My wild guess will be 5.7% - 5.9%

EPF DIVIDEND, EPF

EPF DIVIDEND, EPF

|

|

Jan 13 2020, 12:48 PM Jan 13 2020, 12:48 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

222 posts Joined: May 2010 |

My wild guess will be 5.7% - 5.9%

|

|

|

|

|

|

Jan 18 2020, 02:49 PM Jan 18 2020, 02:49 PM

Return to original view | Post

#2

|

Junior Member

222 posts Joined: May 2010 |

Wont the cash value in epf deteriorated by inflation & global money printing from central banks?

|

|

|

Mar 2 2020, 03:20 PM Mar 2 2020, 03:20 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

222 posts Joined: May 2010 |

|

|

|

Mar 2 2020, 04:40 PM Mar 2 2020, 04:40 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

222 posts Joined: May 2010 |

|

|

|

Mar 3 2020, 10:54 PM Mar 3 2020, 10:54 PM

Return to original view | Post

#5

|

Junior Member

222 posts Joined: May 2010 |

Hi guys,

With the opr reduce, will div 2020. possible decrease as well? |

|

|

Sep 12 2021, 10:25 PM Sep 12 2021, 10:25 PM

Return to original view | Post

#6

|

Junior Member

222 posts Joined: May 2010 |

QUOTE(cklimm @ Sep 11 2021, 09:46 AM) Back then in 80s, they said kwsp will goes kaput, all bought koperasi and went kaput Wow, during those koperasi days, interest is 10++%.in 90s, they said kwsp will goes kaput, all bought shares and went kaput in 2000s, they said kwsp will goes kaput, all bought .com and went kaput in 2010s, they said kwsp will goes kaput, all flip properties and kaput Now what? All tycoon collect money from koperasi n buy forest/palm oil land etc in east Malaysia. This bring back those memory..... |

|

|

|

|

|

Oct 8 2021, 01:27 PM Oct 8 2021, 01:27 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

222 posts Joined: May 2010 |

|

|

|

Dec 23 2021, 05:50 PM Dec 23 2021, 05:50 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

222 posts Joined: May 2010 |

QUOTE(prophetjul @ Dec 23 2021, 02:47 PM) So you think it's acceptable that as shareholder who helped build up the existing asset portfolio with his funds through the years, to be Awarded lower returns compared the other shareholders who may have just started to contribute to the portfolio? Possible like cpf?join the CCP. Roll the money to another fund that capped at certain amount to enjoy higher % return. |

|

|

Dec 23 2021, 06:04 PM Dec 23 2021, 06:04 PM

Return to original view | Post

#9

|

Junior Member

222 posts Joined: May 2010 |

|

|

|

Dec 23 2021, 10:17 PM Dec 23 2021, 10:17 PM

Return to original view | IPv6 | Post

#10

|

Junior Member

222 posts Joined: May 2010 |

QUOTE(sgh @ Dec 23 2021, 07:22 PM) Understand this is a EPF thread. If stray away can don't answer. Not sit home shake leg then Msia at age 55 do what? Still working cannot be correct? Must be enjoying doing their hobbies which they don't have time when they are working day in day out. That is why retiring in Msia is more relaxed compared to Spore. Spore is a good place to earn a lot of good monies but not a place for retirement. But need to remember inflation killed msian easier compare to sgp. |

|

|

Dec 30 2021, 02:04 PM Dec 30 2021, 02:04 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

222 posts Joined: May 2010 |

QUOTE(MNF0 @ Dec 30 2021, 12:12 PM) For them to even think about adding another stage for withdrawal (65) is when the retirement age has been moved to 65. But realistically speaking, I don't see the having the gut to remove the 55 withdrawal. Even if they have the gut, the most they could do is with the 50 withdrawal. And that's a big if. May need to consider the life span of all ethnic. |

|

|

Apr 19 2022, 06:21 PM Apr 19 2022, 06:21 PM

Return to original view | Post

#12

|

Junior Member

222 posts Joined: May 2010 |

Just flashed back YR1970++ till YR1980++ EPF dividend rate during high inflation, 7-8% p.a.

Wow, just wow!!! |

|

|

Apr 19 2022, 07:21 PM Apr 19 2022, 07:21 PM

Return to original view | Post

#13

|

Junior Member

222 posts Joined: May 2010 |

|

|

|

|

|

|

Apr 20 2022, 09:15 AM Apr 20 2022, 09:15 AM

Return to original view | IPv6 | Post

#14

|

Junior Member

222 posts Joined: May 2010 |

[quote=coolguy_0925,Apr 20 2022, 12:50 AM]

I still remember as a kid I saw the board outside MBF FD rate >10% Wonder how was the BLR like back then Saw it with own eyes of the statement from bank bumiputera & commerce, whopping of 10.6%!!! |

|

|

Apr 20 2022, 09:19 AM Apr 20 2022, 09:19 AM

Return to original view | IPv6 | Post

#15

|

Junior Member

222 posts Joined: May 2010 |

[quote=guy3288,Apr 20 2022, 12:30 AM]

i remember my brothers teling me why go for those "lousy" banks... he used the branded Citibank etc with low rates, i didnt care what bank even finance i dint mind, as long as the rate better, but not to the extent of going for the Koperasi MCA or something... which got quite a few burnt. This koperasi, koperasi produce quite a number of ppl invest in East Malaysia land. Every month naik helicopter view the plantation land. |

|

|

Dec 26 2022, 11:32 AM Dec 26 2022, 11:32 AM

Return to original view | IPv6 | Post

#16

|

Junior Member

222 posts Joined: May 2010 |

[quote=Ankle,Dec 24 2022, 10:03 AM]

Ironically those like you who can afford better toys in life such as a bigger car than old city or ifong 14 pro are the very ones avoiding them and those not able to are the very ones owning them to the extreme extent of driving new merc while only owning the 4 tyres and steering while the rest still belongs to the bank. Thats the difference between the financially prudent and the financially non prudent. Save hard, work hard and invest carefully is the right way to achieve financial independence some day. Outwardly your life may appear boring. Agreed. But need to meet the right life partner. If not, it will not last long in marriage life |

|

|

Apr 4 2023, 08:15 PM Apr 4 2023, 08:15 PM

Return to original view | Post

#17

|

Junior Member

222 posts Joined: May 2010 |

|

|

|

Apr 11 2023, 09:38 PM Apr 11 2023, 09:38 PM

Return to original view | Post

#18

|

Junior Member

222 posts Joined: May 2010 |

|

|

|

Apr 13 2023, 06:05 AM Apr 13 2023, 06:05 AM

Return to original view | IPv6 | Post

#19

|

Junior Member

222 posts Joined: May 2010 |

Possible to get 1 & reinvest back into EPF.

|

|

|

Apr 13 2023, 10:50 AM Apr 13 2023, 10:50 AM

Return to original view | IPv6 | Post

#20

|

Junior Member

222 posts Joined: May 2010 |

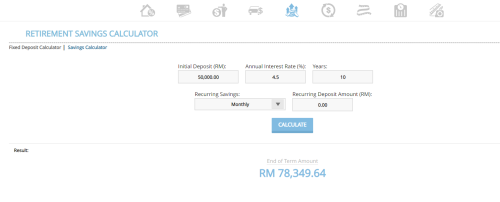

QUOTE(Rinth @ Apr 13 2023, 10:48 AM) I've found something interesting...... This is what mind boggling about Borrow RM 50k put in EPF assume interest 4.5%(same rate as you loan), end of 10 years = RM 78,349.64 Based on MBSB repayment table for 10 years, 1st 12 months repayment RM 187.50 13th onwards RM 564.00 = RM 63,162.00 Different RM 15k over the span of 10 years, same interest rates..... is my calculation correct ah????? or somewhere wrong??? If correct means the timing differences of 1 shoot RM 50k deposit to EPF actually is worth while, even if the interest rate is same... 🤭 |

| Change to: |  0.0481sec 0.0481sec

0.55 0.55

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 10:16 AM |