QUOTE(HotshotS @ Apr 10 2019, 08:28 PM)

Guys, how would you choose for a loan of 550K?

RHB Full Flexi

4.5%

Daily interest calculation (approximately how much can I save each day if I park my monthly salary in the account? Whenever I need to use money then only withdraw from it in order to save daily interest)

No maintenance fee, setup fee, withdrawal fee

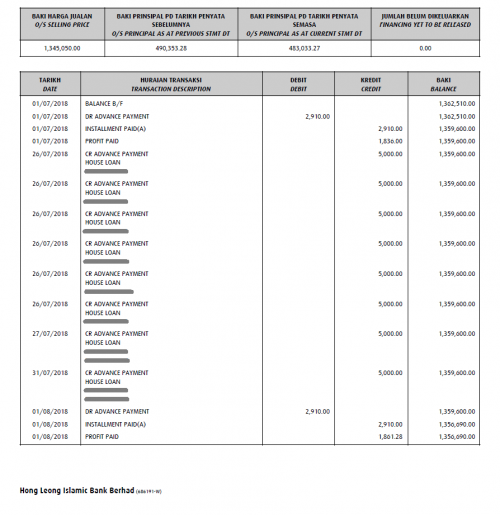

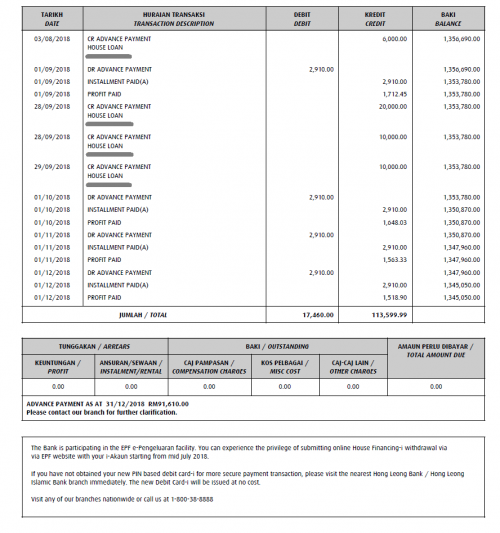

HLB Semi Flexi

4.28% for the first 2 years, after that BR 4.13+0.37 = 4.5% (approximately how much can I save in the first 2 years?)

Daily interest calculation

Withdrawal fee of RM 25 each time

No maintenance fee, setup fee

since HLB does offer 2 years at a lower interest rate then you'll definitely save more than RHB.RHB Full Flexi

4.5%

Daily interest calculation (approximately how much can I save each day if I park my monthly salary in the account? Whenever I need to use money then only withdraw from it in order to save daily interest)

No maintenance fee, setup fee, withdrawal fee

HLB Semi Flexi

4.28% for the first 2 years, after that BR 4.13+0.37 = 4.5% (approximately how much can I save in the first 2 years?)

Daily interest calculation

Withdrawal fee of RM 25 each time

No maintenance fee, setup fee

Apr 10 2019, 11:12 PM

Apr 10 2019, 11:12 PM

Quote

Quote

0.1146sec

0.1146sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled