Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

jyll92

|

May 6 2020, 03:23 PM May 6 2020, 03:23 PM

|

Getting Started

|

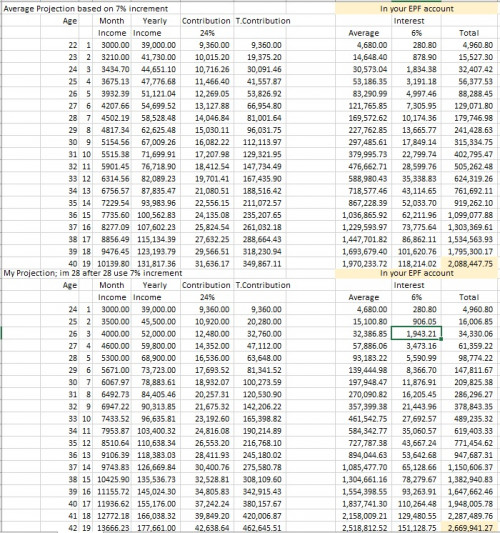

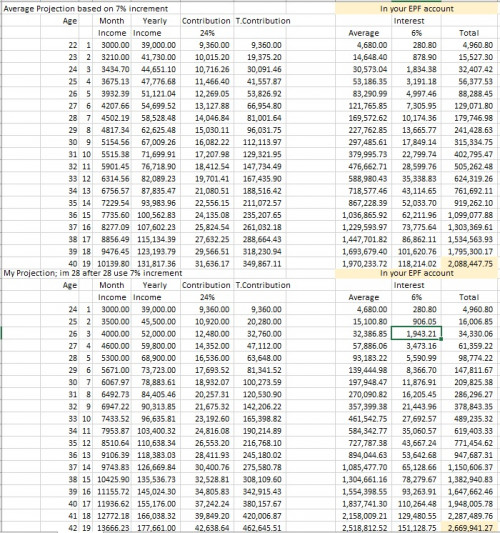

QUOTE(farizmalek @ May 3 2020, 06:31 PM) now only i million... EPF revised. My advise if don't need, just keep it, your contribution per month and compounded dividen will increase the amount when reach 55y. Unless no choice...  guys this is a simple projection of what my epf account will look like after 20 years. u guys can see. getting 1 million is easy as a cake |

|

|

|

|

|

jyll92

|

May 6 2020, 03:32 PM May 6 2020, 03:32 PM

|

Getting Started

|

QUOTE(wayton @ May 6 2020, 03:12 PM) Assume start working at 24, with wages 10k per month at start and remains the same until 39. 10K per month - Total EPF saved per year is only RM27K. 15 years RM414K saved, compounded with EPF return of 6%, still short 1 mil. Need more than 10K. Basically, need 5 digit wages per month. \ no need look at my table. u dont know the power of compoiunding interest. your calculation is off This post has been edited by jyll92: May 6 2020, 03:33 PM |

|

|

|

|

|

jyll92

|

May 6 2020, 03:48 PM May 6 2020, 03:48 PM

|

Getting Started

|

QUOTE(wayton @ May 6 2020, 03:46 PM) From the table first year contributed 9,360, with 6% EPF interest can get 4960?  interest is 280 under interest column . 4960 is total |

|

|

|

|

|

jyll92

|

May 6 2020, 04:06 PM May 6 2020, 04:06 PM

|

Getting Started

|

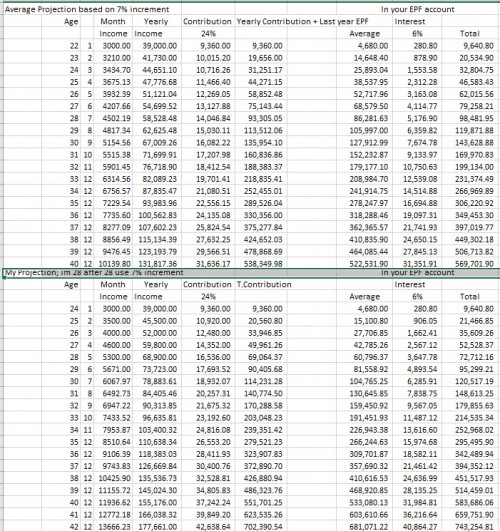

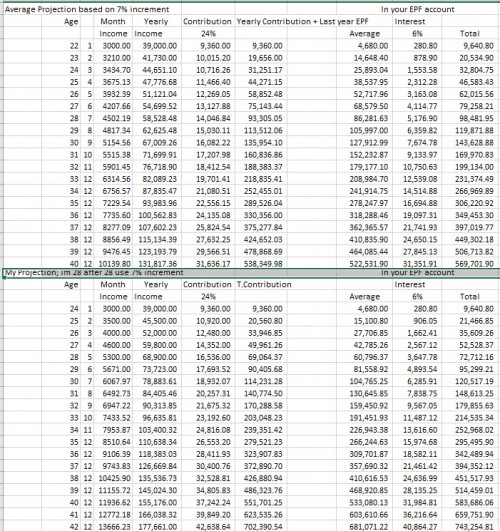

QUOTE(wayton @ May 6 2020, 03:56 PM) what is means by 4960 total. With first year contributed 9360, with 6% interest, no way total interest earned will be 4960. The total column doesn't make sense. yea yea my bad. this shud be right  This post has been edited by jyll92: May 6 2020, 04:07 PM This post has been edited by jyll92: May 6 2020, 04:07 PM |

|

|

|

|

|

jyll92

|

May 6 2020, 04:37 PM May 6 2020, 04:37 PM

|

Getting Started

|

QUOTE(lyc1982 @ May 6 2020, 04:35 PM) ermm....ok based on my own experience...it doesn't look like this but as long as you are confident then ok this is the wrong one i edit edi haha |

|

|

|

|

|

jyll92

|

May 6 2020, 04:44 PM May 6 2020, 04:44 PM

|

Getting Started

|

QUOTE(lyc1982 @ May 6 2020, 04:39 PM) as you can see...even if dividend maintains at 6% (which is optimistic) throughout the years, still not as easy as cake to achieve 1 mil by late 30s, unless you started off with 10k at 24yo anyways...there's an epf calculator in the epf account that we can use to project pretty neat u need to get 10k at by 5th year. need to move fast paced |

|

|

|

|

|

jyll92

|

Feb 18 2021, 08:54 AM Feb 18 2021, 08:54 AM

|

Getting Started

|

QUOTE(James1983 @ Feb 18 2021, 08:53 AM) Hopefully it’s above 6% 🙏🏻 no way that much. already so much fund taken out. have 4.5-5.5 lucky edi This post has been edited by jyll92: Feb 18 2021, 08:54 AM |

|

|

|

|

|

jyll92

|

Feb 18 2021, 09:13 AM Feb 18 2021, 09:13 AM

|

Getting Started

|

QUOTE(MGM @ Feb 18 2021, 08:58 AM) Why would funds taken out this year affects last year performance? the money is stuck in investment. its not cash to pay u they have to sell their liquid holdings. giving too much will not be sensible even when the return is good. last year already can take fund out of epf. i myself took out 6k edi This post has been edited by jyll92: Feb 18 2021, 09:13 AM |

|

|

|

|

|

jyll92

|

Feb 18 2021, 09:42 AM Feb 18 2021, 09:42 AM

|

Getting Started

|

QUOTE(MGM @ Feb 18 2021, 09:23 AM) Liquidating their holdings this year for iSinar will affect 2021 performance n dividend payout in 2022. Dividend paid this year is on paper not cash. When 2020 Q4 result is known we will see how much of the profit is being paid out as dividend. u mean they relasing the money without selling the investment ?  even on paper also need to sell right |

|

|

|

|

|

jyll92

|

Feb 18 2021, 10:39 AM Feb 18 2021, 10:39 AM

|

Getting Started

|

QUOTE(MGM @ Feb 18 2021, 09:53 AM) So u mean if coming dividend is 50billion epf has to liquidate 50 billion of investment? yeah. of course otherwise how to give dividend since dividend is cash. even if they dont pay ppl below 55y.o they still have to pay those senior when they withdraw right. i understand where u come from u imply that dividend is future cash where the investment is not sold yet. liquidating investment is inevitable since they need to pay salaries and retired seniors This post has been edited by jyll92: Feb 18 2021, 10:53 AM |

|

|

|

|

|

jyll92

|

Feb 18 2021, 01:17 PM Feb 18 2021, 01:17 PM

|

Getting Started

|

QUOTE(yklooi @ Feb 18 2021, 11:20 AM)  from this info from this site.... it looks like no need to liquidate investment to pay salaries and retired seniors https://www.kwsp.gov.my/documents/20126/974...t=1564377639847i see . they are using monthly contribution as a mean to roll which means part of what we contribute every month is not reinvested. if epf collected 50billion form contribution from the year its impossible for them to pay interest of more than 50 billion unless they liquidate. (of course its best not to liquidate) |

|

|

|

|

|

jyll92

|

Feb 18 2021, 01:29 PM Feb 18 2021, 01:29 PM

|

Getting Started

|

QUOTE(yklooi @ Feb 18 2021, 01:20 PM) they have more than RM110 bil liquid cash....as per that report i understand they have cash but if they use the cash just to make ppl happy by paying dividend instead of reinvesting isnt it negative cash flow?  |

|

|

|

|

|

jyll92

|

Feb 17 2024, 08:46 AM Feb 17 2024, 08:46 AM

|

Getting Started

|

6% enough to beat inflation and currency depreciation or not.

|

|

|

|

|

|

jyll92

|

Feb 17 2024, 08:54 AM Feb 17 2024, 08:54 AM

|

Getting Started

|

QUOTE(prophetjul @ Feb 17 2024, 08:51 AM) NOT. Depreciated vs USD 1 year - 8.54% Deprecaited vs SGD 1 year -7.53% dont use 1 year ba use 10/20 years and take the cagr more accurate |

|

|

|

|

|

jyll92

|

Feb 17 2024, 08:59 AM Feb 17 2024, 08:59 AM

|

Getting Started

|

QUOTE(prophetjul @ Feb 17 2024, 08:56 AM) You were asking based on last year's expected dividend. So 1 year is right.  based on last year memang holland all the value burnt |

|

|

|

|

May 6 2020, 03:23 PM

May 6 2020, 03:23 PM

Quote

Quote

0.0457sec

0.0457sec

0.91

0.91

7 queries

7 queries

GZIP Disabled

GZIP Disabled