Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

wayton

|

Feb 7 2020, 03:16 PM Feb 7 2020, 03:16 PM

|

|

QUOTE(annoymous1234 @ Feb 6 2020, 11:55 PM) I moved my savings from asm to epf for the higher interest rate and for the sole purpose of paying off my mortgage. I only remember about account 1 and 2 exist after I transfer. And that most of it will go to account 1 which I won't be able to withdraw until I retire. It defeats my purpose which is to clear my house loan. I feel so dumb right now. Arghhhhhhhhhh. Can we ask epf to put the transfer to account 2 only? You can't treat EPF as a saving account. Only those above 55 who can withdraw anytime, then can treat it like saving account. |

|

|

|

|

|

wayton

|

Feb 14 2020, 01:48 PM Feb 14 2020, 01:48 PM

|

|

QUOTE(Havoc Knightmare @ Feb 14 2020, 12:56 PM) There is some basis to the ponzi claim, and I will point to this- https://www.theedgemarkets.com/article/epf-...e-%E2%80%94-ceoAs usual, the public failed to pick up on the accidental slip that the then- new CEO made, though those in the know chuckled quietly at the admission. A fund does not 'cease' just because its outflows exceeds its inflows, unless it is a ponzi. The article talked about outflow more than inflow once population aging. Not related to ponzi or not. A fund will not function well when it is constantly outflow. Fund invested into bonds or shares are long term basis, fund needs constantly sell those invested asset to fund the outflow resulted difficulty in investing. If a fund is run at ponzi basis, it is easy to identify whereby the liabilities towards contributor becomes more than asset owned due to giving more return than its income, and the fund will have net negative equity. Ponzi is about giving return that does not exist. It is separated from the outflow inflow issue. Outflow more means the fund is not able to function properly even give zero return. |

|

|

|

|

|

wayton

|

Feb 14 2020, 10:33 PM Feb 14 2020, 10:33 PM

|

|

QUOTE(nexona88 @ Feb 14 2020, 10:06 PM) Only noobies would believe our inflation rate is 0.7%... From old to new Malaysia.. Same old grouping on basket of products going on.. To calculate the inflation rate.. No logic at all. It got its own logic. The inflation index is a basket of goods that may consist controlled items. A fixed petrol price will bring down inflation rate. Eggs price remains roughly the same,. Rent remains the same. Hawket foods price may goes up 10%. So with just 4 items, the average inflation rate is 2.5%. So the calculation is actually correct. But on personal level, it is personal inflation that matter and the feel on 10% rise foods will anchor the inflation feel of 10%, plus people tends to over spend more nowadays which resulted more living pressure. |

|

|

|

|

|

wayton

|

Feb 23 2020, 10:22 AM Feb 23 2020, 10:22 AM

|

|

QUOTE(vivekprasad87 @ Feb 22 2020, 05:34 PM) Please help to understand, I thought the divident is calculated based on the total until December 2019, is it not the case? My total is lot less than what is to be gotten for 5.45%. Not entire total amount of Dec 2019. Entire amount of 2018 Dec balance + pro-rated increment for each month balance of 2019. If give based on Dec 2019 total amount, then the Dec contributed amount 5.45% x 12 = 65.4% dividend already. If like that, everyone also want to contribute big on Dec.  It should be similar to how bank count the interest. |

|

|

|

|

|

wayton

|

Feb 23 2020, 03:48 PM Feb 23 2020, 03:48 PM

|

|

5.45% is ok, decent and reasonable with worldwide interest cut everywhere.

FD rate is also going down.

While, there many other unit trust also are also registering negative return instead of positive over the last few years, apart from US related and bond funds.

|

|

|

|

|

|

wayton

|

Feb 28 2020, 09:55 AM Feb 28 2020, 09:55 AM

|

|

It is optional, one still can contribute the old rate.

Self contribution also has, if want to contribute more.

|

|

|

|

|

|

wayton

|

Mar 2 2020, 06:46 PM Mar 2 2020, 06:46 PM

|

|

QUOTE(lyc1982 @ Mar 2 2020, 06:10 PM) my company only 12%...can request them to increase to 19% kah ? self-contribution up to 60k annually...on top of employee + employee portions LOL means you want your employer to pay 7% extra for you? Indirectly means pay rise 7%. Haha. |

|

|

|

|

|

wayton

|

May 6 2020, 03:12 PM May 6 2020, 03:12 PM

|

|

QUOTE(lyc1982 @ May 6 2020, 02:53 PM) ermm...if your gross salary is in the range of rm5-10k...i doubt by late 30s can achieve even without withdrawing a single cent Assume start working at 24, with wages 10k per month at start and remains the same until 39. 10K per month - Total EPF saved per year is only RM27K. 15 years RM414K saved, compounded with EPF return of 6%, still short 1 mil. Need more than 10K. Basically, need 5 digit wages per month. |

|

|

|

|

|

wayton

|

May 6 2020, 03:46 PM May 6 2020, 03:46 PM

|

|

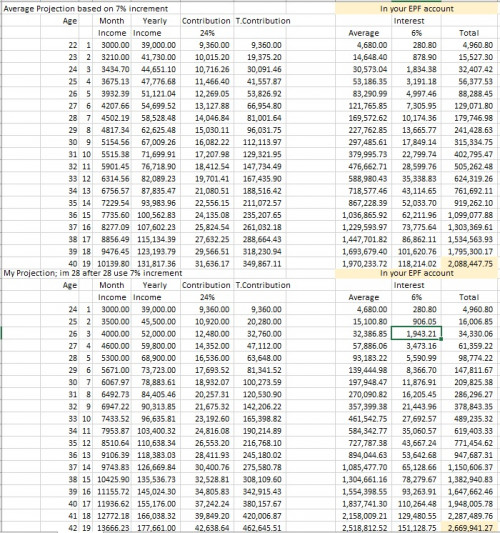

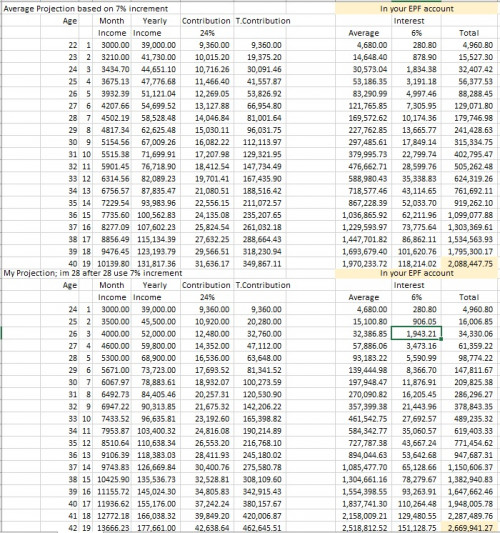

QUOTE(jyll92 @ May 6 2020, 03:23 PM)  guys this is a simple projection of what my epf account will look like after 20 years. u guys can see. getting 1 million is easy as a cake From the table first year contributed 9,360, with 6% EPF interest can get 4960?  |

|

|

|

|

|

wayton

|

May 6 2020, 03:56 PM May 6 2020, 03:56 PM

|

|

QUOTE(jyll92 @ May 6 2020, 03:48 PM) interest is 280 under interest column . 4960 is total what is means by 4960 total. With first year contributed 9360, with 6% interest, no way total interest earned will be 4960. The total column doesn't make sense. This post has been edited by wayton: May 6 2020, 03:57 PM |

|

|

|

|

|

wayton

|

May 6 2020, 03:59 PM May 6 2020, 03:59 PM

|

|

I only know without 5 digit wages at the end of 30s or even 40+, no way EPF accumulated will be 1 mil, unless EPF has interest rate more than 8 to 10%.

|

|

|

|

|

|

wayton

|

May 6 2020, 05:02 PM May 6 2020, 05:02 PM

|

|

QUOTE(bronkos @ May 6 2020, 04:49 PM) #YOLO, cant bring money to afterlife. Money may not be brought afterlife. But with recent MCO or economy recession, it highlights the importance of saving. Whatever YOLO means nothing if next day cannot put food on table. |

|

|

|

|

|

wayton

|

May 7 2020, 11:45 AM May 7 2020, 11:45 AM

|

|

QUOTE(guy3288 @ May 7 2020, 11:28 AM) True or not what you said? you guys have it so easy with many millions in EPF? consider the average earners even those earning RM5-10k a month when they go check their EPF.... The first table is wrong, need to refer amended table posted by the forumer, as the first table is only true if EPF carry an interest near 50%. For average earner 5 to 10K, it is not possible achieve 1 mil mark by late 30s' You need 5 digit wages or EPF give double digit interest. |

|

|

|

|

Feb 7 2020, 03:16 PM

Feb 7 2020, 03:16 PM

Quote

Quote

0.0510sec

0.0510sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled