QUOTE(doce @ Apr 21 2019, 10:20 PM)

Guys,

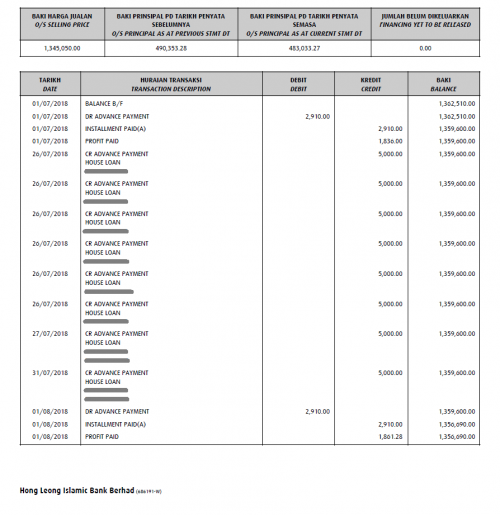

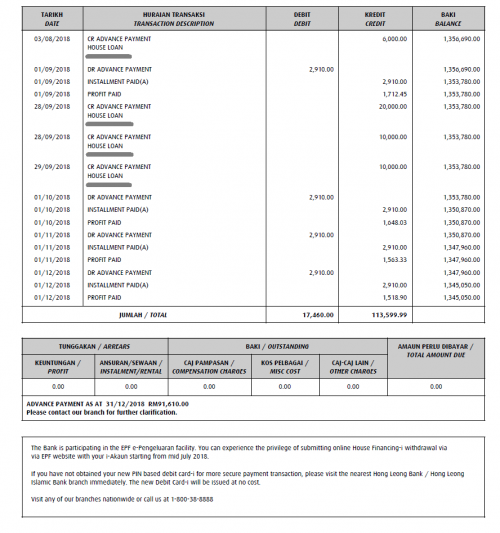

My relative's had started to pay their house loan in advance since july last year. Their loan is from HLB. According to their agent (which is not currently with HLB already), it is a full flexi loan, which therefore "profit" (which is "loan interest" but in islamic term) is calculated daily, and any advance payment should result in lower overall loan repayment. That should also means that by right we should see decrease in "profit" charged, but based on the loan statement, doesn't seem like it.

I'm not beside them now therefore I can't study the loan agreement. Can anyone enlighten me based on the attached statement? Thanks in advanced.

1. Nope, from what I can tell, the

advanced payment has reduced the loan balance used to calculate the interests (profit paid) .

a. based on the profit paid on 1st

July (for June interest accrued of 30 days) it is

RM1,836b. based on the profit paid on 1st

December (for November interest accrued of 30 days) it is

RM1,518Difference is

RM318I noticed there was about RM80k worth of

advanced payment made between the 2 dates I mentioned above in (1) and (2)

Assumption: interest rate is 4.5%

RM80,000 x 4.50% p.a. / 12 =

RM300/m Which is about the same as the difference between the profit paid for the two dates above.

Congratulations.

QUOTE(kevyeoh @ Apr 22 2019, 08:35 AM)

Dear sifus... so what is the right spread/difference in interest rate to consider worth to refinance? And also based on what refinance amount?

Try looking at it this way, by calculating the "savings" vs the costs: Each time you refinance, you would incur about 2% moving cost - legal fees, stamp duty, valuation. You interest rates are charged on a daily basis, but quoted per annum (p.a.).

So if you find out the difference between the

best rate approvable vs. your current interest rate charged by your bank, and compare it to the 2% mentioned earlier, you can find out how many years it would take for you to start "breaking even" with the moving costs.

For example: the best rate approvable is 4.5%, you are being charged 4.9% with your current bank. Difference is 0.4%. Moving cost is 2%, so it takes 5 years for you to break even, and you would start saving money beyond that.

This is a very gross way of calculating it, but it should give you a guideline whether to proceed or otherwise.

There are those who are paying more than 6% interests, and refinancing to get better rates would definitely help.

Best reason to refinance is to unlock the value of the property, so you can reinvest the cash-out into other things

This post has been edited by wild_card_my: Apr 22 2019, 08:53 AM

Apr 15 2019, 04:17 PM

Apr 15 2019, 04:17 PM

Quote

Quote

0.0197sec

0.0197sec

1.89

1.89

6 queries

6 queries

GZIP Disabled

GZIP Disabled