Disability)MRTA premium will be RM3811.00 (one time payment only).

Coverage table for 15 years

[attachmentid=3930353]

-----------------------------------------------------------------------------------------------------------------------

Quotation for MLTA

For MLTA type 1 with NO Surrender Value (but will have some value only if you surrender this policy earlier)

Age: 33 (1981)

Male / Non-smoker

Loan: RM275k

MLTA coverage type 1 coverage of RM275k, Cover Death & TPD (Total Permanent Disability)MLTA type 1 coverage for 10 years,

Monthly premium = RM52.46

Yearly premium = RM599.50

MLTA type 1 coverage for 15 years,

Monthly premium = RM67.14

Yearly premium = RM767.25

MLTA type 1 coverage for 20 years,

Monthly premium = RM88.55

Yearly premium = RM1012.00

--------------------------------------------------------------

For MLTA type 2 with Guaranteed Surrender Value

Age: 33 (1981)

Male / Non-smoker

Loan: RM275k

MLTA Tenure: There is NO term for this MLTA type 2 so it can be use up to age 100, just surrender this policy at any year you want to terminate or when the loan fully paid.

MLTA coverage type 2 coverage of RM275k, Cover Death & TPD onlyMonthly premium = RM295.25

Yearly premium = RM3374.25

GUARANTEED

Surrender value at 40years = RM181,528.00 (total paid only RM134,970.00)

Surrender value at 35years = RM157,572.00 (total paid only RM118,098.75)

Surrender value at 30years = RM131,384.00 (total paid only RM101,227.50)

Surrender value at 25years = RM103,980.00 (total paid only RM84,356.25)

Surrender value at 20years = RM77,740.00 (total paid only RM67,485.00)

Surrender value at 15years = RM53,045.00 (total paid only RM50,613.75)

Surrender value at 14years = RM47,581.00 (total paid only RM47,239.50) <----- RM3374.25 x 14years = RM47,239.50

Your quotation for this MLTA type 2 surrender value will break even at 14 years. Meaning you will get back what you've paid at 14 years guaranteed. Let's say you settle the loan earlier in 14 or 15 years, you already get back more then you paid for the MLTA thus you can say you are getting FREE MLTA coverage for RM275k and earning some interest too. And in the middle, you may refinance or change/upgrade to bigger property as you wish without burn the MLTA.

Beside you have the option to continue this MLTA until age 100 and treat this as your saving account with guaranteed return or even a extra life insurance after the loan settle. This will be cheaper a lot compare that you getting a new RM275k life insurance with same benefit at older age and and the new insurance will subject to approval depend on your health condition at that time too.

---------------------------------------------------------------------------------------

For MLTA type 3 with non guaranteed surrender value

(This is an investment link plan which the surrender value will base on investment fund performance thus the surrender value is not guaranteed)

Age: 33 (1981)

Male / Non-smoker

Loan: RM275k

MLTA Tenure: There is NO term for this MLTA type 3 also, so it can be use up to age 100, just surrender this policy at any year you want to terminate or when the loan fully paid.

MLTA type 3 coverage of RM275k, Cover Death & TPD and OAD (old age disability)Monthly premium = RM150.00

Yearly premium = RM1800.00

Projected Surrender value

At 14 years, High = Rm24,005.00, Low = Rm17,600.00

At 15 years, High = Rm26,605.00, Low = Rm18,943.00

At 20 years, High = Rm40,987.00, Low = Rm24,709.00

At 25 years, High = Rm51,663.00, Low = Rm28,021.00

At 30 years, High = Rm61,458.00, Low = Rm27,960.00

------------------------------------------------------------------------------

Regarding your question,

what would be the MRTA ? is it one time payment or need to pay yearly / monthly ? as i know MRTA gets charged in loan amount when we first apply.. so in the event of death, what ever loan amount left will be paid off ?Your MRTA premium will be RM3811.00. The premium is only one time payment and you may choose to charge into the loan or pay by cash.

In the event of death, the coverage amount will be refer to the coverage table as above. If Let say in the near future the BLR rate rise above the MRTA coverage table of 8%, then your loan balance might be higher then the MRTA coverage thus you will need to pay the different. So we cannot guaranteed MRTA can fully cover the loan amount if BLR rise.

how about MLTA, if im interested in MLTA type 2 with Guaranteed Surrender Value how the quotation ?

so after 15 years tenure once i paid off my loan, i can surrender my MLTA and get back the money or i continue pay ?

but see in previous posting MLTA just covers 50% of the loan amount ? if any death or permanent disability, when the loan amout is 200,000... it just covers 100,000 and the balance i need to settle my self ?For MLTA type 2, your premium will be Rm3374.25 per year. And let's say you pay off the loan at 15th years, you may surrender this MLTA type 2 and get back RM53,045.00 (total paid only Rm3374.25 x 15years = RM50,613.75) guaranteed.

Yes, If you option for only cover 50% of the loan amount (for your case 50% = Rm137,500), at any event of death and TPD, only 50% or RM137,500 will be paid.

But of cause, if you choose to cover 50%, the MLTA premium will be reduce by around 50% too.

From the above quotation,

-MRTA give you the cheapest premium at Rm3811.00 to cover for 15 years. But MRTA coverage is reducing and it's not transferable when you refinance, or getting new loan when change/upgrade property in future. You will need to buy MRTA again and of cause the MRTA premium will be higher as age getting older.

Do note that if you finance the MRTA into the loan, you will be charge interest also. As for Rm3811 finance into loan at BLR-2.4% @ 15 years, you total payment over 15 years will be Rm5143.14.

-If you option for cheapest alternative to replace MRTA, then you may option for MLTA type 1.

MLTA type 1 only cost Rm767.25 per year or Rm11,508.75.

Although it cost almost double of the MRTA, it do provide few extra benefit.

-flexibility to transfer to cover others loan.

-level coverage of RM275k for 15 years.

(For example in the event at the 13th year, MRTA only cover Rm83,944.00 but this MLTA type 1 will still cover Rm275k. An extra of Rm191k cash for your family after settle the loan.)

-Premium is constant and will not increase regardless of BLR rate.

If your commitment allow, then you may option for MLTA type 2, As it will guaranteed you free coverage right after 14 years. As you will get back all your money paid after 14 years. You will also have the option to continue the coverage until age 100.

Regards,

Onn

Apr 6 2014, 03:44 AM

Apr 6 2014, 03:44 AM

Quote

Quote

0.0256sec

0.0256sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled